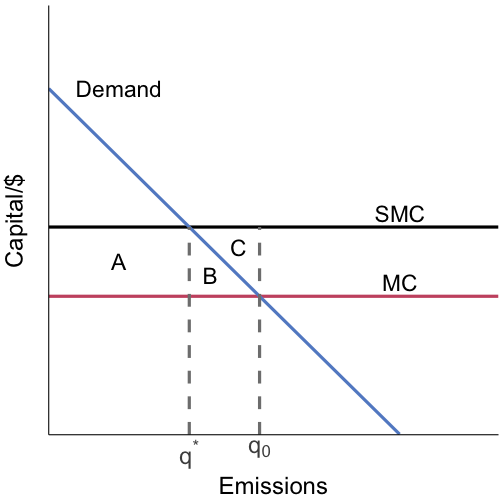

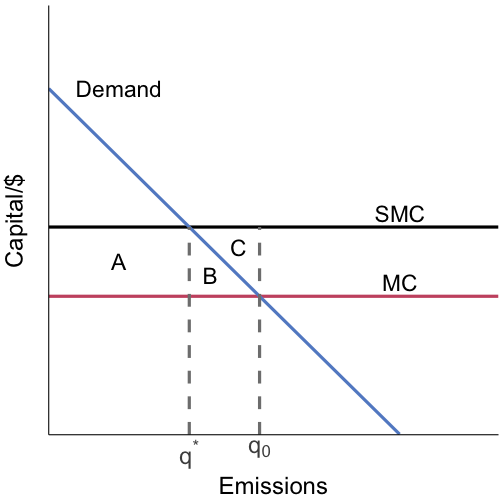

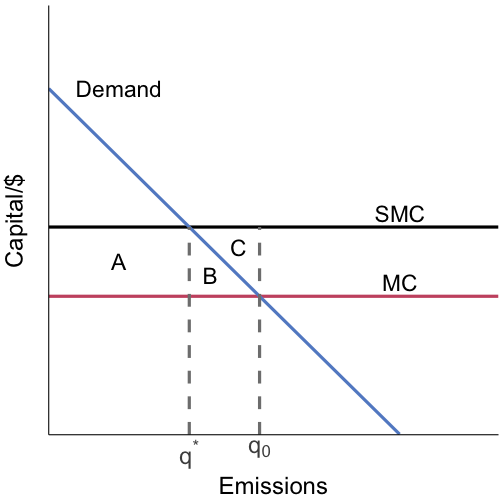

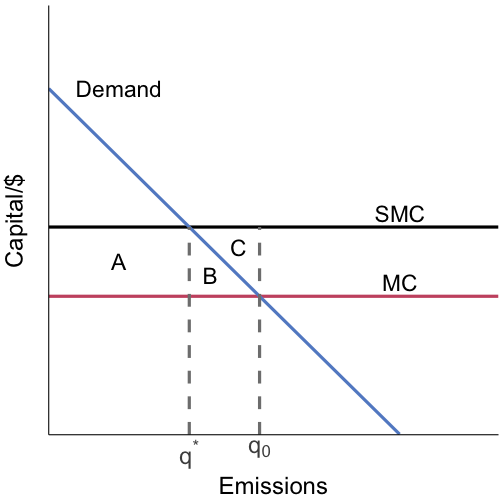

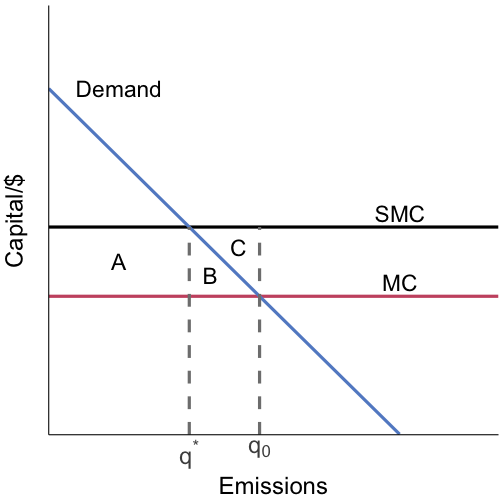

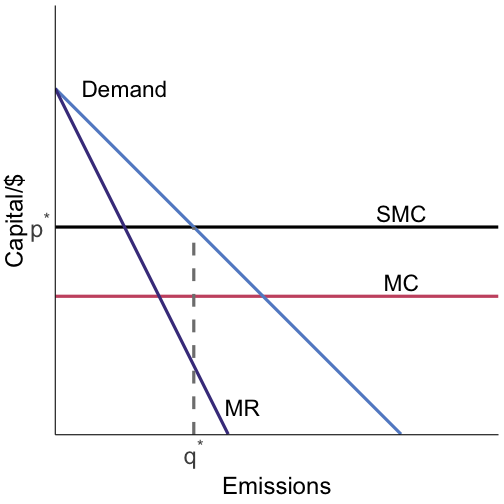

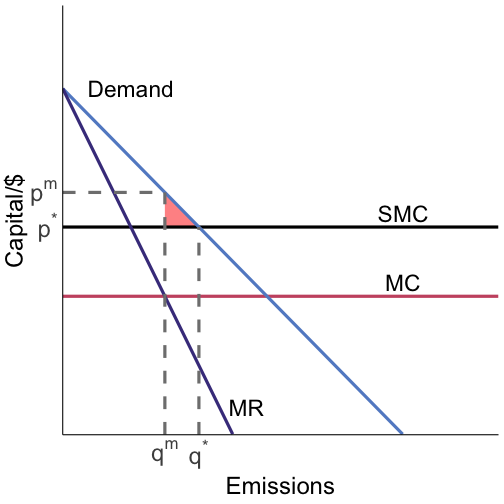

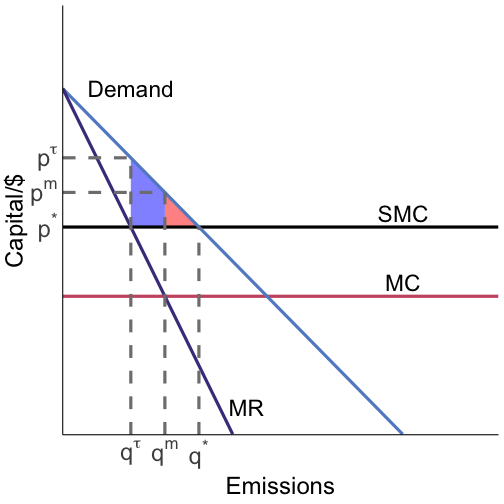

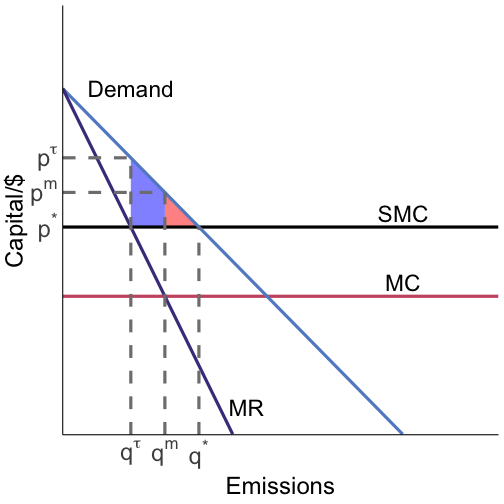

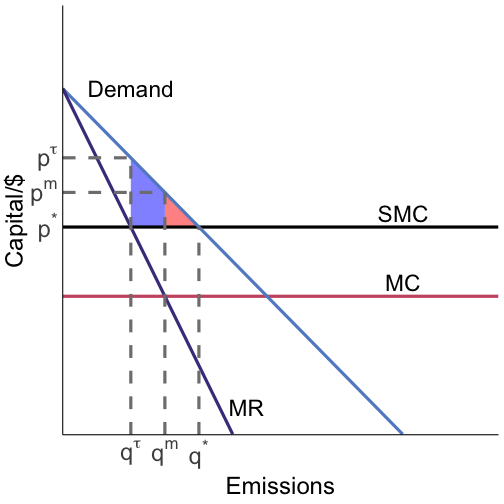

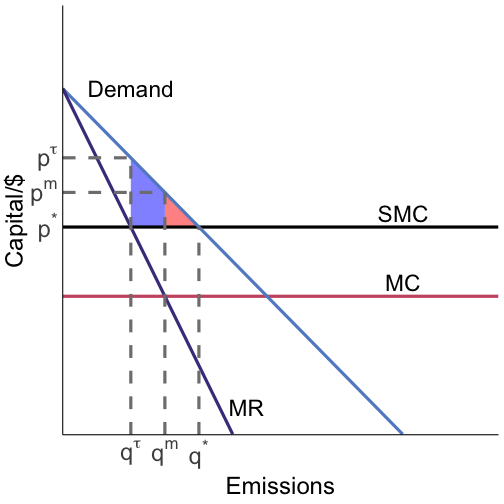

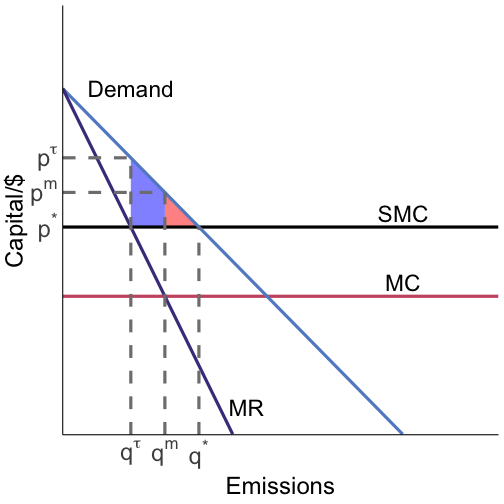

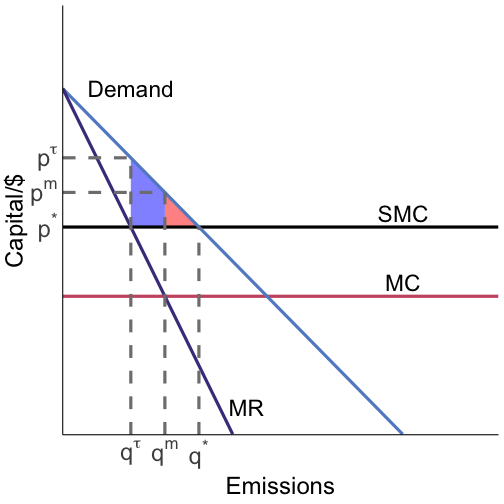

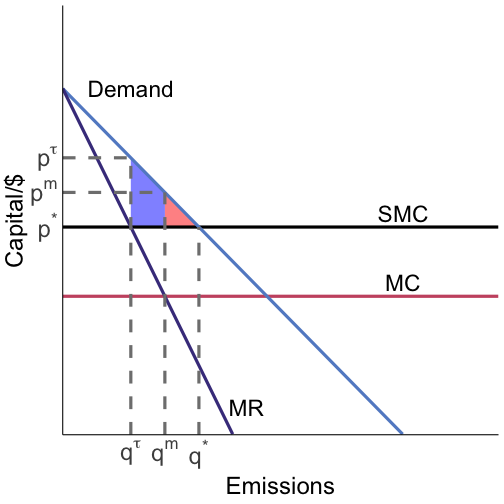

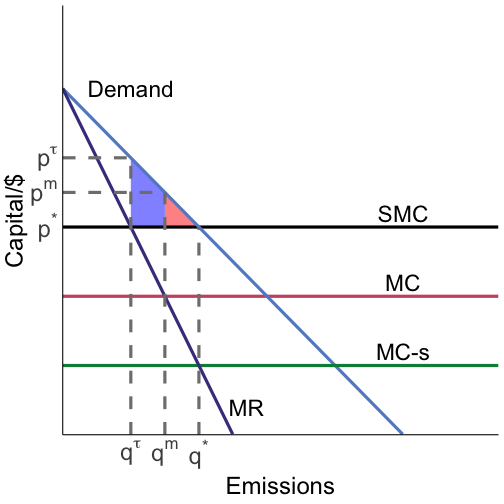

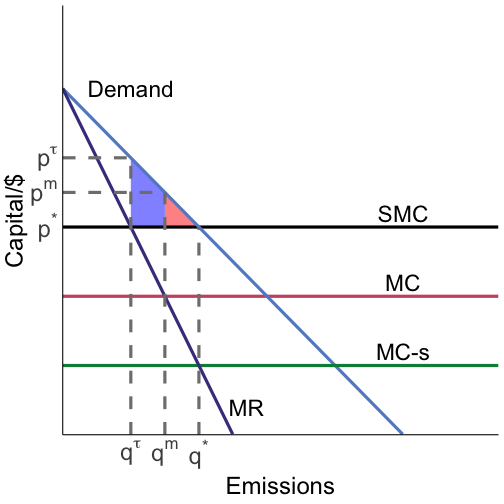

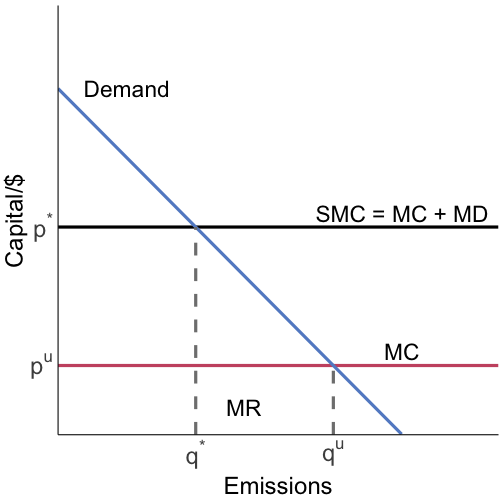

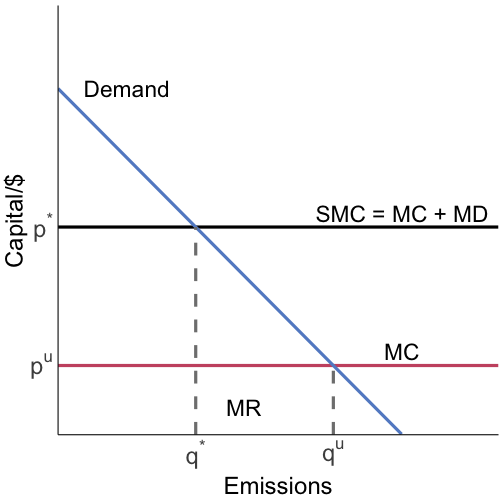

class: center, middle, inverse, title-slide .title[ # Lecture 07 ] .subtitle[ ## Multiple Market Failures and Second-Best Policies ] .author[ ### Ivan Rudik ] .date[ ### AEM 4510 ] --- exclude: true ``` r if (!require("pacman")) install.packages("pacman") ``` ``` ## Loading required package: pacman ``` ``` r pacman::p_load( tidyverse, xaringanExtra, rlang, patchwork, nycflights13, tweetrmd, vembedr ) ``` ``` ## Installing package into '/opt/homebrew/lib/R/4.5/site-library' ## (as 'lib' is unspecified) ``` ``` ## Warning: package 'tweetrmd' is not available for this version of R ## ## A version of this package for your version of R might be available elsewhere, ## see the ideas at ## https://cran.r-project.org/doc/manuals/r-patched/R-admin.html#Installing-packages ``` ``` ## Warning: 'BiocManager' not available. Could not check Bioconductor. ## ## Please use `install.packages('BiocManager')` and then retry. ``` ``` ## Warning in p_install(package, character.only = TRUE, ...): ``` ``` ## Warning in library(package, lib.loc = lib.loc, character.only = TRUE, ## logical.return = TRUE, : there is no package called 'tweetrmd' ``` ``` ## Warning in pacman::p_load(tidyverse, xaringanExtra, rlang, patchwork, nycflights13, : Failed to install/load: ## tweetrmd ``` ``` r options(htmltools.dir.version = FALSE) knitr::opts_hooks$set(fig.callout = function(options) { if (options$fig.callout) { options$echo <- FALSE } knitr::opts_chunk$set(echo = TRUE, fig.align="center") options }) ``` ``` ## Warning in xaringanExtra::style_panelset(panel_tab_color_active = "red"): 'xaringanExtra::style_panelset' is deprecated. ## Use 'style_panelset_tabs' instead. ## See help("Deprecated") ``` ``` ## Warning in style_panelset_tabs(...): The argument names of `style_panelset()` ## changed in xaringanExtra 0.1.0. Please refer to the documentation to update to ## the latest names. ``` ``` ## NULL ``` --- # Roadmap 1. What happens when we have another distortion like market power? 