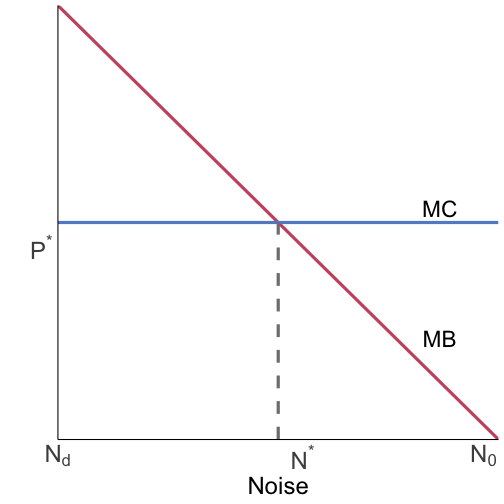

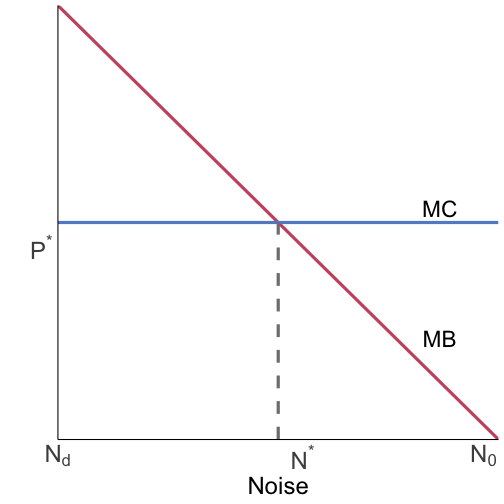

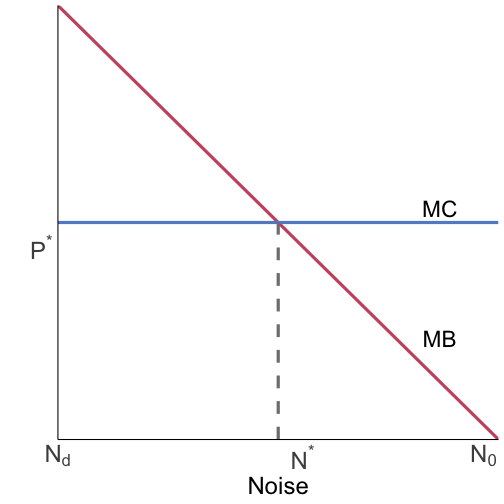

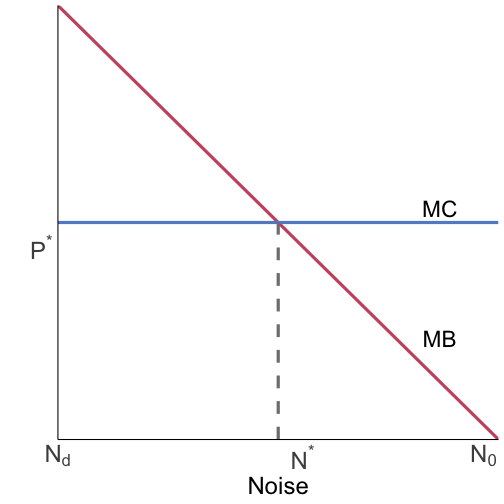

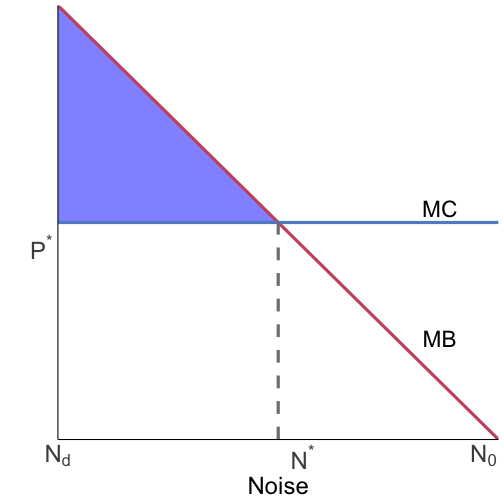

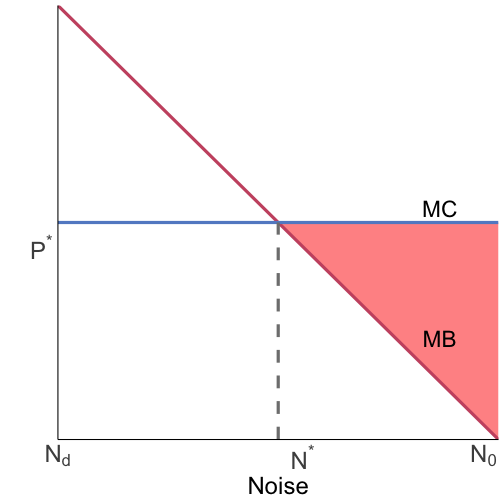

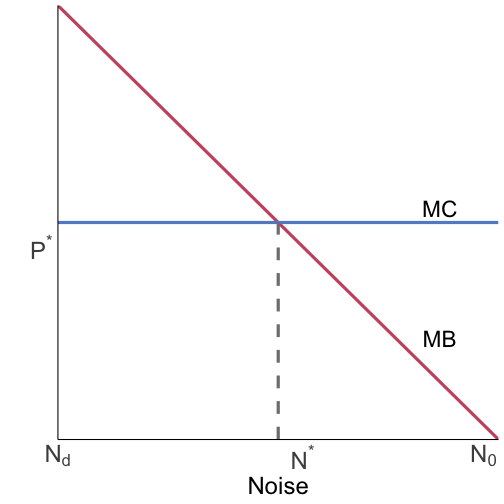

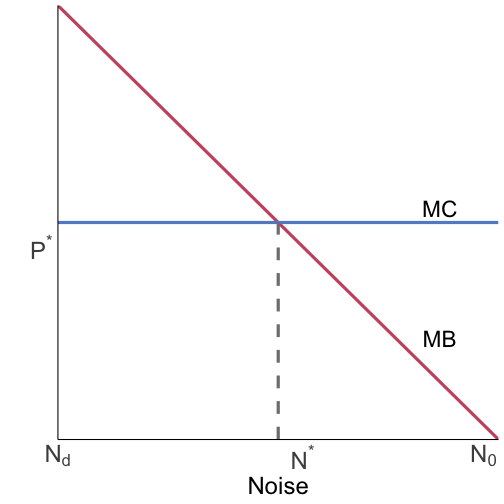

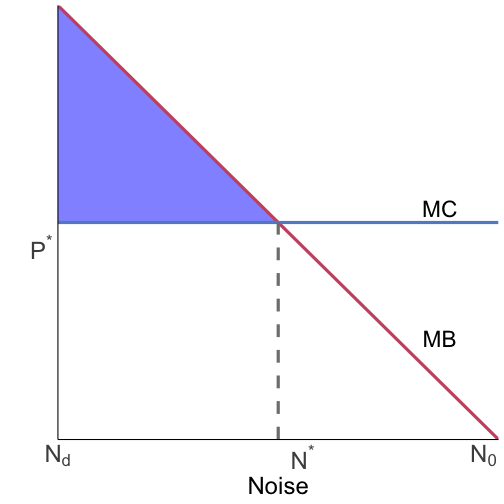

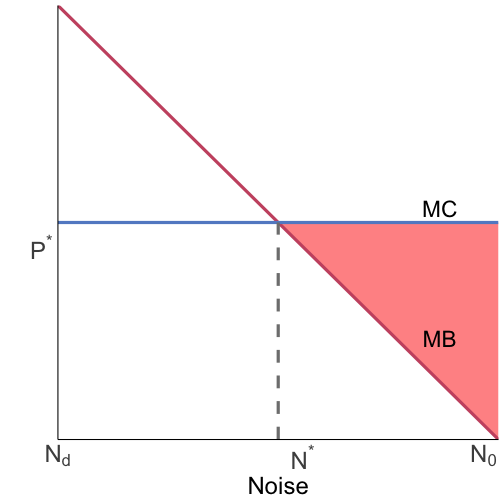

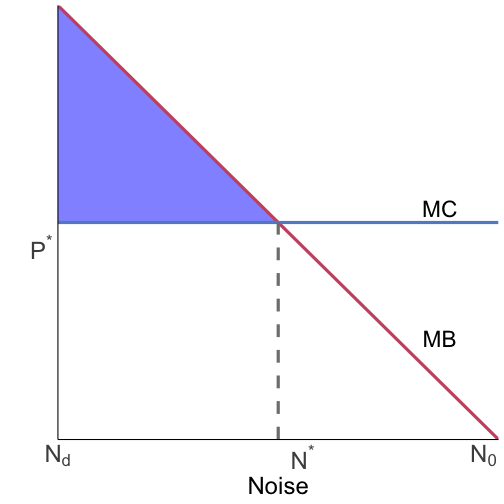

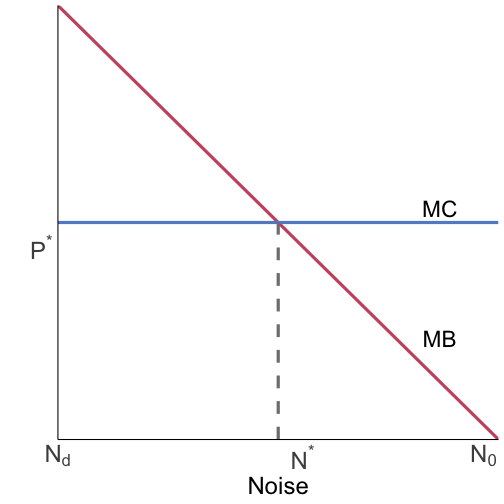

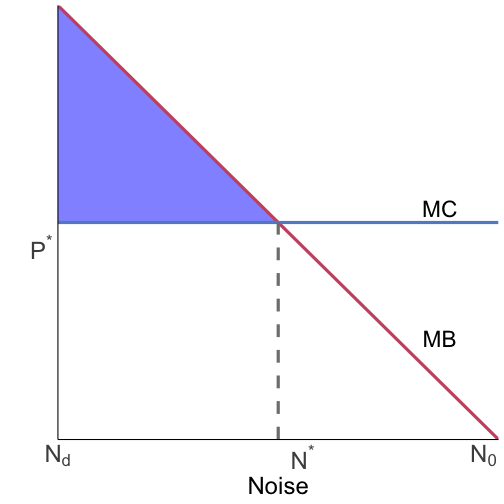

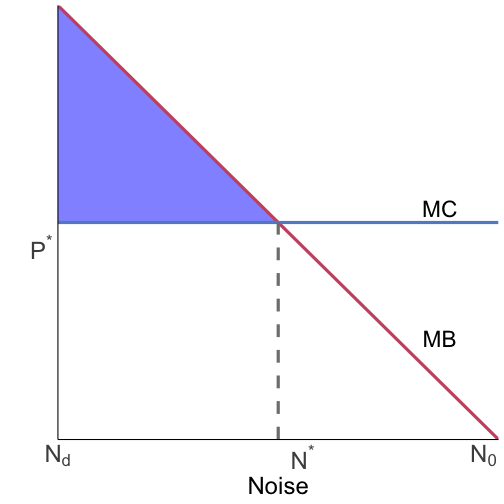

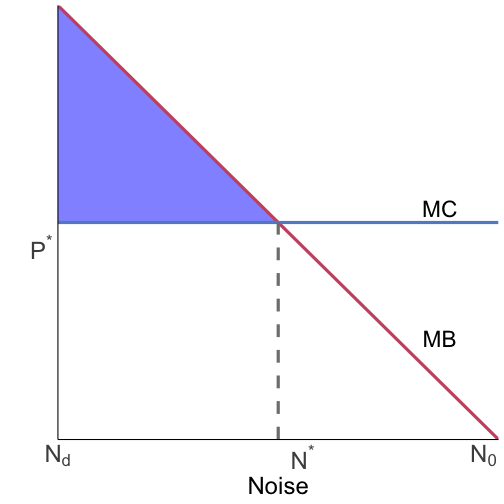

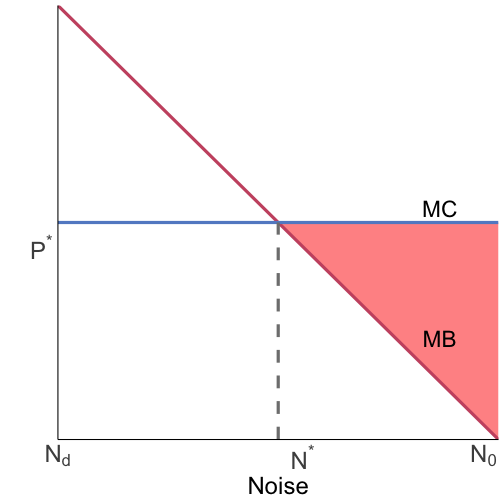

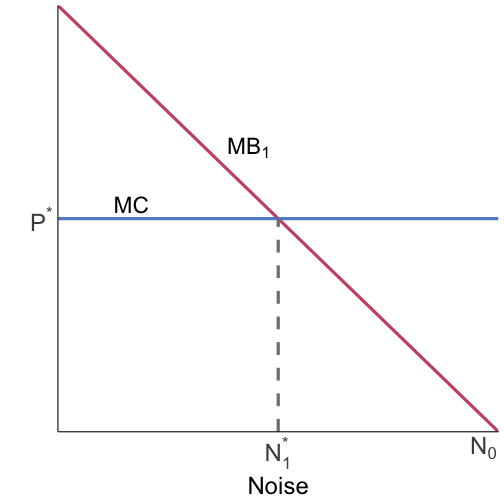

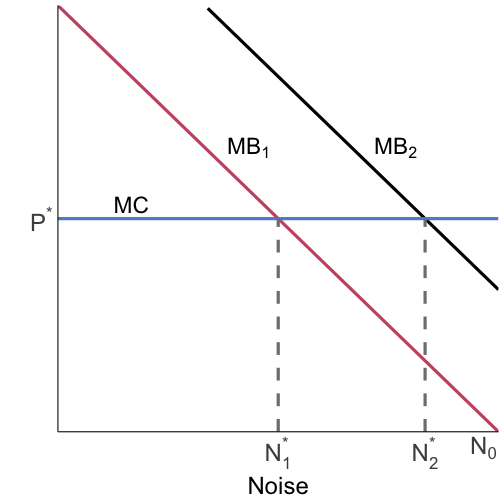

class: center, middle, inverse, title-slide .title[ # Lecture 03 ] .subtitle[ ## Coasean Bargaining ] .author[ ### Ivan Rudik ] .date[ ### AEM 4510 ] --- exclude: true ```r if (!require("pacman")) install.packages("pacman") pacman::p_load( tidyverse, xaringanExtra, rlang, patchwork, tweetrmd, vembedr ) options(htmltools.dir.version = FALSE) knitr::opts_hooks$set(fig.callout = function(options) { if (options$fig.callout) { options$echo <- FALSE } knitr::opts_chunk$set(echo = TRUE, fig.align="center") options }) ``` ``` ## Warning: 'xaringanExtra::style_panelset' is deprecated. ## Use 'style_panelset_tabs' instead. ## See help("Deprecated") ``` ``` ## Warning in style_panelset_tabs(...): The arguments to `syle_panelset()` changed in xaringanExtra 0.1.0. Please refer to the documentation to update your slides. ``` --- # Roadmap 1. Can we achieve the efficient outcome .hi[without] government intervention? 2. What does the Coase theorem say? 3. What are the limits to Coasean bargaining? --- class: inverse, center, middle name: coase # Coase Theorem <html><div style='float:left'></div><hr color='#EB811B' size=1px width=796px></html> --- # Pigou vs Coase We have argued that efficient allocations are not achieved in the presence of externalities -- Why? -- There are no markets through which the source of the externality must pay/be compensated for its effect on society -- i.e. they're not priced -- This means there's a role for government to create this market or price the externality --- # Ronald Coase (1910-2013) .pull-left[ <center> <img src="files/03-coase.png" width="100%" /> </center> ] .pull-right[ In a famous paper (”The Problem of