| Reform Year | J.O. Affected | Income Tax Change |

|---|---|---|

| 1983 | Individuals | 8% increase in most scales; Max tax rate was reduced from 56 to 49% |

| Ltd. Co. | Reduction from 20 to 18%; Now subject to presumptive income | |

| 1986 | Individuals | Max tax rate applied was reduced from 49 to 30% |

| Ltd. Co. | Increased from 18 to 30% | |

| Corporations | Decreased from 40 to 30% |

Tax Evasion and Productivity

Corporate tax evasion through cost overreporting spreads internationally causing governments significant tax revenue losses. Detecting and measuring the magnitude of tax evasion remains a challenge, even for the few studies on overreporting where researchers can exploit administrative data. Moreover, if this evasion strategy accounts for economic losses as large as reported, then cost overreporting might bias estimates of production functions, especially productivity. This paper addresses both issues. I first provide a novel strategy to estimate cost overreporting using commonly available firm-level data. I then formally show that ignoring cost overreporting leads to downward biased productivity estimates. Finally, I demonstrate how to recover productivity in the presence of tax evasion.

Tax Evasion, Cost Overreporting, Production Function Estimation, Productivity

Updates

- Tax Evasion and Productivity: Using PF to identify tax evasion through input overreporting

- CD

- Preliminary results of Tax Evasion: Moments, MLE (Truncated Normal and LogNormal)

- Identification of PF parameters when \(h\) AR(1)

- New Discussion: Variance of the error term and Choosing intermediates in GNR-CD.

- New Preliminary results of PF parameters

- New Productivity results

- TransLog

- Identification strategy for tax evasion

- CD

- Leveraging Tax Policy change to identify changes in tax evasion

- Why? Relax common technology assumption

- Triple difference identification strategy (with CD)

Next Steps

- Tax Evasion and Productivity

- Back of Envelope estimates for Gov Losses in Tax Revenue

- App of Productivity: Aggregate Productivity and Resource Misallocations

- Translog Tax Evasion results

- Translog PF identification strategy

- Translog PF results

- Translog Productivity results

- DiD

- Relaxing parallel trends: Linear trends that in the absence of policy change would have continued

1 TODO

- Using ELVIS to allow for more flexible functional forms of \(h\) the markov process of productivity

- Non-parametric Deconvolution

- Non-parametric PF

2 A parsimonious model of tax evasion through input overreporting

Price-taking firms maximize expected after-tax profits. Firms choose the flexible input \(M_{it}\) to produce output \(Y_{it}\) given output and input prices \(\{P_{t}, \rho_t\}\), a common technology, the production function (Equation 1), and their productivity \(\omega_{it}\).

\[ Y_{it}=G(M_{it})\exp(\omega_{it}+\varepsilon_{it}) \tag{1}\]

As standard in the literature, productivity \(\omega_{it}\) is known to firms when they make input decisions. This is the well-known endogeneity problem of simultaneity. On the other hand, firms face output shocks. The output shock \(\varepsilon_{it}\) is not part of the firms’ information set.

The model departs from the literature by allowing firms to overreport their inputs \(e_{it}\) to reduce their tax burden and optimize after-tax profits. Firms, then, consider in their optimization problem the profit tax \(\tau\), the evasion penalty/cost \(\kappa(e)\), and the probability of detection \(q(e_{it}|\theta_{it})\).

Firms solve Equation 2 \[ \begin{aligned} \max_{M_{it}, e_{it}\in [0,\infty)} [1-q(e_{it}|\theta_{it})]&\left[(P_t\mathbb{E}[Y_{it}]-\rho_{t} M_{it})-\tau\left(P_t\mathbb{E}[Y_{it}]-\rho_{t} (M_{it}+e_{it})\right)\right]\\ +q(e_{it}|\theta_{it})&\left[(1-\tau)(P_t\mathbb{E}[Y_{it}]-\rho_{t} M_{it})-\kappa(e)\right] \\ \text{s.t. }\; Y_{it}=G(M_{it})&\exp(\omega_{it}+\varepsilon_{it}) \end{aligned} \tag{2}\]

The probability of detection \(q(e_{it}|\theta_{it})\) is monotonically increasing in the amount evaded \(e_{it}\), conditional on the type of the firm \(\theta_{it}\). Intuitively, for a given type, firms that evade more are more likely to get caught.

The type of the firm \(\theta_{it}\) might be discrete, like the type of juridical organization, or continuous, like the level of revenue1. Some types might be more likely to be detected if the firm engages in tax evasion. For example, in contrast to other types of juridical organizations in Colombia, corporations are closely supervised and are required to have an auditor. That is, for a given level of tax evasion \(e_0\) and two different types \(\theta' \not= \theta \in \mathbfcal{\Theta}\), then \(q(e_0|\theta')\ge q(e_0|\theta)\).

If the type \(\theta\) is continuous, it might be a function of inputs; for example, level of revenue. Firms will then affect their probability of detection \(q(e|\theta)\) in two ways: directly, by choosing how much they evade \(e\); and indirectly, when choosing inputs \(M\).

The optimal decision of the firm will depend on the fiscal environment \(\Gamma=\{\tau, \kappa, q \}\), namely the tax rates, the penalty/cost of detection, and the probability of detection.

The firms’ problem (Equation 2) can be rewritten as follows, \[ \begin{aligned} \max_{M_{it},e_{it}} \mathbb{E}[\pi_{it}|\Gamma] = &(1-\tau)\left(\mathbb{E}[Y_{it}]-\frac{\rho_{t}}{P_t} M_{it}\right)+[1-q(e_{it}|\theta_{it})]\left(\frac{\rho_{t}}{P_t}e_{it}\tau\right) -q(e_{it}|\theta_{it})\kappa(e_{it}) \\ &\text{s.t. }\; Y_{it}=G(M_{it})\exp(\omega_{it}+\varepsilon_{it}) \end{aligned} \tag{3}\]

Intuitively, if the firm overreports her inputs’ cost, she will get the share of the value she overreported with probability \((1-q)\) and she will be penalized with probability \(q\).

Assuming well-behaved functions and no corner solutions, the first-order conditions lead to the following system of differential equations,

\[ G_M(M_{it})\exp(\omega_{it})\mathcal{E}-\frac{\rho_{t}}{P_t} = \frac{1}{(1-\tau)}\frac{\partial q(e_{it}|\theta_{it})}{\partial \theta_{it}}\frac{\partial \theta_{it}}{\partial M}\left[\frac{\rho_t}{P_t}e_{it}\tau+\kappa(e_{it})\right] \tag{4}\]

\[ [1-q(e_{it}|\theta_{it})]\frac{\rho_t}{P_t}\tau-q(e_{it}|\theta_{it})\kappa'(e_{it})=q'(e_{it}|\theta_{it})\left[\frac{\rho_t}{P_t}\tau e_{it} + \kappa(e_{it})\right] \tag{5}\]

where \(\mathbfcal{E}=\mathbb{E}[\exp(\varepsilon_{it})]\). The type of firms is continuous and increasing on the input. The probability of detection is increasing in the type continuum. In particular, \(\frac{\partial q(e_{it}|\theta_{it})}{\partial \theta_{it}}\frac{\partial \theta_{it}}{\partial M}\ge0\).

The left-hand side of Equation 4 is the familiar marginal output of inputs and the price ratio. In the absence of incentives’ distortions induced by the fiscal environment, they are equal. But now, the equality holds no more. There’s a wedge arising from the fiscal environment. The right-hand side of the equation is positive by the assumptions of the model.

Equation 12 solves the optimal evasion decision. The left-hand side is the marginal benefit net of the marginal cost of evasion. The right-hand side is the rate of change of the probability of detection due to a change in evasion weighted by the benefit and cost of evading.

2.1 Case 1 (Independence): \(q(e|\theta)=q(e)\) and \(\kappa(e)=\kappa_0\)

Consider the case when the probability of detection is independent of type, \(q(e|\theta)=q(e)\). This could be the case if the type is the juridical organization of the firm. Hence, the type of the firm, and thus the probability of detection, does not change with the firm’s input decisions, \(\frac{\partial q(e_{it}|\theta_{it})}{\partial \theta_{it}}\frac{\partial \theta_{it}}{\partial M}=0\). In addition, assume the evasion cost is constant, \(\kappa(e)=\kappa_0\), for simplicity.

In this case, the first-order conditions of Equation 2 with respect to the input \(M_{it}\) and the tax evasion \(e_{it}\) yield the following

\[ G_M(M_{it})\exp(\omega_{it})\mathcal{E}=\frac{\rho_{t}}{P_t} \tag{6}\]

\[ e_{it}=\frac{1-q(e_{it})}{q'(e_{it})}-\frac{\kappa_0}{\frac{\rho_{t}}{P_t}\tau} \tag{7}\]

Equation 6, the well-known optimality condition, says that the price ratio is equal to the marginal product of the inputs.

Likewise, Equation 7 reveals the firms’ optimal tax evasion decision decreases if the probability of detection \(q(e_{it})\) or the penalty of evading \(\kappa\) increases. Tax evasion also depends on how sensitive the probability of detection is to the level of evasion \(q'(e)\). In particular, greater sensibility will result in lower levels of evasion.

Note that the net change of tax evasion due to an increase in the relative prices \(\frac{\rho_{t}}{P_t}\) or the tax rate \(\tau\) is not evident at first sight. The net effect will also depend on the change in the detection probability induced by the changes in the relative prices or the tax rate. In particular, an increase in relative prices \(\frac{\rho_{t}}{P_t}\) or the tax rate \(\tau\) will incentivize a higher tax evasion level, however, a higher tax evasion level will increase the probability of detection —depending on the shape of the probability as a function of \(e\)—, so it will deter higher levels of evasion. An increase in the tax rate, for instance, will only increase tax evasion if the change in the tax rates increases the incentives to evade more than the decrease in the incentives due to the changes in the detection probability.

Formally, suppose a firm increases its tax evasion, \(e_1-e_0>0\) because of an increase in taxes \(\tau_1>\tau_0\). Then, it follows that

\[ \left(\frac{\tau_1-\tau_0}{\tau_1\tau_0}\right)\frac{P\kappa}{\rho}> \left(\frac{1-q(e_1)}{q'(e_1)}-\frac{1-q(e_0)}{q'(e_0)}\right) \]

The change in the probability of detection weighted by the slope of the probability function should be less than the change in the tax rate weighted by the penalty of evading and the relative prices2.