3. How do second-best policies like output taxes or intensity standards work? --- class: inverse, center, middle name: tradable permits # Market power and pollution <html><div style='float:left'></div><hr color='#EB811B' size=1px width=796px></html> --- # Market power Lets consider two extreme cases to understand whether and how market power matters 1. Perfect competition 2. Monopoly -- In both cases we will assume that: 1. Marginal costs of production are constant `\(MC\)` 2. The marginal damage from a unit of output is constant giving us constant social marginal costs `\(SMC = MC + MD\)` --- # Perfect competition .pull-left[  ] .pull-right[ The effect of moving from `\(q_0 \rightarrow q^*\)` using a tax equal to marginal damage (SMC - MC): ] --- # Perfect competition .pull-left[  ] .pull-right[ The effect of moving from `\(q_0 \rightarrow q^*\)` using a tax equal to marginal damage (SMC - MC): Loss in CS: -(A+B) ] --- # Perfect competition .pull-left[  ] .pull-right[ The effect of moving from `\(q_0 \rightarrow q^*\)` using a tax equal to marginal damage (SMC - MC): Loss in CS: -(A+B) Avoided damages: B+C ] --- # Perfect competition .pull-left[  ] .pull-right[ The effect of moving from `\(q_0 \rightarrow q^*\)` using a tax equal to marginal damage (SMC - MC): Loss in CS: -(A+B) Avoided damages: B+C Tax revenue: A ] --- # Perfect competition .pull-left[  ] .pull-right[ The effect of moving from `\(q_0 \rightarrow q^*\)` using a tax equal to marginal damage (SMC - MC): Loss in CS: -(A+B) Avoided damages: B+C Tax revenue: A .hi-blue[Net gain: -(A+B) + (B+C) + A = C] ] --- # Monopoly Now consider a monopolist with the same marginal cost and marginal damage structure -- What is the difference with a monopolist? -- The monopolist can set the price -- This means that the MR curve lies beneath the demand curve -- Why? -- The monopolist accounts for how additional output lowers the market price on inframarginal units --- # Monopoly .pull-left[  ] .pull-right[ The socially efficient allocation is where social marginal cost is equal to the social marginal benefit This is where SMC crosses the demand curve: `\((q^*,p^*)\)` What is the welfare outcome under the unregulated monopolist outcome? ] --- # Monopoly .pull-left[  ] .pull-right[ In the absence of regulation, the monopolist maximizes profit where MR = MC: `\((q^m, p^m)\)` This results in deadweight loss equal to the .hi-red[red] area Now what happens if we set a Pigouvian tax equal to marginal damage? ] --- # Monopoly .pull-left[  ] .pull-right[ The Pigouvian tax restricts output even more, adding deadweight loss equal to the .hi-blue[blue] area on top of the deadweight loss in the .hi-red[red] area The tax actually made us worse off by the blue area! Why? ] --- # Monopoly .pull-left[  ] .pull-right[ We now have two distortions: 1. Market power 2. Pollution externality ] --- # Monopoly .pull-left[  ] .pull-right[ We now have two distortions: 1. Market power 2. Pollution externality With market power, the unregulated equilibrium quantity is .hi[too low] ] --- # Monopoly .pull-left[  ] .pull-right[ We now have two distortions: 1. Market power 2. Pollution externality With market power, the unregulated equilibrium quantity is .hi[too low] With a pollution externality, the unregulated equilibrium quantity is .hi[too high] ] --- # Monopoly .pull-left[  ] .pull-right[ They have opposing forces on quantities, so the market failures offset each other (partially) ] --- # Monopoly .pull-left[  ] .pull-right[ They have opposing forces on quantities, so the