Social Cost”), 1991 Nobel prize winner Ronald Coase made people rethink this Do we actually .hi[NEED] government intervention? ] --- # Ronald Coase (1910-2013) <div class="vembedr" align="center"> <div> <iframe src="https://www.youtube.com/embed/pKJiXZKIh_U" width="533" height="300" frameborder="0" allowfullscreen="" data-external="1"></iframe> </div> </div> --- # The Coase Theorem If there are: 1. No wealth effects on demand 2. No transactions costs 3. Well-defined and enforceable property rights then: -- the most efficient or optimal economic activity will occur regardless of who holds the property rights -- The right to pollute (a resource) will end up in the hands who value it most through negotiation --- # Property rights <div class="vembedr" align="center"> <div> <iframe src="https://www.youtube.com/embed/fe05EYFlMLk" width="533" height="300" frameborder="0" allowfullscreen="" data-external="1"></iframe> </div> </div> Property rights are only as good as prevailing norms or enforcement --- # Coasean arguments Coase versus Pigou: externalities are reciprocal in nature -- A power plant produces emissions that nearby residents breathe and those people incur the external costs -- By breathing the air, the nearby residents help create the externality (i.e. if they weren’t there, there would be no external cost from emitting pollution) --- # Coasean arguments What is more valuable to society? -- The externality-producing good generated by the power plant or letting people live nearby? -- Argument resonates better in the context of the legal cases being considered by Coase (e.g. the doctor and the confectioner). In the context of the power plant the victims aren’t “producing” anything --- # The Doctor and the Confectioner More noise = more candy and less medical services -- Less noise = less candy and more medical services -- Which is better from a social point of view depends upon the relative values of candy and medical services -- Is the net benefit to society better at no noise, 0, or the level of noise that maximizes confectioner profit, N<sub>0</sub> --- # The Doctor and the Confectioner .pull-left[  ] .pull-right[ MC is the marginal cost imposed on the doctor by noise MB is the marginal benefit to the confectioner (marginal profits) from the production process that creates noise ] --- # Coase: Point 1 .pull-left[  ] .pull-right[ It is important to establish that