2.2 Case 2 (Spain): Discrete increase in the probability of detection after a certain threshold of revenue

In Spain, the Large Taxpayers Unit (LTU) of the tax authority focuses exclusively on firms with total operating revenue above 6 million euros. The LTU has more auditors per taxpayer than the rest of the tax authority, and these auditors are on average more experienced and better trained to deal with the most complex taxpayers. This LTU creates a discontinuity in the monitoring effort of the tax authority. Consequently, at this arbitrary revenue level, the probability of detection increases discretely (Almunia and Lopez-Rodriguez 2018).

In this scenario, depending on the productivity shock, the firm might be better off choosing not to produce past the revenue threshold. Indeed, for a relevant range of productivity draws \(\Omega^B=[\omega^L, \omega^H]\), the firms will not choose to grow past the revenue threshold if the expected after-tax profits of staying small are greater than the expected after-tax profits of growing.

In the model, there is now a threshold of revenue \(\theta^L\) after which the probability of detection increases discretely. To make things simpler, assume that before the threshold, the probability changes as a function of evasion but does not vary conditional on size. After the threshold, the probability increases for every level of evasion but does not vary conditional on size.

Formally, let \(\Theta_{L} = \{\theta_i : \theta_{i} < \theta^L \}\) and \(\Theta_{H} = \{\theta_i : \theta_{i} \ge \theta^L \}\), then for all \(e_0\) and \(\theta'_i\not=\theta_i\), \(q(e_0|\theta_i \in \Theta_k)=q(e_0|\theta'_i \in \Theta_k)\) with \(k=\{L,H\}\), but \(q(e_0|\theta'_i \in \Theta_H)\ge q(e_0|\theta_i \in \Theta_L)\).

Firms’ revenue with productivity draw \(\omega^L\) corresponds exactly to the enforcement threshold \(\theta^L\). Production and reporting decisions of firms with productivity draws below \(\omega^L\) are not affected by the change in the probability of detection. Firms choose their inputs according to Equation 6 and their evasion decision according to Equation 12. Firms with productivity draws above \(\omega^U\)

Firms with productivity \(\omega_{i}\in \Omega^B\) will choose the input level \(\tilde{M}_{i}\) resulting in an expected revenue below the threshold \(\theta_{i}<\theta^L\), if the expected after-tax profit of staying small are greater than growing, \(\mathbb{E}[\pi_{i}|\Theta_L, \Omega^B]-\mathbb{E}[\pi_{i}|\Theta_H, \Omega^B]\ge0\).

The optimal input choice \(M^*_{i}\) for firms with productivity \(\omega_i\in\Omega^B\) implies an expected revenue greater than or equal to the threshold \(\theta^*_{i}\ge \theta^L\). Let the expected profits given \(M^*_{i}\) and the optimal tax evasion in the range of size \(\theta_l\), \(e^*_{it}\), is \(\pi_l\equiv\mathbb{E}[\pi(M^*_{it}, e^*_{it})|\theta_l]\). Let \(\tilde{M}_{it}\) be the input level such that the expected revenue is below the threshold \(\tilde{s}_{it}<\theta^L\) and \(\tilde{e}_{it}\) be the optimal tax evasion in the range of size \(\theta_s\). Let also the expected profits of staying small are \(\pi_s\equiv\mathbb{E}[\pi(\tilde{M}_{it},\tilde{e}_{it})|\theta_s]\).

In this second case, therefore, firms might optimally choose to remain small if, for a low productivity shock, the expected profits of not growing are greater than the expected profits of growing \(\pi_l<\pi_s\). Firms choosing to remain small will lead to a bunching below the threshold in the size distribution of firms.

Besides the higher levels of evasion before the threshold —simply because of the higher probability of detection—, we can also expect bunching firms to evade more than their similar-sized peers. At \(\tilde{M}_{it}\), the optimization condition of Equation 6 no longer holds, hence, the marginal product of the input is now greater than the relative prices. Therefore, according to Equation 7, bunching firms would compensate for their higher costs by increasing overreporting.

2.2.1 Discussion

What is new in this paper relative to the literature is that it focuses on the production function framework using public data whereas Almunia and Lopez-Rodriguez (2018) and other papers use a bunching estimator with government administrative data which is difficult to access. Second, the paper focuses on input overreporting rather than on revenue underreporting, which is the relevant margin of evasion for manufacturing firms. More on this point in the revenue underreporting section. Finally, in contrast to Almunia and Lopez-Rodriguez (2018) where the authors conclude that misreporting does not imply real losses in production but only fictitious reduction of the real sales, firms might optimally forgo higher revenue levels if the expected profits of staying small and evade taxes by misreporting are greater than the expected profits of growing and avoid misreporting.

2.3 Case 3 (Colombia & Mexico): Discrete increase in the tax rate after a revenue threshold

2.3.1 Colombia, Individual Proprietorships

In Colombia between 1981 and 1991, individual firm proprietors were subject to the individual income tax schedule. Individuals had incentives to not form juridical organizations to avoid double taxation. The tax authority suffered from severe limitations and inefficiencies at the time.

In this case, after the revenue threshold, the tax rate increases discretely but the probability of detection does not. The jump in the tax rate generates the incentive to increase evasion. However, a higher level of evasion increases the cost of evading by increasing the probability of detection. If the cost of an increased evasion outweighs the benefits of growing past the revenue threshold, the firms would bunch below the cutoff.

2.3.2 Mexico, Irreversible Change in Tax Regime after a Revenue Threshold

In Mexico, firms with annual revenues below 2 million pesos are taxed under the REPECO (Regime de Pequeños Contribuyentes) regime of small contributors at 2 percent of annual revenues, while firms above that threshold are taxed under the general regime at 30 percent. Firms must transition to the general regime if revenues increase beyond the threshold. Once in the general regime, firms cannot revert to the REPECO regime.

Firms’ decision is now dynamic. Firms will maximize the sum of current and future after-tax profits. The discrete jump in the tax rate will lead to a bunching below the threshold. Moreover, the bunching will be exacerbated because firms will choose to grow past the cutoff only if the future productivity shocks allow the firm to continue to be profitable.

2.4 Case 4 (Colombia): Firms first choose type, input decisions do not affect the probability of detection

In Colombia between 1981 and 1991, Corporations were closely supervised by the Superintendent of Corporations and were required to have an auditor. All other firms were subject to the regular monitoring efforts of the tax authority, which suffered from severe limitations and inefficiencies at the time.

In the model, firms first choose their type. Input decisions do not affect the probability of detection. However, if the type is Corporation the probability of detection is higher than Partnership. Firms maximize the sum of their expected profits. In their optimization problem, firms will consider the sum of expected productivity shocks and their corresponding probability of detection. High-productivity firms will self-select into Corporations.

2.5 Other Sources of Heterogeneity

Currently, only productivity. But, it can also be

- Probability of detection might be a random function (idiosyncratic random shocks on the beliefs about being detected)

- Cost of evasion (different technologies of evasion)

3 Colombia 1981-1991

3.1 Colombian Corporate Tax System

The relevant corporate taxes for input overreporting in Colombia during this period are the Corporate Income Tax (CIT) and the Sales Tax. The Sales Tax gradually transformed into a kind of Value-Added Tax (VAT). Also relevant for the CIT are the different juridical organizations that exist in Colombia.

This period was characterized by high levels of overall tax evasion (Torres and Sourdis 1994). The fiscal rules had a system of penalties and interest that encouraged false and delinquent returns (Mclure 1989). The fiscal authority was characterized by having an inefficient auditing system, being overburdened, and legal loopholes (Perry and Triana 1990).

3.1.1 Juridical Organizations

In Colombia, there are five types of juridical organizations: Corporations, Partnerships, Limited Liability Companies, and Individual Proprietorships.

Corporations (sociedad anónima) are the typical associations of capital. They are the counterpart of the US corporation. The capital of a corporation is provided by the shareholders (no less than 5) and is divided into tradable shares of equal value. Shareholders’ liability is limited to the capital contributed. Corporations are subject to the Superintendent of Corporations and are closely supervised, being required to have an auditor.

Joint Stock Companies (sociedad en comandita por acciones) comprises two or more managing partners who are jointly and severally liable, and five or more limited partners whose liability is limited to their respective contributions. Joint Stock Companies are taxed as Corporations. Its shares are tradable, like the shares of Corporations.

Partnerships are associations of two or more persons. Partners are jointly and severally liable for the partnership’s operations. Partnerships include general partnerships (sociedad colectiva), de Facto partnerships (sociedades de hecho), and ordinary limited partnerships (sociedad en comandita simple).

A limited liability company (sociedad de responsabilidad limitada) is an association of two or more persons —not exceeding 20 (Fiscal Survey) or 25 (1992 EAM survey documents)—, whose shares cannot be traded. The personal liability of the partners is limited to the capital contributed. The Limited Liability Company is quite important in Colombia (Fiscal Survey).

Finally, proprietorships are individuals (natural persons) who allocate part of their assets to conduct commercial activities.

There are other juridical organizations in the data that will be excluded from the final analysis. These organizations are non-profit, like cooperatives and community enterprises, or state industrial enterprises, the proceeds of which come from taxes, fees, or special contributions.

3.1.2 Corporate Income tax

The juridical organizations were subject to different Corporate Income Tax rates. Corporations were taxed at a fixed rate of 40%, while Partnerships and Limited Liability companies at 20%. Individual proprietors were subject to the graduated Individual Tax Schedule consisting of 56 rates, ranging from 0.50 to 51 percent.

Corporations were taxed on their distributed dividends, while partnerships and limited liability companies were taxed on their profits, whether or not distributed. Owners of juridical organizations were double taxed, at the firm and the individual level, whereas the income of proprietorships was taxed only once, at the individual level.

Since 1974, individuals and juridical organizations, except for limited liability companies, were subject to the minimum presumptive income. Rent (income and profits) was presumed to be no less than 8 percent of net wealth (assets less depreciation, real estate, livestock, securities).

Certain industries like airlines, publishing, and reforestation sectors, and various activities in selected regions (primarily “frontier” and other less developed ones) had their income tax exempted, limited, or reduced.

| Organization | Corporate Income Tax | Liability | Capital | Owners |

|---|---|---|---|---|

| Corporation | 40% (on distributed dividends) | Limited to capital participation | Tradable capital shares | \(N\ge5\) |

| Limited Co. | 20% (on profits) | Limited to capital participation | Non-tradable capital shares | \(2\le N \le 20 (25)\) |

| Partnership | 20% (on profits) | Full | Not a capital association | \(N\ge2\) |

| Proprietorship | Individual Income Tax | Full | Owner | \(N=1\) |

3.1.3 Sales taxes

Sales taxes were originally targeted at the manufacturing sector on finished goods and imports. Since 1974, manufacturers were allowed to credit taxes paid on any purchase made by the firm, except the acquisition of capital goods (Perry and Triana 1990). The credits worked through a system of refunds. Consequently, the tax became a kind of value-added tax (VAT).