market failures offset each other (partially) This means that if we fully correct the pollution externality, we no longer get the off-setting benefit and have the full welfare cost of market power ] --- # Monopoly .pull-left[  ] .pull-right[ What is the actual optimal thing to do here? ] --- # Monopoly .pull-left[  ] .pull-right[ What is the actual optimal thing to do here? .hi[subsidize output] at rate `\(s\)` so `\(MC - s\)` crosses `\(MR\)` at `\(q^*\)` ] --- # Monopoly .pull-left[  ] .pull-right[ What is the actual optimal thing to do here? .hi[subsidize output] at rate `\(s\)` so `\(MC - s\)` crosses `\(MR\)` at `\(q^*\)` In this example, the market power externality dominates the pollution externality: we need to increase output ] --- # Monopoly What did we learn? -- With multiple market failures we don't necessarily want to .hi[fully] correct for a single market failure -- In this example we actually wanted to do the .hi-red[opposite] of what you likely thought -- You can always draw this example in a different way where you should tax output -- You just need marginal damages to be sufficiently large relative to the market power effect on quantity --- # Monopoly: more generally So this was a .hi[special case]: we assumed the marginal damage from production was constant -- If we generalize this so that the emission and output decisions are separate, we still have the two opposing market failures<sup>1</sup> .footnote[ <sup>1</sup> The key thing here is that emissions are no longer a single function of output like `\(E = f(q)\)`. This means we can no longer write MD as a function of output `\(q\)`. ] -- What changes is we can no longer fix them both with just a pollution tax/subsidy --- # Monopoly: more generally Typically we must follow the .hi[Tinbergen rule:] you need as many policy instruments as you have market failures to achieve the efficient outcome -- What does that mean here? -- We need: 1. Pollution tax -- 2. Output subsidy The tax incentivizes abatement, the subsidy incentivizes production --- # Output taxes Sometimes emission taxes and abatement subsidies are difficult to administer because monitoring is hard -- What can we do instead? -- We can tax the output of the production process -- e.g. tax on electricity, cement -- Will this be efficient? -- If so, what assumptions do we need about the production process? --- # Output taxes .pull-left[  ] .pull-right[ Assume emissions are proportional to output And MD is constant The firm chooses to produce/emit at `\(q^u\)` in the unregulated equilibrium If we tax output equal to MD we can achieve the socially optimal allocation `\(q^*\)` ] --- # Output taxes .pull-left[  ] .pull-right[ An output tax can be efficient, .hi[if we assume that emissions are proportional to output] Now let's break the link between output and emissions by writing down a slightly more complicated model where the firm chooses emissions and output separately ] --- # Output taxes, part two Here's our model: - Cobb-Douglas production using labor and emissions as inputs: `\(Q = L^\alpha E^{1-\alpha}\)` - The firm pays wages `\(w\)` to labor, rental rate `\(r\)` to emissions (capital) - The firm receives a price `\(p\)` per unit of output - Emissions cause marginal damage `\(d\)` -- The firm can increase output without more emissions by increasing `\(L\)` -- What does an output tax `\(\tau_o\)` do versus a regular emission tax `\(\tau_e\)`? --- # Output taxes, part two The regulator wants the firm to internalize its social costs: `$$\max_{L,E} p\,L^\alpha E^{1-\alpha} - wL - rE - dE$$` -- The first-order conditions for a socially efficient allocation of `\(L\)` and `\(E\)` are: `$$\underbrace{\alpha p L^{\alpha-1} E^{1-\alpha}}_{\text{MR}} = \underbrace{w}_{\text{MC}} \qquad \underbrace{(1-\alpha) p L^{\alpha} E^{-\alpha}}_{\text{MR}} = \underbrace{r + d}_{\text{MC}}$$` -- The for a social optimum we want to equate the MR (left hand side) with the SMC (right hand side) for both inputs --- # Output taxes, part two The firm's problem for the output tax is: `$$\max_{L,E} (p-\tau_o)L^\alpha E^{1-\alpha} - wL - rE$$` -- The firm's profit-maximizing choices are given by the first-order conditions: `$$\alpha(p-\tau_o)L^{\alpha-1} E^{1-\alpha} = w \qquad (1-\alpha)(p-\tau_o)L^{\alpha} E^{-\alpha} = r$$` -- The firm equates the MR and MC of each input -- The output tax penalizes the use of clean labor (despite it not causing any externalities) at a marginal rate of: `\(\tau_o L^{\alpha-1} E^{1-\alpha}\)`, this is .hi-red[not efficient] --- # Output taxes, part two How does this compare to a pure emission tax? -- The firm's problem when facing an emission tax is: `$$\max_{L,E} pL^\alpha E^{1-\alpha} - wL - (r+\tau_e)E$$` -- The firm's profit-maximizing choices are given by the first-order conditions: `$$\alpha(p)L^{\alpha-1} E^{1-\alpha} = w \qquad (1-\alpha) p L^{\alpha} E^{-\alpha} = r + \tau_e$$` -- A tax of `\(\tau_e = d\)` can achieve the efficient allocation! --- # Output taxes takeaways If emissions are perfectly determined by output, we can use output taxes to achieve the efficient outcome -- If emissions can be chosen separately from outcome by the firm, this is no longer true -- In this case an output tax incorrectly taxes our clean inputs <!-- --- --> <!-- # Intensity standards --> <!-- One of the most commonly used regulations for environmental problems is the .hi[intensity standard] --> <!-- -- --> <!-- Intensity standards regulate the intensity of something --> <!-- -- --> <!-- E.g. --> <!-- -- --> <!-- Intensity of emissions in output --> <!-- -- --> <!-- Intensity of clean electricity sources in the total electricity portfolio --> <!-- -- --> <!-- Intensity of ethanol in the fuel supply --> <!-- --- --> <!-- # Intensity standards: RPS --> <!-- <center> --> <!-- ```{r, out.width = "100%", fig.pos="c", echo = FALSE} --> <!-- knitr::include_graphics("files/06-rps.png") --> <!-- ``` --> <!-- </center> --> <!-- --- --> <!-- # Intensity standards: RPS --> <!-- <center> --> <!-- ```{r, out.width = "100%", fig.pos="c", echo = FALSE} --> <!-- knitr::include_graphics("files/06-rps2.png") --> <!-- ``` --> <!-- </center> --> <!-- --- --> <!-- # Intensity standards --> <!-- Consider a case where we have a good with two types: --> <!