someone has the property rights Otherwise, trade will not happen Give property rights to the confectioner Initial outcome will be N=N<sub>0</sub> What happens next? ] --- # Coase: Point 1 .pull-left[  ] .pull-right[ the doctor can pay the confectioner to stay quiet (stop producing) for part of the day Why? Because MC to the doctor is higher than the MB to the confectioner for the units of noise after N<sup>*</sup> ] --- # Coase: Point 1 .pull-left[  ] .pull-right[ ] --- # Coase: Point 1 .pull-left[  ] .pull-right[ The doctor is willing to pay more (MC) than the confectioner is willing to accept (MB) until noise is reduced to N<sup>*</sup> This is where total benefit is maximized (blue area) ] --- # Coase: Point 1 .pull-left[  ] .pull-right[ The doctor and confectioner can split the .hi-red[bargaining surplus], the red area This is just the avoided deadweight loss from the noise externality ] --- # Coase: Point 1 .pull-left[  ] .pull-right[ Instead of assigning property rights to the confectioner we could have assigned them to the doctor In this case what happens? ] --- # Coase: Point 1 .pull-left[  ] .pull-right[ First, we start at N<sub>d</sub> now since the doctor does not like noise Confectioner pays the doctor to be allowed to make noise The confectioner is willing to pay (MB) more than the doctor is willing to accept (MC) until we reach N<sup>*</sup> ] --- # Coase: Point 1 .pull-left[  ] .pull-right[ We now maximize surplus (.hi-blue[blue]) and gain bargaining surplus (.hi-blue[blue]) that is split between the doctor and confectioner .hi[It didn't matter who had the property rights, we managed to get to N<sup>*</sup>] ] --- # Coase: Point 2 .pull-left[  ] .pull-right[ The initial assignment of property rights does matter for the distribution of surplus If we give the confectioner property rights, they get paid by the doctor some quantity up to the total size of the red area (bargaining surplus) ] --- # Coase: Point 2 .pull-left[  ] .pull-right[ The initial assignment of property rights does matter for the distribution of surplus If we give the doctor property rights, they get paid by the confectioner some quantity up to the total size of the blue area (bargaining surplus) ] --- # Coase: Point 2 .pull-left[  ] .pull-right[ This means that property rights are valuable! If you have property rights, others have to incentivize you in order to deviate from your privately optimal