The basic rate was 15 percent. There was also a preferential rate of 6 percent for certain industries like clothing, footwear, and major inputs used for building popular housing, and a rate of 35 percent for luxury goods. Exports, foodstuff, drugs, and textbooks were excluded from the beginning. Also excluded were inputs, transportation equipment, agricultural machinery, and equipment.

3.1.4 Discussion

From Colombia’s tax system, we can conclude that corporations are the least likely to evade taxes by misreporting because of at least three reasons. One, the Superintendent of Corporations closely monitored corporations by requiring them to have an auditor. In the model, this implies that the probability of detection is higher for them. Second, free tradable shares impose an incentive to be profitable because the market value of the shares might be negatively affected otherwise. In other words, if a corporation fakely reports lower profits, the value of its shares would likely decrease scaring away shareholders and potential investors. Joint stock companies have freely tradable shares too. Three, corporations pay CIT on distributed dividends, not on profits as Partnerships and LLCs did. Corporations have an additional margin regarding the income tax they pay because they decide when to pay dividends. This might generate other types of incentives that might be influenced by the corporation’s policy regarding their dividends and the demands of their shareholders. On the other hand, Proprietorships and LLCs are subject to the incentive to evade CIT by artificially reducing their profits.

Moreover, Proprietorships, Partnerships, and Limited Companies had incentives to overreport inputs to evade VAT and CIT. The incentives to evade varied across industries because the sales tax rate differed between industries. The incentives to evade also varied within industry sectors because juridical organizations within an industry were subject to different CIT rates. There were additional sources of variation depending on the firm’s location due to local exemptions and sales composition (inputs to other firms, to consumers, to the foreign market).

Lastly, Individual proprietorships were likely to bunch at the individual income thresholds because they were subject to individual income tax which was increasing by brackets.

3.2 Fiscal Reforms

During this period, Colombia went through three major fiscal reforms (1983, 1986, 1990).

3.2.1 1983

The 1983 reform tried to alleviate double taxation by introducing a tax credit of 10% of dividends received by shareholders of corporations.

In addition, Law 9 of 1983 instituted a new measure of presumptive income equal to 2 percent of gross receipts to supplement the measure based on net wealth. This reform was aimed specifically at the commerce and service sectors; the former was thought to evade the wealth-based presumptive tax by systematically understating inventories. Under the original presumptive income, a juridical entity cannot declare income less than 8% of its capital (wealth).

In addition, the 1983 reform extended the presumptive income tax to limited liability companies. Before this reform, all juridical organizations were subject to the presumptive income tax except for limited liability companies.

In 1983, the value-added tax (VAT) was extended to the retail level, with a simplified system being made available to small retailers to ease compliance costs and the administrative burden.

The 1983 reform relatively unified the value-added tax (VAT) rates by combining previously taxed goods at 6% and 15 percent into 10%. The number of the products and services that were levied expanded.

In 1984, VAT exemptions for agricultural machinery, transportation equipment, and certain other goods were eliminated.

3.2.2 1986

The 1986 reforms unified the taxation of corporations and limited liability companies by taxing both at a rate of 30%. The top tax rate applied to individual income was reduced from 49 to 30%.

Double taxation was eliminated. The reform exempted corporate dividends and participation in profits of limited liability companies from tax at the individual shareholder/owner level.

Lastly, the 1986 reform relocated the tax collection and reception of tax reports to the banking system, among other things.

3.2.3 1990

The 1990 reform increased the VAT from 10% to 12%.

In addition, the individual income obtained from the sale of shares through the stock market was exempted from taxation. Income tax was waived for investment funds, mutual funds, and securities, and the rates for remittances and income for foreign investment were reduced. Tax amnesties were granted, and the sanitation tax was reduced to encourage the repatriation of capital.

3.2.4 Discussion

Increases in the VAT would increase the incentives to evade. Decreases in CIT would decrease them. Intuitively, we expect higher levels of tax evasion if tax rates increase.

The CIT homogenization between Corporations and LLCs in 1986 would have motivated LLCs to incorporate. Likewise, the elimination of double taxation also in 1986 would have motivated proprietorships to become LLCs, Corporations, or Partnerships.

On the other hand, reporting more information to the tax authority — like the banking system being responsible for the collection and reception of tax reports in 1986— would decrease tax evasion.

| Industry Description | Sales Tax Change | SIC | Industry |

|---|---|---|---|

| Beverages and Tobacco | - to 35;10 | 313 | Beverage Industries |

| - to 35;10 | 314 | Tobacco Manufactures | |

| Textiles | 6 to 10 | 321 | Textiles |

| Paper | 15 to 10 | 341 | Paper and Paper Products |

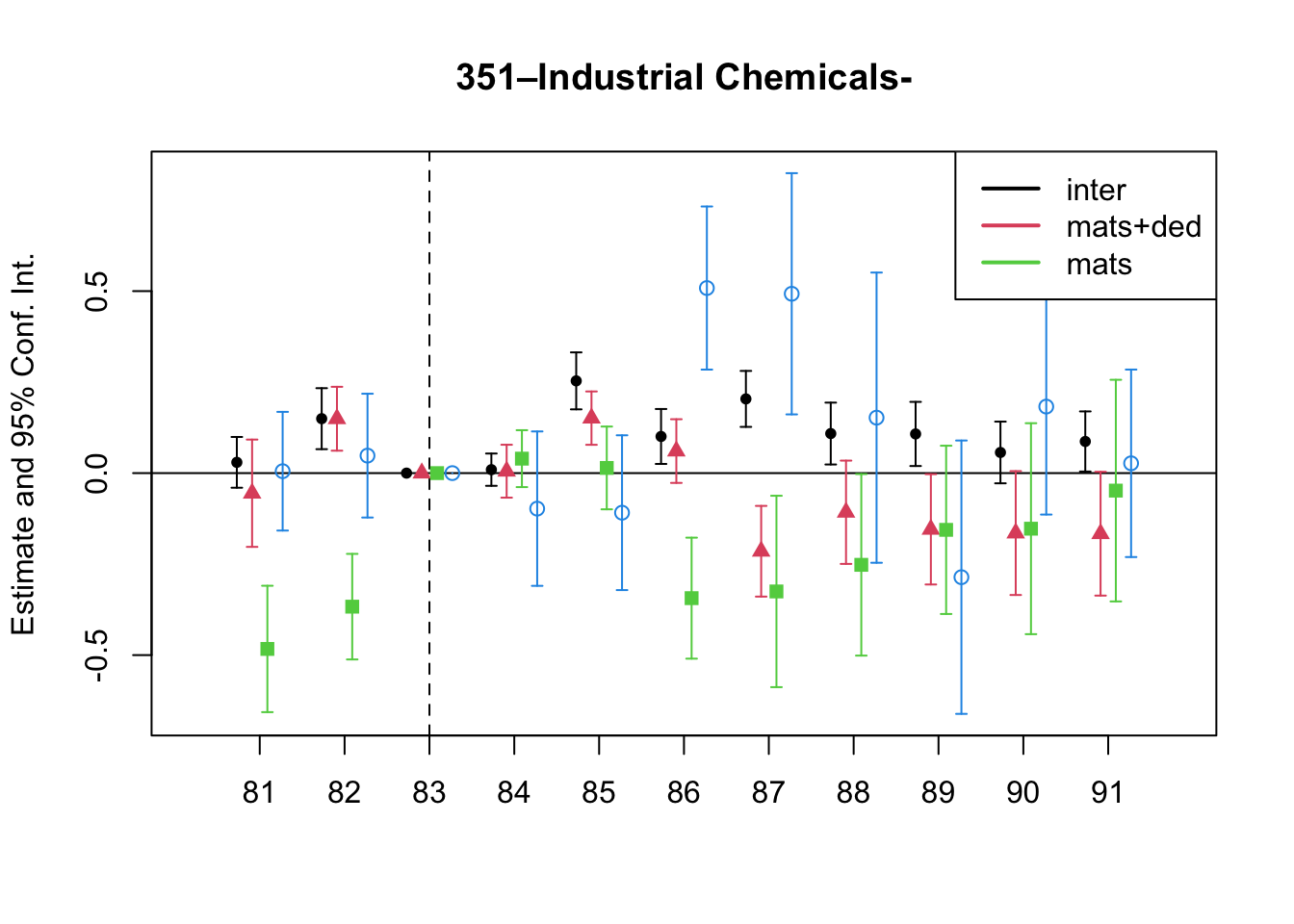

| Other Chemical Products | 15 to 10 | 351 | Industrial Chemicals |

| Soap | 6;15 to 10 | 352 | Other Chemical Products |

| Oil and Coal Derivatives | 10 to 14 | 354 | Miscellaneous Products of Petroleum and Coal |

| Plastics | 15 to 10 | 356 | Plastic Products Not Elsewhere Classified |

| Iron and Steel; Nickel Smelting | 6;15 to 10 | 371 | Iron and Steel Basic Industries |

| Equipment and Machinery | 6 to 10 | 382 | Machinery Except Electrical |

| 6 to 10 | 383 | Electrical Machinery Apparatus, Appliances and Supplies | |

| Transportation | 6 to 10 | 384 | Transport Equipment |

4 Data

The Colombian data is a well-known firm-level panel data set that has been used in the estimation of production functions and productivity before. The Colombian dataset comes from the Annual Survey of Manufacturing (EAM) and contains information about manufacturing firms with more than 10 employees from 1981 to 1991.