-- - a high type `\(H\)` that results in a high level of emissions --> <!-- - a low type `\(L\)` that results in a low level of emissions --> <!-- -- --> <!-- The emission rate per unit of output for each is `\(\beta_H\)` and `\(\beta_L\)` --> <!-- -- --> <!-- The marginal damage from emissions is `\(d\)` --> <!-- -- --> <!-- The cost function to produce each type of output is `\(C_H(Q_H)\)` and `\(C_L(Q_L)\)` --> <!-- -- --> <!-- The social benefit of consuming the goods is given by a social utility function `\(U(Q_H,Q_L)\)` --> <!-- --- --> <!-- # Intensity standards: social planner --> <!-- That's our set up! --> <!-- -- --> <!-- The social planner's problem is: --> <!-- `$$\max_{Q_H,Q_L} U(Q_H,Q_L) - \underbrace{(C_H(Q_H) + C_L(Q_L))}_{\text{private cost}} - \underbrace{\tau(\beta_H Q_H + \beta_L Q_L)}_{\text{external cost}}$$` --> <!-- -- --> <!-- Maximize the social utility of the good, minus the private and external costs --> <!-- -- --> <!-- The first-order conditions tell us how social welfare is maximized: --> <!-- `$$\frac{\partial U(Q_H,Q_L)}{\partial Q_i} = \frac{\partial C_i(Q_i)}{\partial Q_i} + \tau \beta_i \,\,\, i = L,H$$` --> <!-- --- --> <!-- # Intensity standards: social planner --> <!-- `$$\frac{\partial U(Q_H,Q_L)}{\partial Q_i} = MC_i + \tau \beta_i \,\,\, i = L,H$$` --> <!-- where we label marginal cost `\(MC_i = \frac{\partial C_i(Q_i)}{\partial Q_i}\)` --> <!-- What is this condition saying? --> <!-- -- --> <!-- The marginal benefit of producing the good must equal the private marginal cost of production, plus the marginal damages --> <!-- -- --> <!-- Now what if we try to address the pollution externality with an intensity standard: a cap on the emissions per unit of output? --> <!-- --- --> <!-- # Intensity standards: social planner --> <!-- An emission standard might look something like this: --> <!-- `$$\frac{\overbrace{\beta_H Q_H + \beta_L Q_L}^{\text{total emissions}}}{\underbrace{Q_H+Q_L}_{\text{total output}}} = \sigma$$` --> <!-- -- --> <!-- The left hand side is emissions (top) per unit of total output (bottom) --> <!-- -- --> <!-- The right hand side is the standard: `\(\sigma\)` is the required emissions intensity --> <!-- -- --> <!-- For the standard to make any sense it must be: `\(\beta_L \leq \sigma \leq \beta_H\)`, --> <!-- -- --> <!-- otherwise it doesn't do anything `\(\sigma > \beta_H\)` or its unattainable `\(\sigma < \beta_L\)` --> <!-- --- --> <!-- # Intensity standards: firm --> <!-- Now how does the firm respond to an intensity standard? --> <!-- -- --> <!-- Suppose there are prices `\(p_H\)` and `\(p_L\)` for each type of the good --> <!-- -- --> <!-- The firm's maximizes profit subject to the intensity standard: --> <!-- -- --> <!-- $$\max_{Q_H,Q_L} \pi(Q_H,Q_L) = p_H Q_H + p_L Q_L - C_H(Q_H) - C_L(Q_L) \,\,\, \\ --> <!-- \text{subject to: } \frac{\beta_H Q_H + \beta_L Q_L}{Q_H+Q_L} = \sigma$$ --> <!-- --- --> <!-- # Intensity standards: firm --> <!-- Notice that we can solve the intensity standard constraint for `\(Q_H\)`: --> <!-- `$$Q_H = \frac{\sigma - \beta_L}{\beta_H - \sigma}Q_L$$` --> <!-- -- --> <!-- We can plug it into the firm's profit function to get rid of one of the output variables: --> <!