choice You will only change the level of noise if your welfare/surplus improves ] --- # Coase: Point 3 What if the choice is discrete: noise or silence? -- Suppose the surplus to the two people under noise and silence is given by: | | Confectioner | Doctor | |--------- |:------------: |:------: | | Noise | 500 | 0 | | Silence | 0 | 250 | What happens? -- Total surplus is maximized with noise (500 > 250)... --- # Coase: Point 3 | | Confectioner | Doctor | |--------- |:------------: |:------: | | Noise | 500 | 0 | | Silence | 0 | 250 | If the confectioner has the property rights, we are already at the efficient outcome -- If the doctor has property rights, the confectioner can pay the doctor > 250 but < 500 and both are better off, a Pareto improvement! --- # Coase Caveats Coasean bargaining does not always work There are two key pieces we need to have satisfied: 1. No Transactions costs 2. No income effects --- # Coase Caveats: Transactions costs Suppose the doctor owns the property right of zero noise Noise `\(N\)` imposes cost `\(C(N)\)` on the doctor, benefits `\(B(N)\)` to the confectioner -- The confectioner could propose a contract where the doctor accepts some noise `\(N\)`, in exchange for a payment `\(\theta\)` --- # Coase Caveats: Transactions costs The confectioner could propose a contract `\((N,\theta)\)` consisting of noise level `\(N\)` and transfer payment `\(\theta\)` -- The doctor can then accept or refuse the contract `\((N,\theta)\)` -- Negotiating is .hi[costly] and has its own transactions cost `\(tr\)` --- # Coase Caveats: Transactions costs When does the doctor accept the contract? -- The doctor is weakly better off accepting the contract if the transfer payment `\(\theta\)` (the benefit) is at least the cost of noise `\(C(N)\)` -- In our graphical example, C(N) = MC `\(\times\)` N since MC is constant -- What contract does the confectioner offer in equilibrium? -- i.e. what contract proposal maximizes the confectioner's profit? --- # Coase Caveats: Transactions costs The confectioner will choose to offer `\(\theta = MC \times N\)` -- Why? -- It's the least amount required for the doctor to accept --- # Coase Caveats: Transactions costs This means we can write the confectioner's total profit as: -- `$$\pi(N) = B(N) - MC \times N - tr$$` Where `\(B(N)\)` is the benefits to the confectioner of noise (area under the MB curve) -- It's optimal choice