Besides the information on output, intermediates, capital, and labor, the dataset includes the type of juridical organization and the sales taxes. Table 4 offers some summary statistics.

| Missing (%) | Mean | SD | Q1 | Median | Q3 | |

|---|---|---|---|---|---|---|

| Sales Taxes | 0 | 0.066 | 0.051 | 0.006 | 0.069 | 0.100 |

| Skilled Labor (Wages) | 0 | 0.043 | 1.620 | 0.009 | 0.021 | 0.046 |

| Unskilled Labor (Wages) | 0 | 0.086 | 0.106 | 0.019 | 0.051 | 0.119 |

| Capital | 0 | 0.495 | 7.555 | 0.126 | 0.261 | 0.499 |

| Materials (M) | 0 | 0.457 | 0.191 | 0.333 | 0.457 | 0.582 |

| Electricity (E) | 0 | 0.018 | 0.028 | 0.005 | 0.010 | 0.020 |

| Fuels (F) | 0 | 0.011 | 0.025 | 0.001 | 0.003 | 0.010 |

| Repair & Maintenance (R&M) | 0 | 0.007 | 0.013 | 0.001 | 0.003 | 0.009 |

| Services (S) | 0 | 0.103 | 0.167 | 0.052 | 0.084 | 0.130 |

| Deductible Inter. (M+E+F+R&M) | 0 | 0.493 | 0.180 | 0.371 | 0.488 | 0.610 |

| Non-Deductible Inter. (S) | 0 | 0.103 | 0.167 | 0.052 | 0.084 | 0.130 |

| J. Org. | N | % | ||||

| Proprietorship | 5343 | 12.877 | ||||

| Ltd. Co. | 25457 | 61.353 | ||||

| Corporation | 8761 | 21.114 | ||||

| Partnership | 1425 | 3.434 |

4.1 Top Industries by Revenue in Colombia

| description | sic_3 | n_sic | n_Corp | Market Share | Cum. Mkt Share | N Share | Cum. N Share |

