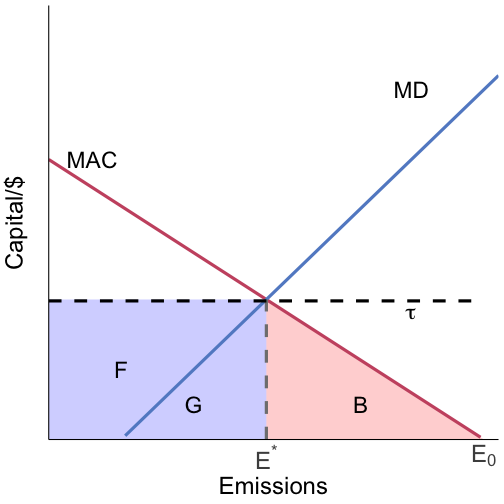

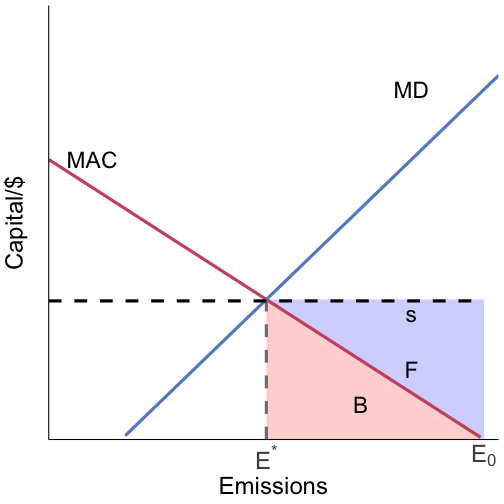

class: center, middle, inverse, title-slide .title[ # Lecture 05 ] .subtitle[ ## Taxes ] .author[ ### Ivan Rudik ] .date[ ### AEM 4510 ] --- exclude: true ```r if (!require("pacman")) install.packages("pacman") ``` ``` ## Loading required package: pacman ``` ```r pacman::p_load( tidyverse, xaringanExtra, rlang, patchwork, nycflights13, tweetrmd, vembedr ) options(htmltools.dir.version = FALSE) knitr::opts_hooks$set(fig.callout = function(options) { if (options$fig.callout) { options$echo <- FALSE } knitr::opts_chunk$set(echo = TRUE, fig.align="center") options }) ``` ``` ## Warning: 'xaringanExtra::style_panelset' is deprecated. ## Use 'style_panelset_tabs' instead. ## See help("Deprecated") ``` ``` ## Warning in style_panelset_tabs(...): The arguments to `syle_panelset()` changed in xaringanExtra 0.1.0. Please refer to the ## documentation to update your slides. ``` --- # Roadmap 1. What are the different kinds of price instruments in theory and the real world? 2. What happens under a tax? --- class: inverse, center, middle name: taxes # Taxes <html><div style='float:left'></div><hr color='#EB811B' size=1px width=796px></html> --- # Emission taxes <div class="vembedr" align="center"> <div> <iframe src="https://www.youtube.com/embed/SXAjk3lYNV0" width="533" height="300" frameborder="0" allowfullscreen="" data-external="1"></iframe> </div> </div> --- # Emission taxes The main tax we will focus on is an .hi[emission tax] -- When a polluter faces an emission tax, it must pay a fee `\(\tau\)` to the regulator for each unit of emissions `\(E\)` -- It is as if the government claimed the property rights to the air on behalf of the citizens, and then sold the rights to pollute back to the firm at price `\(\tau\)` -- Solves the two big problems with externalities: 1. Poorly defined property rights (assigned to the regulator) 2. High transactions costs (pay a flat fee) --- # Emission taxes What is the socially optimal tax? -- The `\(\tau\)` that minimizes total social cost: abatement cost + damages (ignore tax payments since they're just a transfer from firms to the regulator) -- Let `\(C(E)\)` be abatement cost of emissions level `\(E\)` and `\(D(E)\)` be damages at `\(E\)` -- We know abatement costs are decreasing in emissions and damages are increasing in emissions --- # Emission taxes To figure out the socially optimal tax we need to know how the firm and regulator make decisions -- First lets set up the firm problem: they want to minimize the cost of satisfying the policy --- # Emission taxes: firm The firm's problem is then: $$ \min_E C(E) + \tau E$$ -- The firm's first-order condition to minimize costs is: `$$\underbrace{-C'(E^*)}_{\text{MAC}} = \tau$$` -- The firm minimizes costs by choosing emissions `\(E^*\)` so that its MAC equals the tax --- # Emission standards: firm The firm minimizes costs by choosing emissions so that its MAC equals the tax -- This makes sense! -- The tax is the PMC of emitting, the MAC is the PMB of emitting (reduced abatement cost) -- Costs are minimized when these two things are equal --- # Emission taxes: regulator The regulator's problem is to maximize social welfare / minimize total costs of abatement and damages -- We already know this occurs when: `$$-C'(E^*) = D'(E^*)$$` -- but we know that firms select `\(E^*\)` so that: `$$-C'(E^*) = \tau$$` -- This means that the regulator's optimal tax is given by: `$$\tau^* = D'(E^*)$$` --- # Emission taxes: regulator The optimal tax is equal to the MD .hi[at the optimal emission level] -- This also makes a lot of sense -- We want the firm to act as if they are bearing the damage costs on the margin -- The tax actually makes them bear a cost exactly equal to marginal damage --- # Emission taxes: graphical .pull-left[  ] .pull-right[ The optimal tax equals MD at `\(E^*\)` You can think of this as the firm being forced to pay for damages equal to the cost of the last unit of emissions In addition to paying abatement cost equal to the red area `\(B\)`, the firm also has a tax payment equal to the blue area `\(F+G\)` ] --- # Emission taxes: real world Australia started carbon tax on July 1, 2012 $23 AUD per ton of carbon emitted for large emitters as a response to the Copenhagen Accord of 2009 Australia hopes to reduce carbon emissions by 80% below 2000 levels by 2050 Started by Julia Gillard government and revoked by Tony Abbott government in July 2014 --- # Emission taxes: real world In 2008, the province of British