of `\(N\)` (and therefore `\(\theta\)`) is given by the first-order condition: -- `$$B'(E) = MC \leftrightarrow MB(E) = MC$$` which matches our condition for efficiency in noise -- .hi[Did transactions costs actually cause any problems?] --- # Coase Caveats: Transactions costs .pull-left[  ] .pull-right[ Yes! Why? ] --- # Coase Caveats: Transactions costs .pull-left[  ] .pull-right[ Yes! Why? To have a mutually beneficial contract we still need the total gain in surplus (.hi-blue[blue]) to be greater than `\(tr\)` ] --- # Coase Caveats: Transactions costs .pull-left[  ] .pull-right[ Yes! Why? To have a mutually beneficial contract we still need the total gain in surplus (.hi-blue[blue]) to be greater than `\(tr\)` Otherwise the total cost of the bargaining is greater than the total benefit from bargaining `\(\rightarrow\)` bargaining makes us worse off ] --- # Coase Caveats: Transactions costs If the confectioner has the rights to noise, we just flip the script -- The doctor proposes a contract `\((N, \theta)\)` where the confectioner reduces noise from `\(N_0\)` in exchange for a transfer payment -- The confectioner accepts or rejects the contract When does the confectioner accept the contract? -- The confectioner accepts if `\(\theta \geq B(N_0) - B(N)\)` (payment > loss of benefits) -- The doctor will then offer the minimum required: `\(\theta = B(N_0) - B(N)\)` --- # Coase Caveats: Transactions costs The doctor's problem is then to maximize the benefits of the transaction: `$$\max_{N} \underbrace{MC \times(N_0-N)}_{\text{noise cost reduction}} - \theta - tr$$` Which we can write as: `$$\max_{N} MC \times (N_0-N) - \underbrace{(B(N_0) - B(N))}_{\theta} - tr$$` --- # Coase Caveats: Transactions costs `$$\max_{N} MC \times (N_0-N) - \underbrace{(B(N_0) - B(N))}_{\theta} - tr$$` -- First term is the avoided noise costs, second term is the payment, third term is the transaction cost -- The doctor's problem gives us the first-order condition: `$$MC = B'(E) \equiv MC = MB$$` --- # Coase Caveats: Transactions costs .pull-left[  ] .pull-right[ We again reach the social optimum! To have a mutually beneficial contract we still need the total gain in surplus (.hi-red[red]) to be greater than `\(tr\)` Otherwise the total cost of the bargaining is greater than the total benefit from bargaining `\(\rightarrow\)` bargaining makes us worse off ] --- # Coase Caveats: Transactions costs