|---|---|---|---|---|---|---|---|

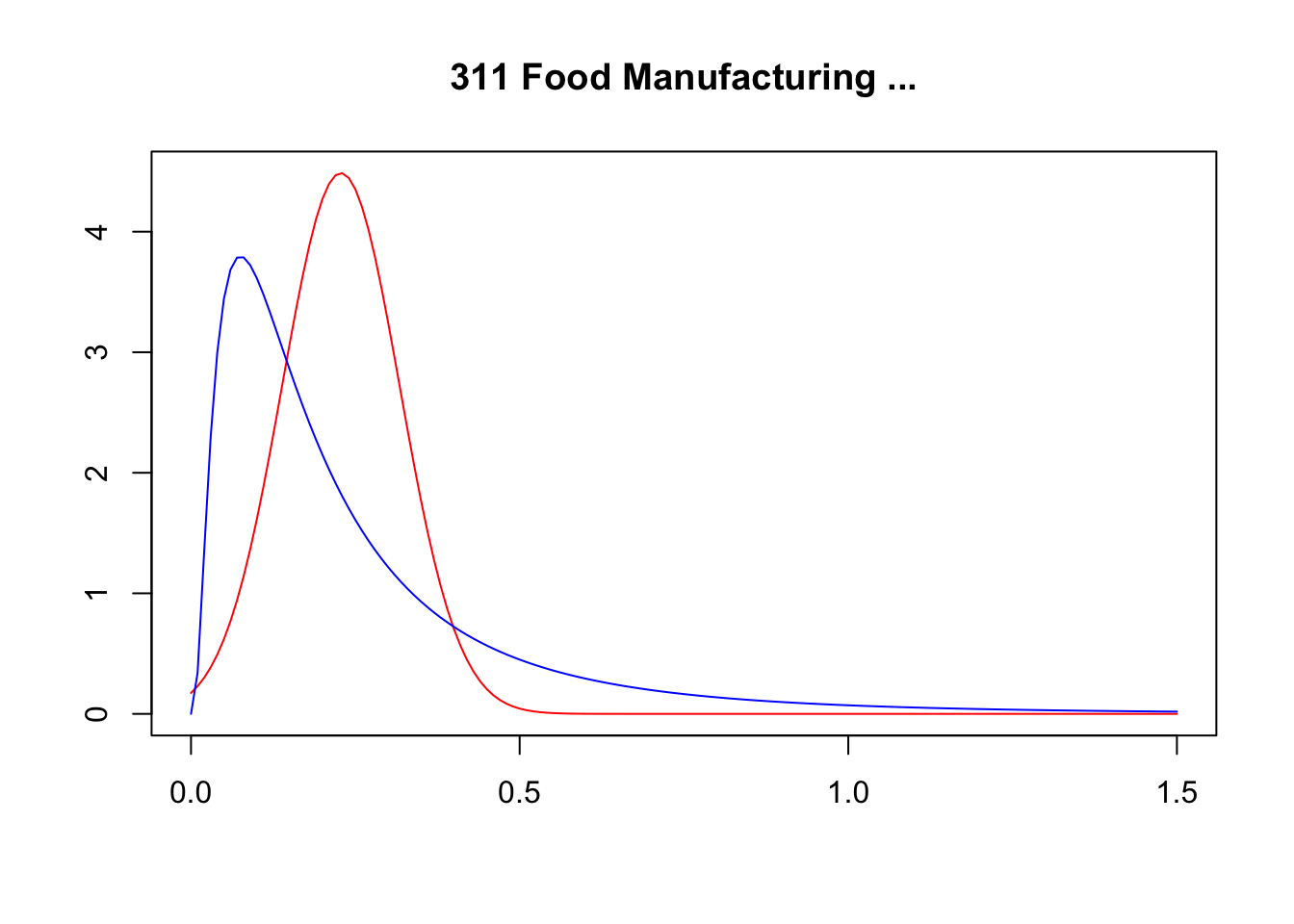

| Food Manufacturing | 311 | 912 | 150 | 23.5 | 23.5 | 14.6 | 14.6 |

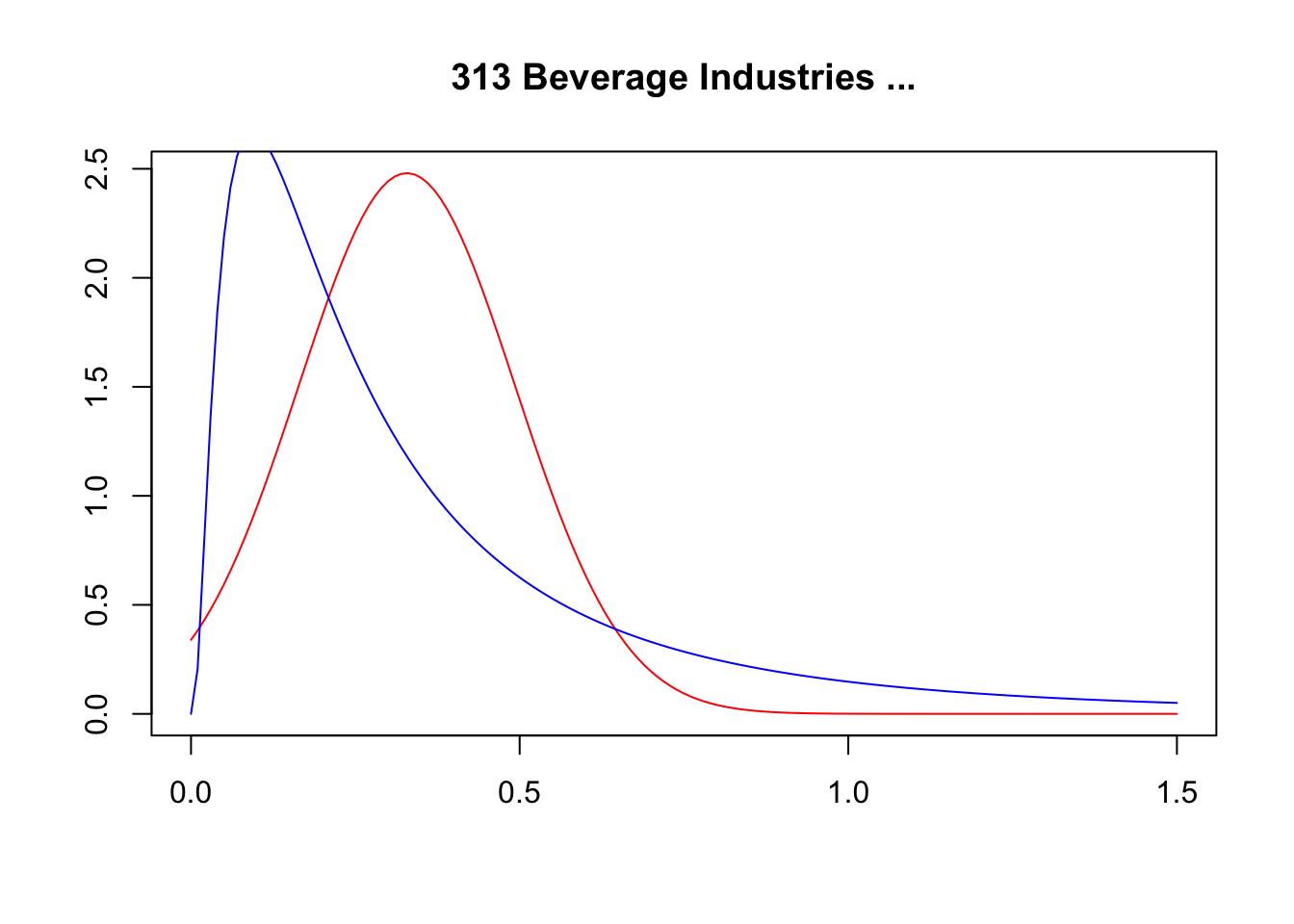

| Beverage Industries | 313 | 130 | 74 | 9.6 | 33.2 | 2.1 | 16.7 |

| Other Chemical Products | 352 | 301 | 101 | 8.5 | 41.6 | 4.8 | 21.5 |

| Industrial Chemicals | 351 | 117 | 69 | 7.5 | 49.1 | 1.9 | 23.4 |

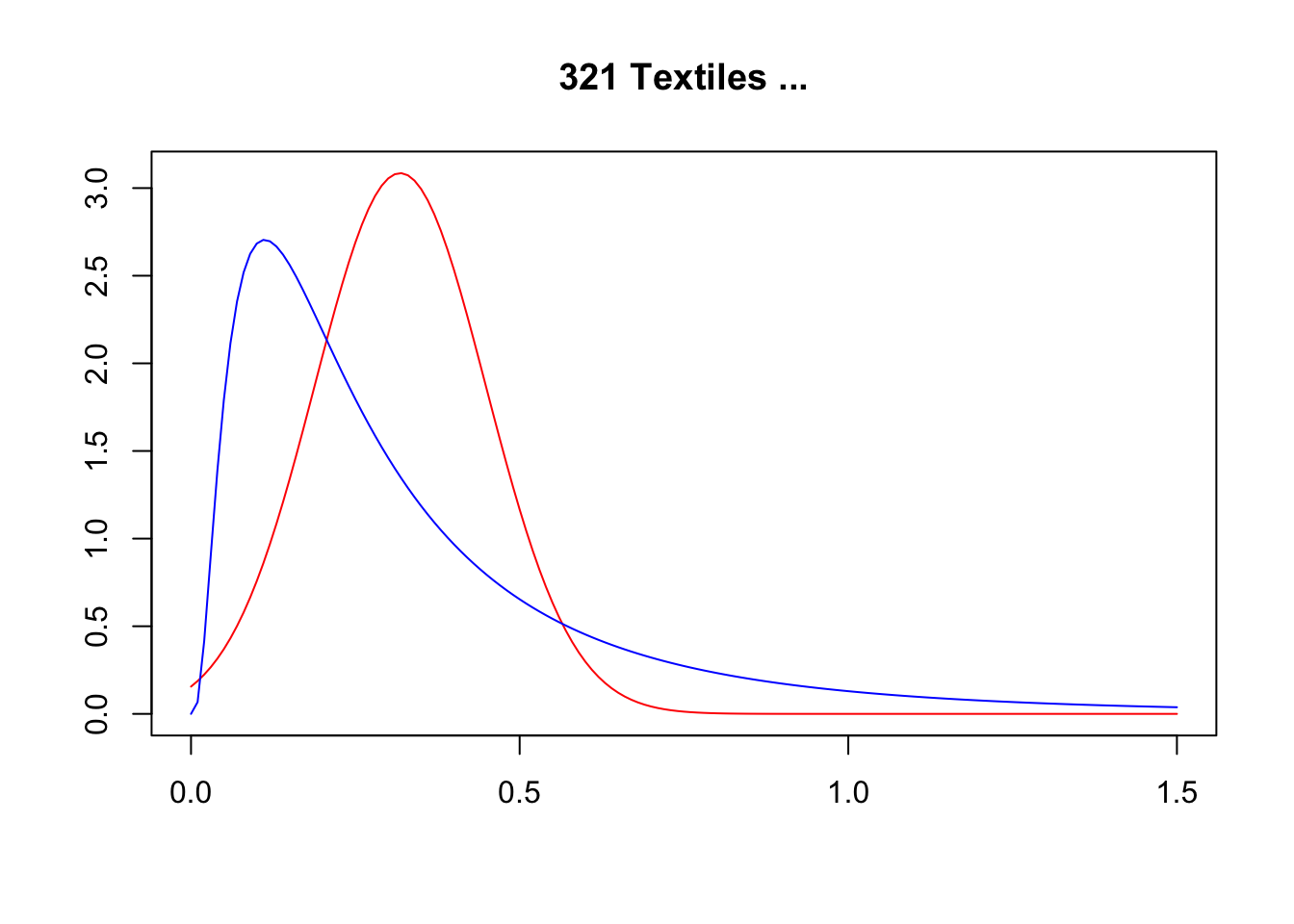

| Textiles | 321 | 476 | 71 | 7.4 | 56.5 | 7.6 | 31.1 |

| Transport Equipment | 384 | 238 | 42 | 6.8 | 63.4 | 3.8 | 34.9 |

| Food Manufacturing | 312 | 193 | 41 | 5.3 | 68.7 | 3.1 | 38.0 |

| Paper and Paper Products | 341 | 153 | 41 | 5.1 | 73.8 | 2.5 | 40.4 |

| Fabricated Metal Products, Except Machinery and Equipment | 381 | 633 | 85 | 3.9 | 77.7 | 10.2 | 50.6 |

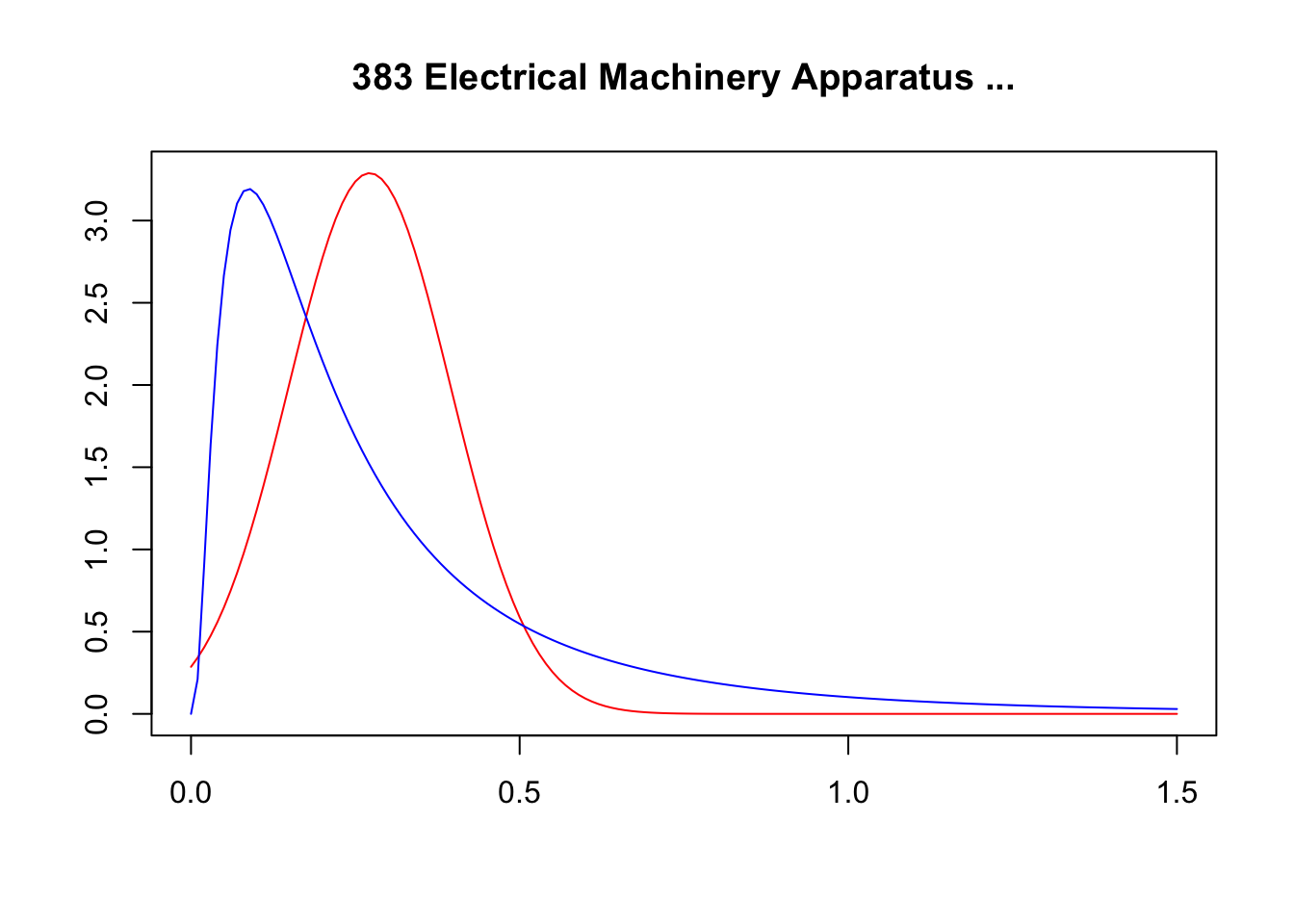

| Electrical Machinery Apparatus, Appliances and Supplies | 383 | 213 | 57 | 3.9 | 81.6 | 3.4 | 54.0 |

4.2 Corporations by Industry

Looking into industry sectors.

| Industry | SIC | N | Corps. (N) | Corps. (%) | Market Share (Corps.) |

|---|---|---|---|---|---|

| Food Manufacturing | 311 | 955 | 150 | 15.7 | 64.5 |

| Wearing Apparel, Except Footwear | 322 | 756 | 24 | 3.2 | 20.8 |

| Fabricated Metal Products, Except Machinery and Equipment | 381 | 654 | 85 | 13.0 | 65.6 |