Columbia implemented North America’s first broad-based carbon tax The carbon tax applies to the purchase and use of fossil fuels and covers approximately 70% of provincial greenhouse gas emissions Beginning April 1, 2018, B.C.'s carbon tax rate is $35 per tonne of carbon dioxide equivalent emissions To improve affordability, government increased the Climate Action Tax Credit --- class: inverse, center, middle name: subsidies # Subsidies <html><div style='float:left'></div><hr color='#EB811B' size=1px width=796px></html> --- # Abatement subsidies What is the socially optimal abatement subsidy `\(s\)`? -- The `\(s\)` that minimizes total social cost: abatement cost + damages (ignore tax payments since they're just a transfer from firms to the regulator) -- Let `\(C(E)\)` be abatement cost of emissions level `\(E\)` and `\(D(E)\)` be damages at `\(E\)` -- First lets set up the firm problem: they want to minimize the cost of satisfying the policy --- # Abatement subsidies: firm The firm's problem is then: $$ \min_E C(E) - s(E_0-E)$$ where we are substituting in `\(E_0-E\)` for `\(A\)` -- The firm's first-order condition to minimize costs is: `$$-C'(E^*) = s$$` -- The firm minimizes costs by choosing emissions `\(E^*\)` so that its MAC equals the subsidy rate! --- # Abatement subsidies: firm The firm minimizes costs by choosing emissions so that its MAC equals the subsidy rate -- This makes sense! -- The subsidy is the MC of emitting: the forgone abatement subsidy The MAC is the marginal benefit of emitting (reduced abatement cost) -- Costs are minimized when these two things are equal --- # Abatement subsidies: firm The regulator's problem is to minimize the social cost of emissions, we know they want to set: `$$-C'(E^*) = D'(E^*)$$` -- but we know that firms set: `$$-C'(E^*) = s$$` -- This means that the regulator wants to set: `$$s^* = D'(E^*)$$` --- # Emission taxes: regulator The optimal subsidy is equal to the MD at the optimal emission level -- This also makes a lot of sense -- We want the firm to act as if they are bearing the damage costs on the marginal -- The subsidy actually makes them bear a cost exactly equal to marginal damage --- # Abatement subsidies: graphical .pull-left[  ] .pull-right[ The optimal subsidy equals MD at `\(E^*\)` You can think of this as the firm being forced to pay for damages equal to the cost of the last unit of emissions In addition to paying abatement cost equal to the red area `\(B\)`, the firm also has subsidy **revenues** equal to the red+blue area `\(B+F\)` ] --- # Abatement subsidies It is as if the government claimed the property rights to the air on behalf of the firm, and then pays the firm for the right to clean air on behalf of the citizens --- # Taxes vs Standards <center> <img src="files/05-bakken.png" width="80%" /> </center> --- # Taxes vs Standards <center> <img src="files/05-bakken.png" width="80%" /> </center> --- # Emission taxes <div class="vembedr" align="center"> <div> <iframe src="https://www.youtube.com/embed/kiiLzsleuwU" width="533" height="300" frameborder="0" allowfullscreen="" data-external="1"></iframe> </div> </div> --- # Unconventional oil <center> <img src="files/05-drill.png" width="80%" /> </center> --- # Unconventional oil <center> <img src="files/05-complete.png" width="80%" /> </center> --- # Unconventional oil <center> <img src="files/05-flare.png" width="80%" /> </center> --- # Flaring regulations in North Dakota North Dakota Industrial Commission established firm-level flaring limits beginning in October 2014 <center> <img src="files/05-flaring1.png" width="80%" /> </center> <center> <img src="files/05-flaring2.png" width="80%" /> </center> --- # Flaring regulations in North Dakota This is a .hi-blue[standard]: a mandate on the quantity of gas captured -- It was applied uniformly across firms -- We know that means it'll be inefficient --- # Real world MACs Firms appear to be cost-minimizing to comply <center> <img src="files/05-firm-mac.png" width="60%" /> </center> --- # Real world MACs But this doesn't mean total costs are minimized given the quantity of gas captured <center> <img src="files/05-industry-mac.png" width="50%" /> </center> --- # What if we used a tax? What if we set a tax instead of a standard? -- Suppose we just used the existing *public* lands royalty rate -- We could capture 99% of the gas as the regulation, but 50% of the cost --- # Almost everyone is better off The majority of firms are better off with a tax <center> <img src="files/05-flaring4.png" width="60%" /> </center>