-- `$$\max_{Q_L} p_H \frac{\sigma - \beta_L}{\beta_H - \sigma}Q_L + p_L Q_L - C_H\left(\frac{\sigma - \beta_L}{\beta_H - \sigma}Q_L\right) - C_L(Q_L)$$` --> <!-- -- --> <!-- Next, the first-order condition for a maximum --> <!-- --- --> <!-- # Intensity standards: firm --> <!-- The first-order condition is: --> <!-- `$$p_H \frac{\sigma - \beta_L}{\beta_H - \sigma} + p_L = \frac{\sigma - \beta_L}{\beta_H - \sigma} MC_H + MC_L$$` --> <!-- which is equivalent to: --> <!-- `$$\frac{p_L - MC_L}{\beta_L - \sigma} = \frac{p_H - MC_H}{\beta_H - \sigma}$$` --> <!-- -- --> <!-- To get to the final part of the intuition let: --> <!-- `$$\lambda \equiv (p_i - MC_i) / (\beta_i-\sigma)$$` --> <!-- --- --> <!-- # Intensity standards: firm --> <!-- `$$\lambda \equiv (p_i - MC_i) / (\beta_i-\sigma)$$` --> <!-- This lets us write the `\(Q_L\)` FOC as: --> <!-- `$$p_L = MC_L(Q_L) + \lambda(\beta_L-\sigma)$$` --> <!-- and it turns out if we instead framed the problem instead of `\(Q_H\)` we'd get the same FOC: --> <!-- `$$p_H = MC_H(Q_H) + \lambda(\beta_H-\sigma)$$` --> <!-- -- --> <!-- What are these FOCs telling us about the firm's problem: --> <!-- `$$p_i = MC_i(Q_i) + \lambda(\beta_i-\sigma) \,\,\, i=L,H$$` --> <!-- --- --> <!-- # Intensity standards: firm --> <!-- The firm equates marginal revenue `\(p_i\)` and total marginal cost for each type `\(i\)` --> <!-- -- --> <!-- The marginal cost is composed of two pieces: --> <!-- 1. The actual marginal cost of production `\(MC_i\)` --> <!-- 2. The .hi[implicit] marginal cost imposed by the regulation: `\(\lambda(\beta_i-\sigma)\)` --> <!-- -- --> <!-- The regulation forces the firm to choose an allocation that is away from its unconstrained optimum, 2. is what picks up this economic force --> <!-- -- --> <!-- What is the sign of `\(\lambda(\beta_i-\sigma)\)`? --> <!-- --- --> <!-- # Intensity standards: firm --> <!-- What is the sign of `\(\lambda(\beta_i-\sigma)\)`? --> <!-- -- --> <!-- Recall: `\(\beta_L \leq \sigma \leq \beta_H\)` --> <!-- -- --> <!-- `\(\lambda(\beta_i-\sigma) \geq 0\)` for `\(i = H\)`, `\(\lambda(\beta_i-\sigma) \leq 0\)` for `\(i = L\)` --> <!-- -- --> <!-- The regulation is acting like an implicit marginal .hi-red[tax] on the high emission good, and an implicit .hi-blue[subsidy] on the low emission good! --> <!-- -- --> <!-- The intensity standard aims to shift production from high emission intensity to low emission intensity goods --> <!-- -- --> <!-- Is the intensity standard efficient? --> <!-- --- --> <!-- # Intensity standards: efficiency --> <!-- Social welfare is maximized when: --> <!-- `$$\frac{\partial U(Q_H,Q_L)}{\partial Q_i} = MC_i + \tau \beta_i \,\,\, i = L,H$$` --> <!-- -- --> <!-- The firm maximizes profit under the intensity standard at: --> <!-- `$$p_i = MC_i(Q_i) + \lambda(\beta_i-\sigma) \,\,\, i=L,H$$` --> <!-- `\(\frac{\partial U(Q_H,Q_L)}{\partial Q_i} = p_i\)` from household utility maximization<sup>1</sup> --> <!-- .footnote[ --> <!-- <sup>1</sup>Prices reflect the marginal value of consumption. --> <!-- ] --> <!-- --- --> <!-- # Intensity standards: efficiency --> <!