| Textiles | 321 | 499 | 71 | 14.2 | 68.1 |

| Machinery Except Electrical | 382 | 376 | 46 | 12.2 | 53.5 |

| Printing, Publishing and Allied Industries | 342 | 364 | 40 | 11.0 | 46.1 |

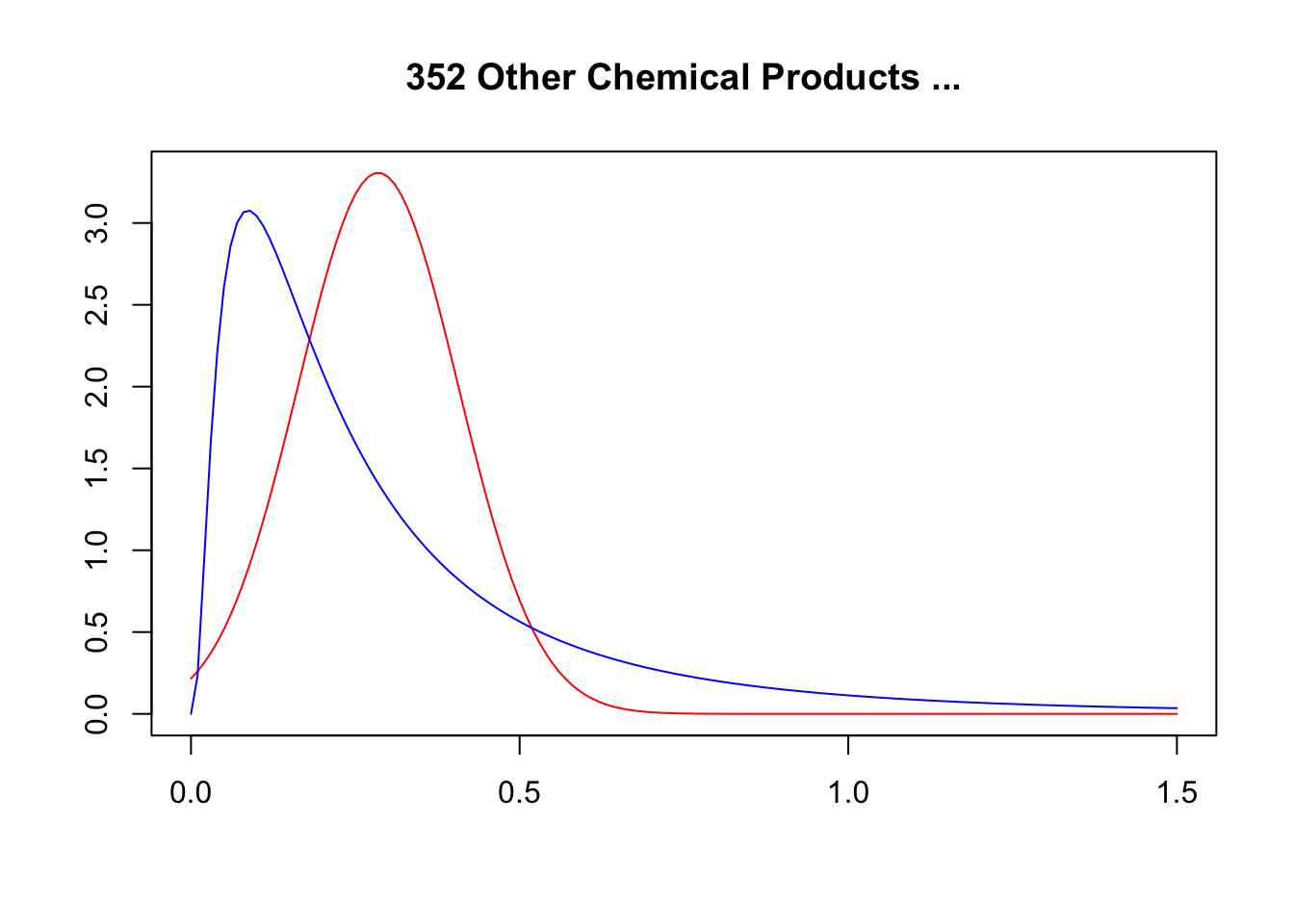

| Other Chemical Products | 352 | 318 | 101 | 31.8 | 85.8 |

| Other Non-Metallic Mineral Products | 369 | 311 | 62 | 19.9 | 88.5 |

| Plastic Products Not Elsewhere Classified | 356 | 295 | 54 | 18.3 | 62.2 |

| Transport Equipment | 384 | 251 | 42 | 16.7 | 86.5 |

| Electrical Machinery Apparatus, Appliances and Supplies | 383 | 225 | 57 | 25.3 | 80.0 |

| Food Manufacturing | 312 | 207 | 41 | 19.8 | 72.5 |

| Furniture and Fixtures, Except Primarily of Metal | 332 | 199 | 12 | 6.0 | 31.0 |

| Footwear, Except Vulcanized or Moulded Rubber or Plastic Footwear | 324 | 196 | 9 | 4.6 | 61.3 |

| Other Manufacturing Industries | 390 | 181 | 18 | 9.9 | 47.4 |

| Wood and Wood and Cork Products, Except Furniture | 331 | 174 | 13 | 7.5 | 67.9 |

| Paper and Paper Products | 341 | 160 | 41 | 25.6 | 88.2 |

| Beverage Industries | 313 | 135 | 74 | 54.8 | 79.8 |

| Industrial Chemicals | 351 | 124 | 69 | 55.6 | 87.5 |

| Leather and Products of Leather, Leather Substitutes and Fur, Except Footwear and Wearing Apparel | 323 | 104 | 13 | 12.5 | 58.0 |