Main takeaway: transactions costs can prevent Coasean bargaining from achieving the efficient allocation -- Why? -- In cases where the gains from bargaining are small, transactions costs may exceed the benefits and prohibit bargaining from occurring --- # Coase Caveats: Income effects .pull-left[  ] .pull-right[ Suppose the confectioner is given the property rights (start at N<sub>0</sub>) Doctor pays confectioner to eliminate noise and move to N<sub>1</sub><sup>*</sup> The confectioner gets some amount of surplus/income What can the confectioner do with it? ] --- # Coase Caveats: Income effects .pull-left[  ] .pull-right[ The confectioner can buy more candy-making machines, increasing its MB from noise This changes the optimal noise to N<sub>2</sub><sup>*</sup> We have a new equilibrium! If they contracted to reach N<sub>1</sub><sup>*</sup>, it is now .hi[inefficient] ] --- # Ways to alleviate transactions cost One common issue is incomplete information -- Disseminating information can make it easier to know each other's costs and benefits which makes beneficial trades more likely to occur --- # Ways to alleviate transactions cost Emergency Planning and Community Right-to-know Act (1986) set-up the Toxic Release Inventory (TRI): http://www.epa.gov/tri/ Green (“eco”) labeling - Allows companies to learn which firms took positive steps to reduce pollution, and to reward them in the marketplace - Firms need to be able to increase demand by enough to offset higher costs and raise profits -- Is there a role for the government to be involved in verifying “green” claims? What really constitutes “organic”? --- # Coase theorem While transaction costs can be the downfall of Coasian bargaining, there are costs to government policy: - Bureaucratic costs - Government might set the policy incorrectly -- Coase and Pigou both have trade-offs to their approaches to solving environmental issues --- class: inverse, center, middle name: coase # An example: The Cheshire transaction <html><div style='float:left'></div><hr color='#EB811B' size=1px width=796px></html> --- # The Cheshire transaction Cheshire, Ohio: a small town with a population 221 before 2002 -- In the 1970’s the town welcomed the construction of a power plant nearby -- Gavin Power plant owned by American Electric Power (AEP): 2.6 GW Enough power for 2 million people (completed 1975) -- In the 1990’s, property values in the