-- Social efficiency: --> <!-- `$$\frac{\partial U(Q_H,Q_L)}{\partial Q_i} = MC_i + \tau \beta_i \,\,\, i = L,H$$` --> <!-- Firm choice: --> <!-- `$$\frac{\partial U(Q_H,Q_L)}{\partial Q_i} = MC_i(Q_i) + \lambda(\beta_i-\sigma) \,\,\, i=L,H$$` --> <!-- -- --> <!-- These conditions show us that an intensity standard is .hi[not] efficient --> <!-- -- --> <!-- Why? --> <!-- --- --> <!-- # Intensity standards: efficiency --> <!-- At a social optimum, we want to .hi[tax] both `\(L\)` and `\(H\)` goods because they are both polluting --> <!-- -- --> <!-- But the intensity standard .hi[subsidizes] `\(L\)` --> <!-- -- --> <!-- The intensity standard cannot reach the efficient allocation because it is subsidizing a good that produces a negative externality<sup>1</sup> --> <!-- .footnote[ --> <!-- <sup>1</sup>Technically it can in the specific case when the `\(L\)` type good does not emit any pollution, `\(\beta_L = 0\)`, but in general this won't be true. --> <!-- ] --> <!-- -- --> <!-- We call policies that can't achieve the social optimum .hi[second-best] --> <!-- --- --> <!-- # Intensity standards: graphical --> <!-- Now lets look at intensity standards graphically --> <!-- A few things you'll need to know: --> <!-- 1. .hi[Iso-profit curves:] ovals that tell us the combinations of `\(Q_H,Q_L\)` that achieve the same profit --> <!-- 2. .hi[Iso-welfare curves:] ovals that tell us the combinations of `\(Q_H,Q_L\)` that achieve the same social welfare --> <!-- --- --> <!-- # Intensity standards: graphical --> <!-- These are like indifference curves for consumers, but are ovals instead of convex curves --> <!-- Why ovals? --> <!-- -- --> <!-- Producing too much can decrease profit and/or welfare so eventually profit starts falling --> <!-- With consumption, more is always better so increasing consumption always moves onto higher ICs --> <!-- --- --> <!-- # Intensity standards: what happens? --> <!-- .pull-left[ --> <!-- <center> --> <!-- ```{r, out.width = "100%", fig.pos="c", echo = FALSE} --> <!-- knitr::include_graphics("files/06-int-standard3.png") --> <!-- ``` --> <!-- </center> --> <!-- ] --> <!-- .pull-right[ --> <!-- The circles are iso-private welfare (iso-profit) curves --> <!-- A is where profit is maximized for the firm --> <!-- The line `\(Q_L = \frac{\beta_H-\sigma}{\sigma-\beta_L}Q_H\)` tells us which combos of `\(Q_L,Q_H\)` satisfy the intensity standard --> <!-- Holland, Hughes, and Knittel (2010) --> <!-- ] --> <!-- --- --> <!-- # Intensity standards: what happens? --> <!-- .pull-left[ --> <!-- <center> --> <!-- ```{r, out.width = "100%", fig.pos="c", echo = FALSE} --> <!-- knitr::include_graphics("files/06-int-standard3.png") --> <!-- ``` --> <!-- </center> --> <!-- ] --> <!-- .pull-right[ --> <!-- The intensity standard forces the firm to produce on the line --> <!-- The highest iso-profit curve it can achieve is at point C --> <!-- This is more `\(Q_L\)` and less `\(Q_H\)` than is optimal, consistent with the subsidy/tax combination implicit in the policy --> <!-- ] --> <!-- --- --> <!-- # Intensity standards: perverse incentives --> <!-- .pull-left[ --> <!-- <center> --> <!