4.3 The Fiscal Reforms

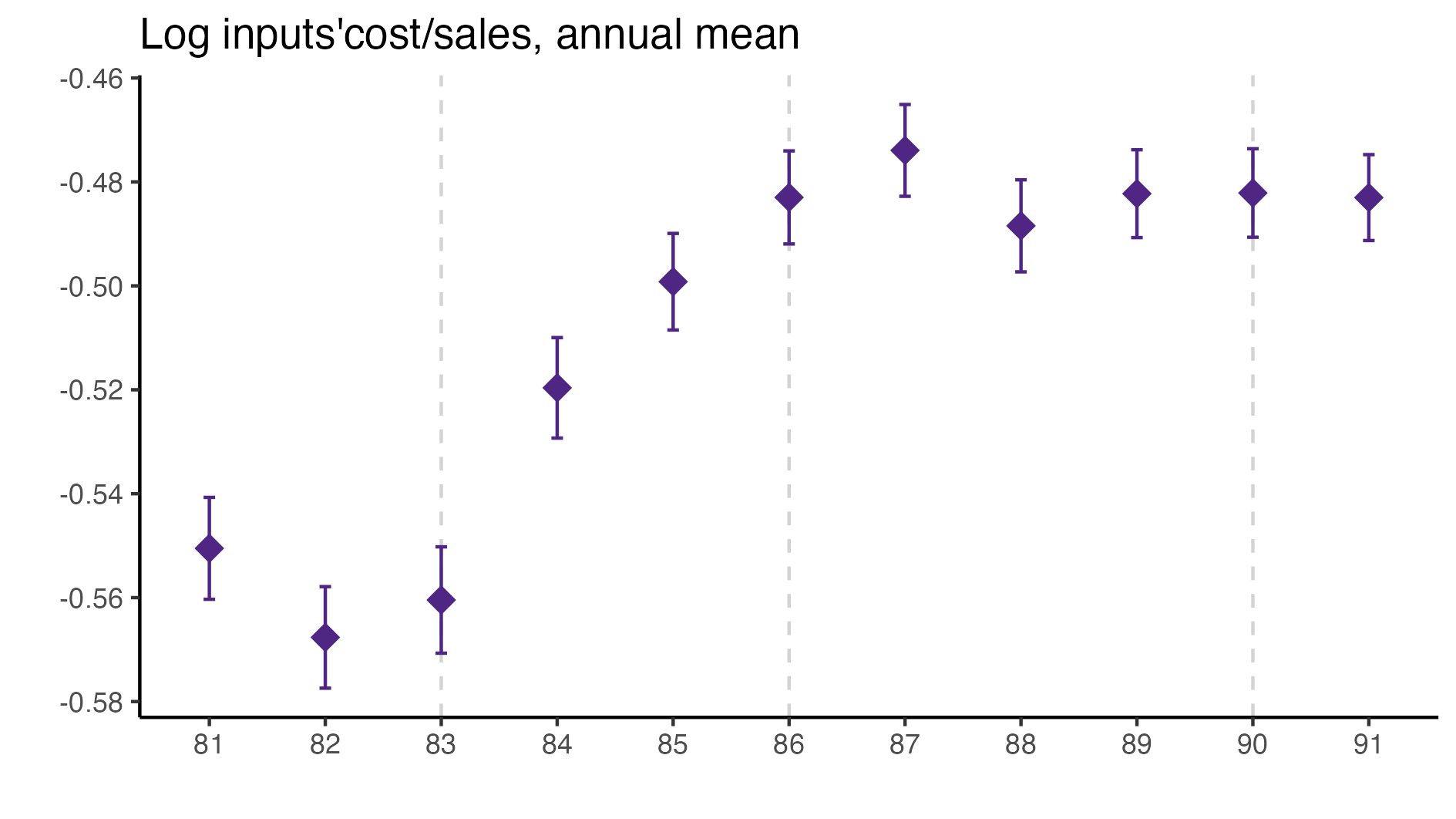

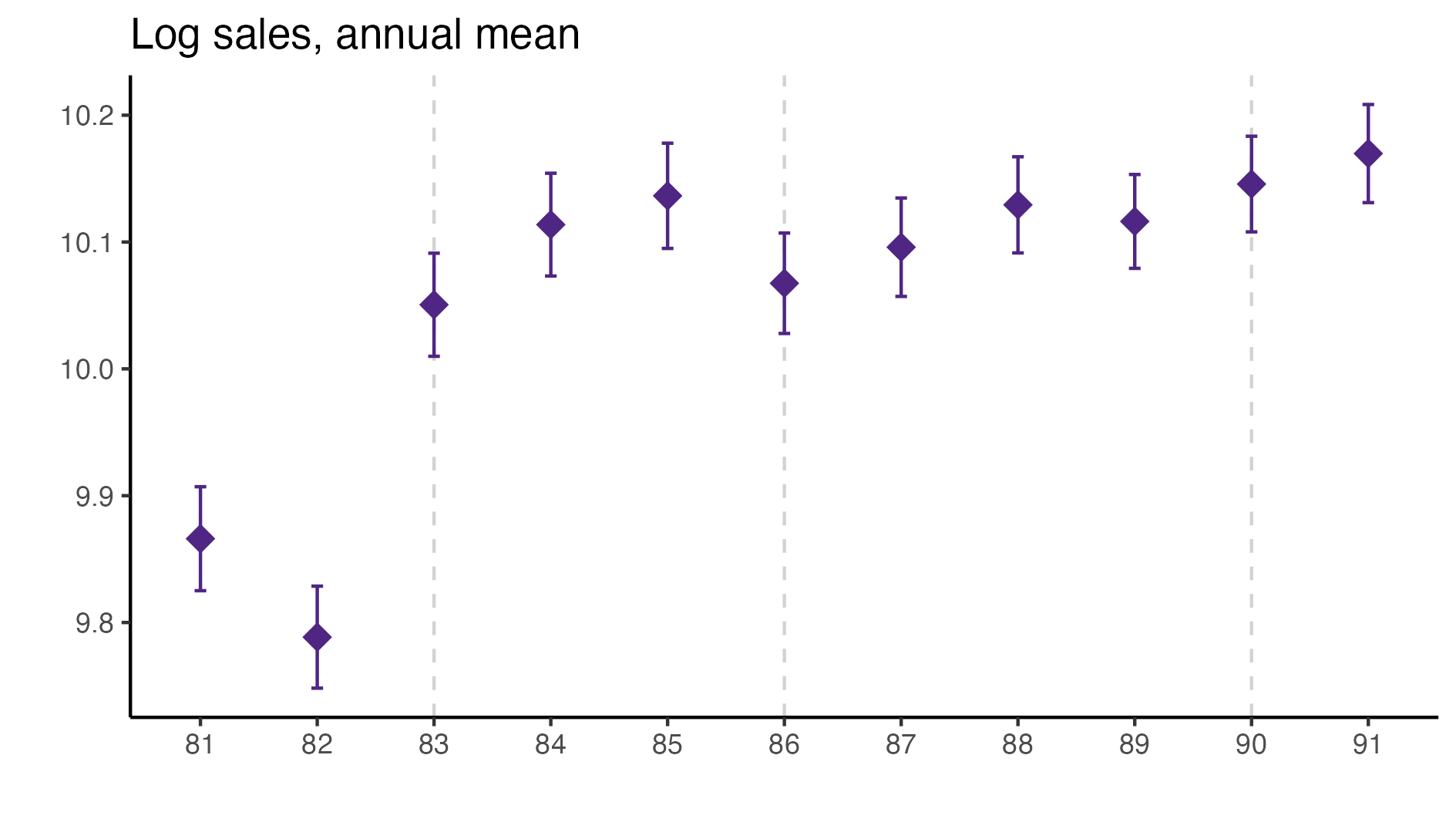

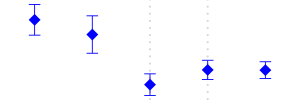

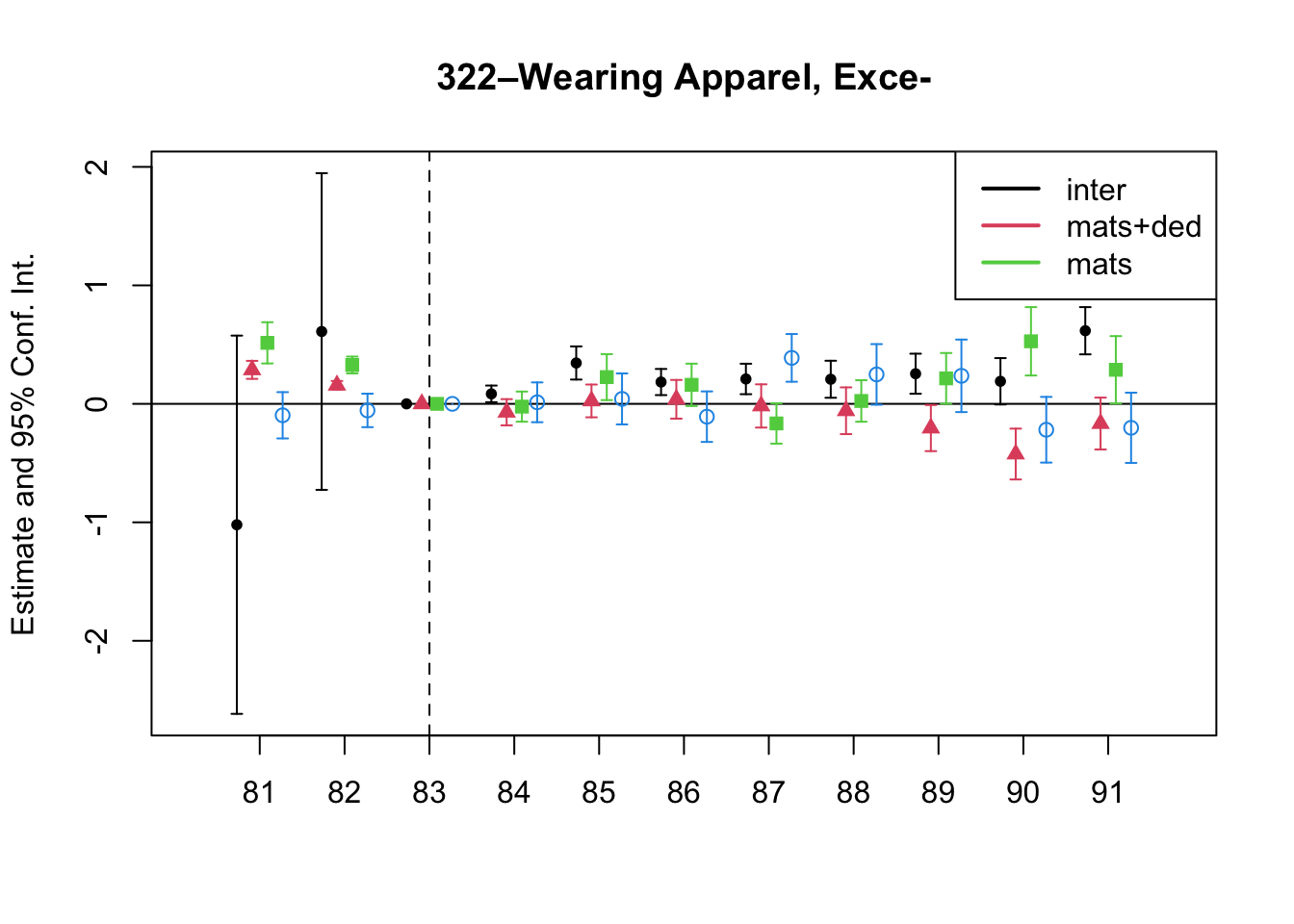

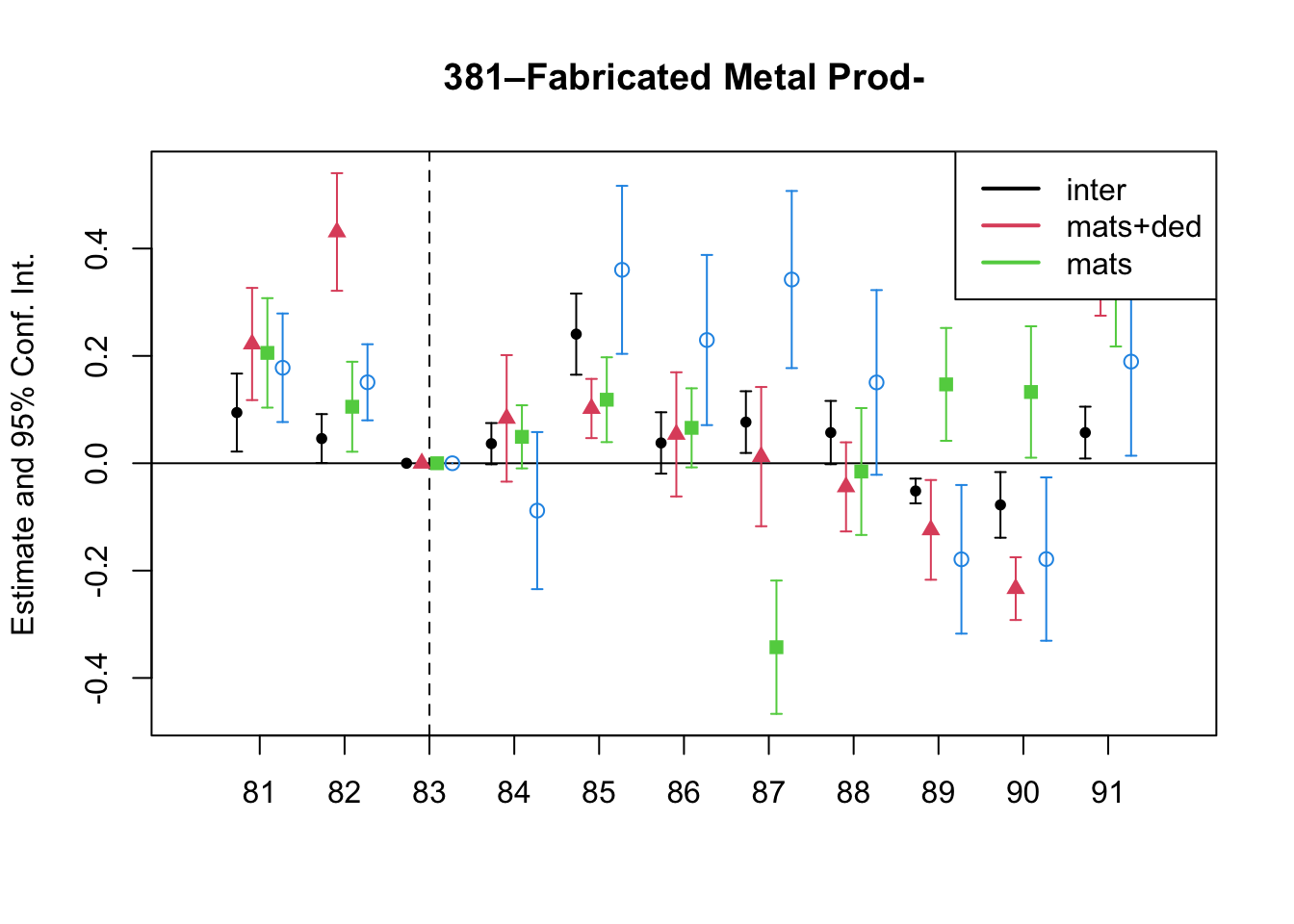

A simple graphical analysis shows that the average (of the log) intermediates cost share of sales started growing after 1983 and that it stabilized in 1988 after the policy changes of the 1986 reform settled in (Figure 1). The dataset does not capture any changes after the 1990 reform, although there is only one more year of data.