village plummeted -- Why would this be the case? --- # The Cheshire transaction Acid rain fallout damaged cars, odors nauseated residents and thick plumes of smoke sometimes blocked the sun -- In August 2000 the Environmental Protection Agency declared the Gavin plant in violation of the Clean Air Act -- A later study found that the air in Cheshire was five times the level necessary to cause an asthma attack -- What happened next? Some real world Coasean bargaining --- # The Cheshire transaction Fall 2001: the village selected a law group from Washington, DC to pressure the power plant and its owner to heed their concerns and clean up the plant’s emissions -- Others wanted the plant to compensate them for diminished property value and to address health concerns -- April 16, 2002: AEP announced its plan to acquire the incorporated town for $20 million -- September 24, 2002: AEP announces that it has finalized the buyout. About 90 percent of town residents have participated in the buyout offer and have signed the health waivers and the confidentiality agreements --- # The Cheshire transaction Property owners in town receive 3.5x assessed value Outside town: 2x assessed value Renters receive $5k for each year lived in Cheshire, up to $25k Must sign a health waiver prohibiting them from suing AEP for future health problems --- # The Cheshire transaction Must also sign a confidentiality agreement -- Cheshire residents over age of 71 able to remain in homes rent free until death -- Original population: 221. Current population: <20 -- Total settlement disbursed by AEP: $20 million -- Attorneys take about 1/3 of settlement money --- # The Cheshire transaction: was it a good thing? We know the efficient pollution control decision was made, why? -- AEP could have abated instead of compensating! Basically all the involved parties agreed to the contract -- Now imagine that AEP Gavin’s control costs were low, and the efficient outcome would be to install additional control equipment -- Would it matter whether we granted the “right to clean air” to the town or to AEP? --- # Coase in practice Cap-and-trade is effectively Coase at large scale -- It allocates a number of rights to pollute (permits or allowances) -- The total number of rights is the cap -- Coase tells us that the initial distribution of permits does not matter -- The cap-and-trade system will then achieve the efficient outcome