-- ```{r, out.width = "100%", fig.pos="c", echo = FALSE} --> <!-- knitr::include_graphics("files/06-int-standard2.png") --> <!-- ``` --> <!-- </center> --> <!-- ] --> <!-- .pull-right[ --> <!-- Intensity standards can actually backfire and increase emissions --> <!-- How? --> <!-- ] --> <!-- --- --> <!-- # Intensity standards: perverse incentives --> <!-- .pull-left[ --> <!-- <center> --> <!-- ```{r, out.width = "100%", fig.pos="c", echo = FALSE} --> <!-- knitr::include_graphics("files/06-int-standard2.png") --> <!-- ``` --> <!-- </center> --> <!-- ] --> <!-- .pull-right[ --> <!-- `\(\beta_H Q_H + \beta_L Q_L = K\)` is the line showing all combinations of `\(Q_L,Q_H\)` that generate `\(K\)` units of emissions --> <!-- K crosses through point `\(A\)` which is the unregulated profit-maximizing choice by the firm --> <!-- Anything to the top right of the line is .hi-red[more emissions] --> <!-- ] --> <!-- --- --> <!-- # Intensity standards: perverse incentives --> <!-- .pull-left[ --> <!-- <center> --> <!-- ```{r, out.width = "100%", fig.pos="c", echo = FALSE} --> <!-- knitr::include_graphics("files/06-int-standard2.png") --> <!-- ``` --> <!-- </center> --> <!-- ] --> <!-- .pull-right[ --> <!-- The regulation induces the firm to move to point `\(C\)` --> <!-- This is slightly less `\(Q_H\)`, but .hi[a lot] more `\(Q_L\)` --> <!-- The increase in emissions from `\(Q_L\)` is more than the decrease from the lowering of `\(Q_H\)` --> <!-- Overall emissions went up! --> <!-- ] --> <!-- --- --> <!-- # Intensity standards: perverse incentives --> <!-- .pull-left[ --> <!-- <center> --> <!-- ```{r, out.width = "100%", fig.pos="c", echo = FALSE} --> <!-- knitr::include_graphics("files/06-int-standard2.png") --> <!-- ``` --> <!-- </center> --> <!-- ] --> <!-- .pull-right[ --> <!-- This perverse outcome was possible because production of the `\(L\)` type was very elastic while the `\(H\)` type was inelastic --> <!-- ] --> <!-- --- --> <!-- # Intensity standards: second-best --> <!-- .pull-left[ --> <!-- <center> --> <!-- ```{r, out.width = "100%", fig.pos="c", echo = FALSE} --> <!-- knitr::include_graphics("files/06-int-standard1.png") --> <!-- ``` --> <!-- </center> --> <!-- ] --> <!-- .pull-right[ --> <!-- What is the best intensity standard? --> <!-- The dashed ovals are the iso-profit curves --> <!-- The solid ovals are the iso-welfare curves --> <!-- Welfare is maximized at point B --> <!-- Profit is maximized at point A --> <!-- ] --> <!-- --- --> <!-- # Intensity standards: second-best --> <!-- .pull-left[ --> <!-- <center> --> <!-- ```{r, out.width = "100%", fig.pos="c", echo = FALSE} --> <!-- knitr::include_graphics("files/06-int-standard1.png") --> <!-- ``` --> <!-- </center> --> <!-- ] --> <!-- .pull-right[ --> <!-- The solid line shows the firm's choices of `\(Q_L,Q_H\)` as we increase the intensity standard `\(\sigma\)` --> <!-- Increasing `\(\sigma\)` pivots the intensity standard counter-clockwise: `\(Q_L = \frac{\beta_H-\sigma}{\sigma-\beta_L}Q_H\)` --> <!-- The optimal intensity standard is the one that lets us get on the highest iso-welfare curve, which is at point `\(C\)` --> <!-- ] -->