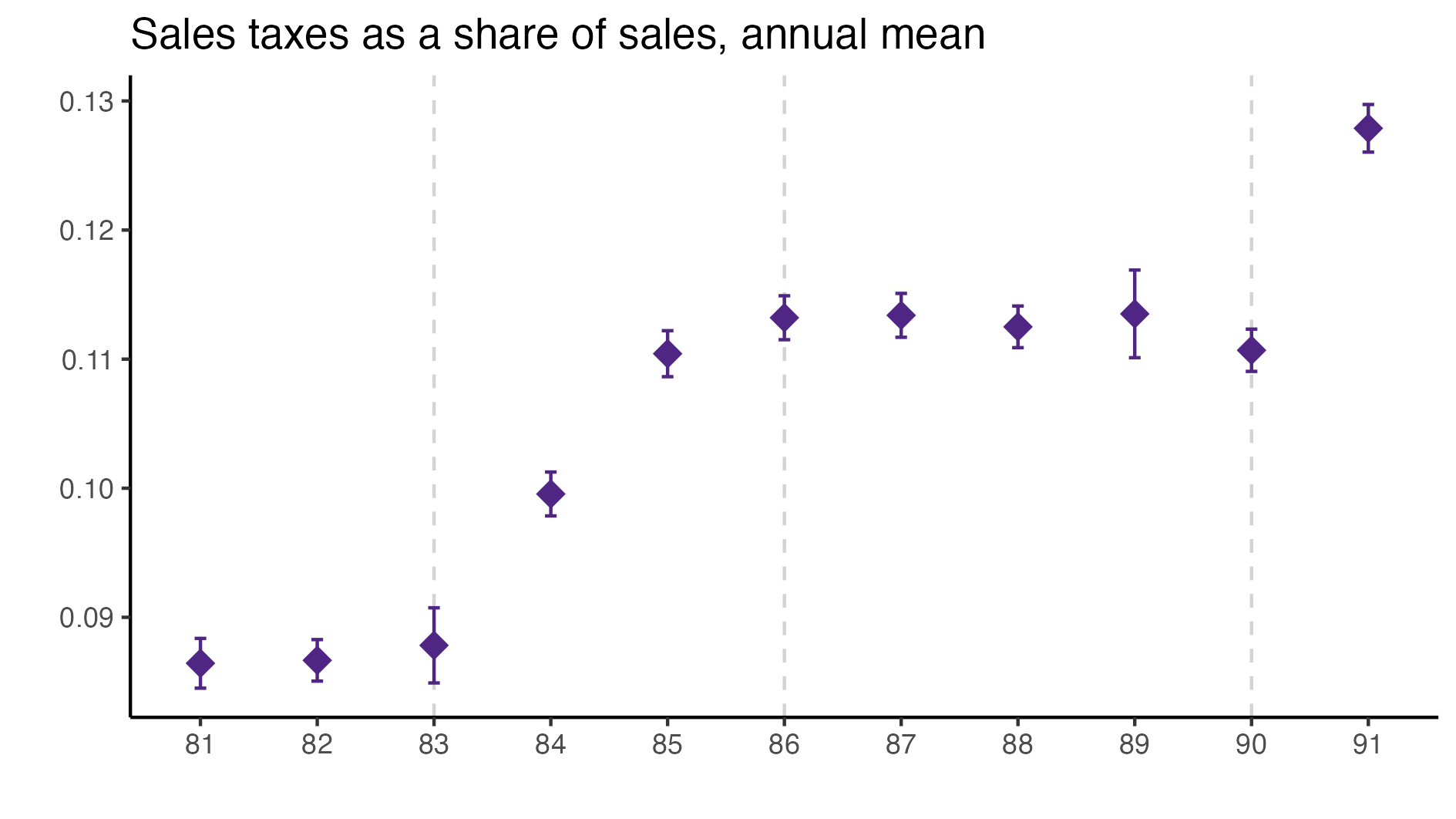

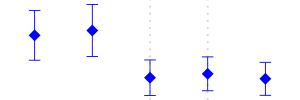

As a validation exercise, we can see that the VAT changes induced by the three fiscal reforms are captured in the dataset. Figure 2 shows that the sales tax increased to 10% after the 1983 reform, and then around 12% after the 1990 reform.

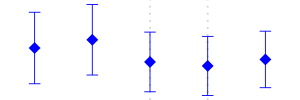

Just as an exercise to see if other economic changes in this period were driving the apparent changes in overreporting, Figure 3 shows that sales, for instance, were not exactly following the changes in fiscal policy. Sales started to grow during 1983, the year of the reform, whereas the cost share of sales started to grow the year after. Likewise, sales fell in 1986, while the cost share seems to reduce its growth after 1986.

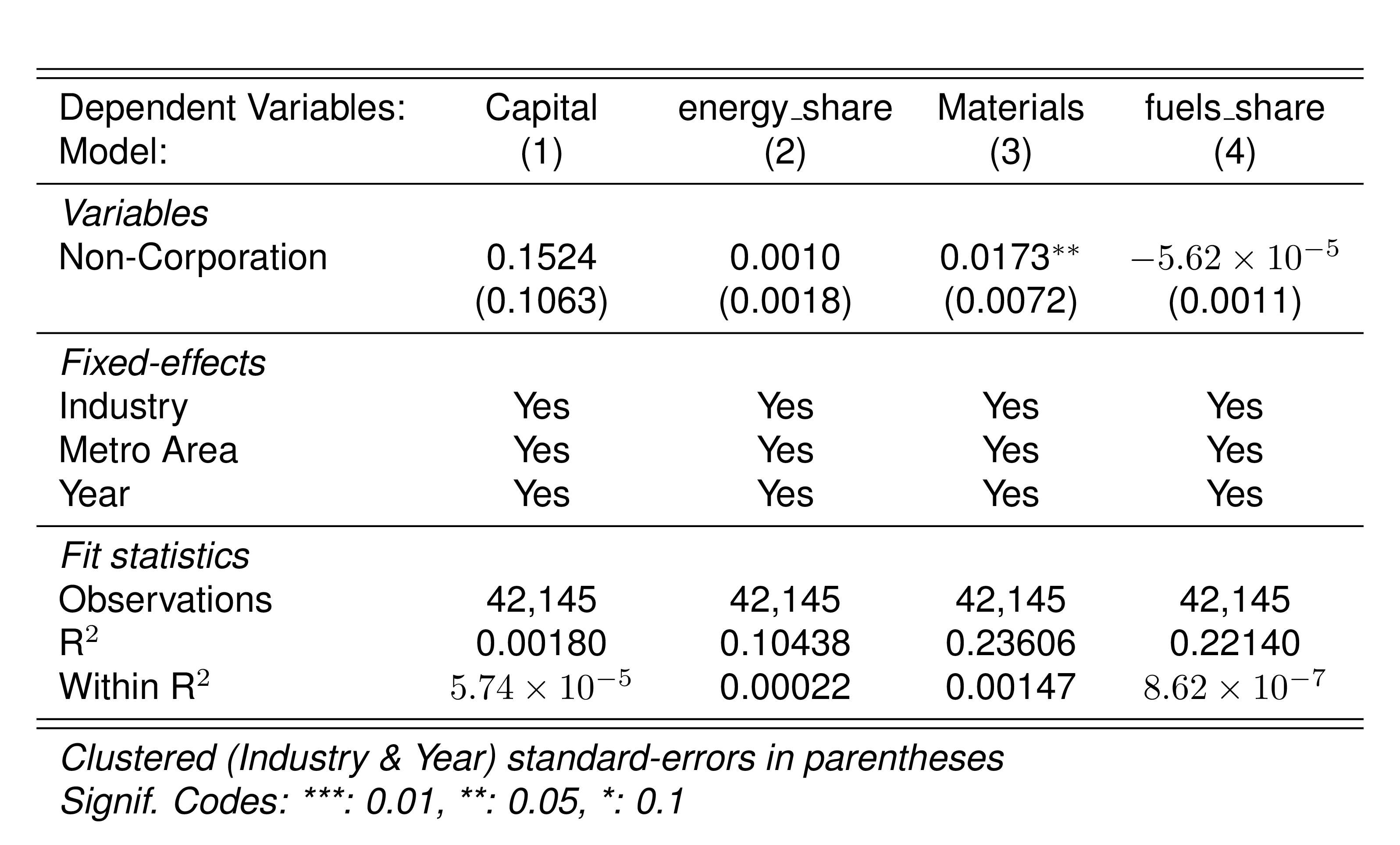

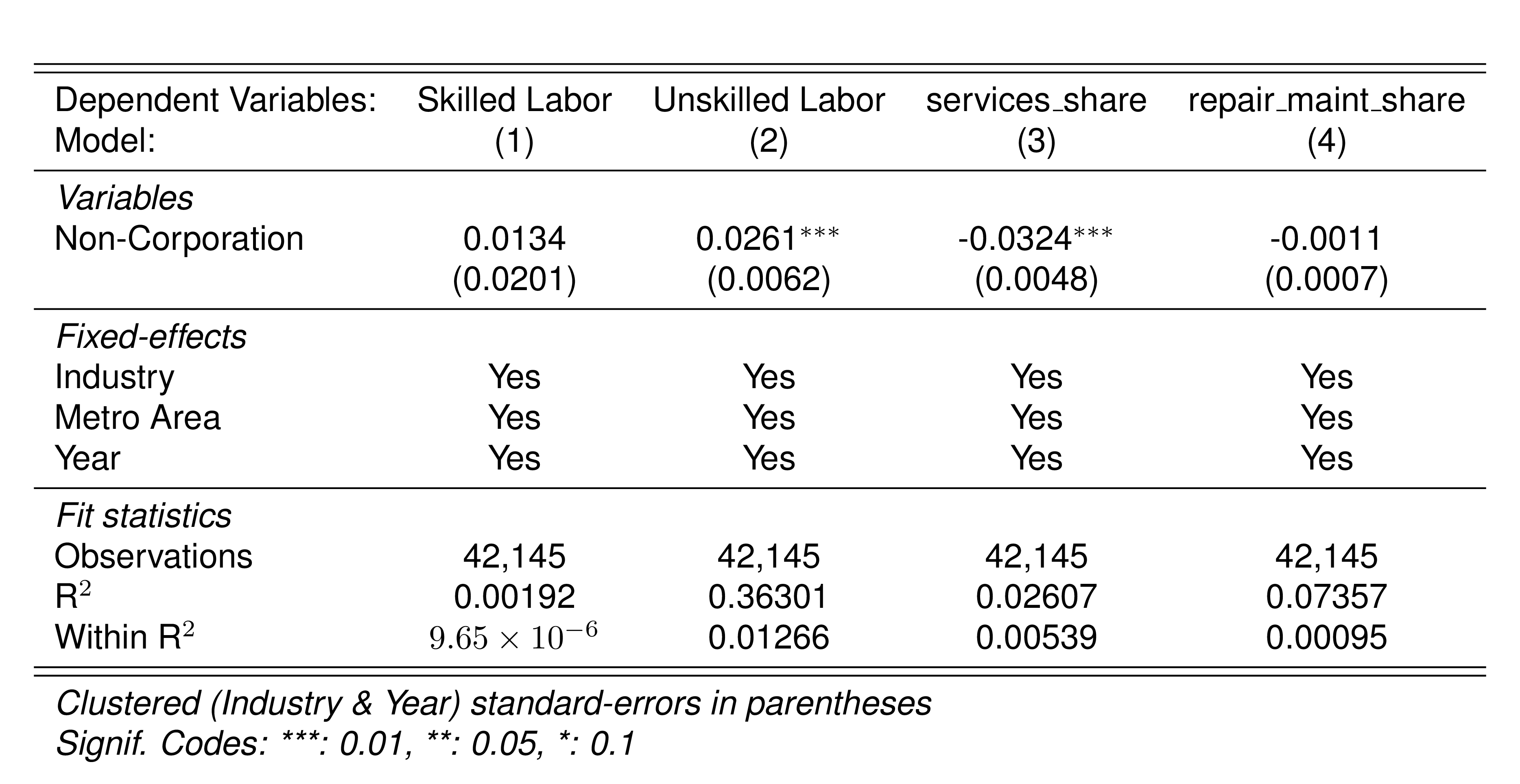

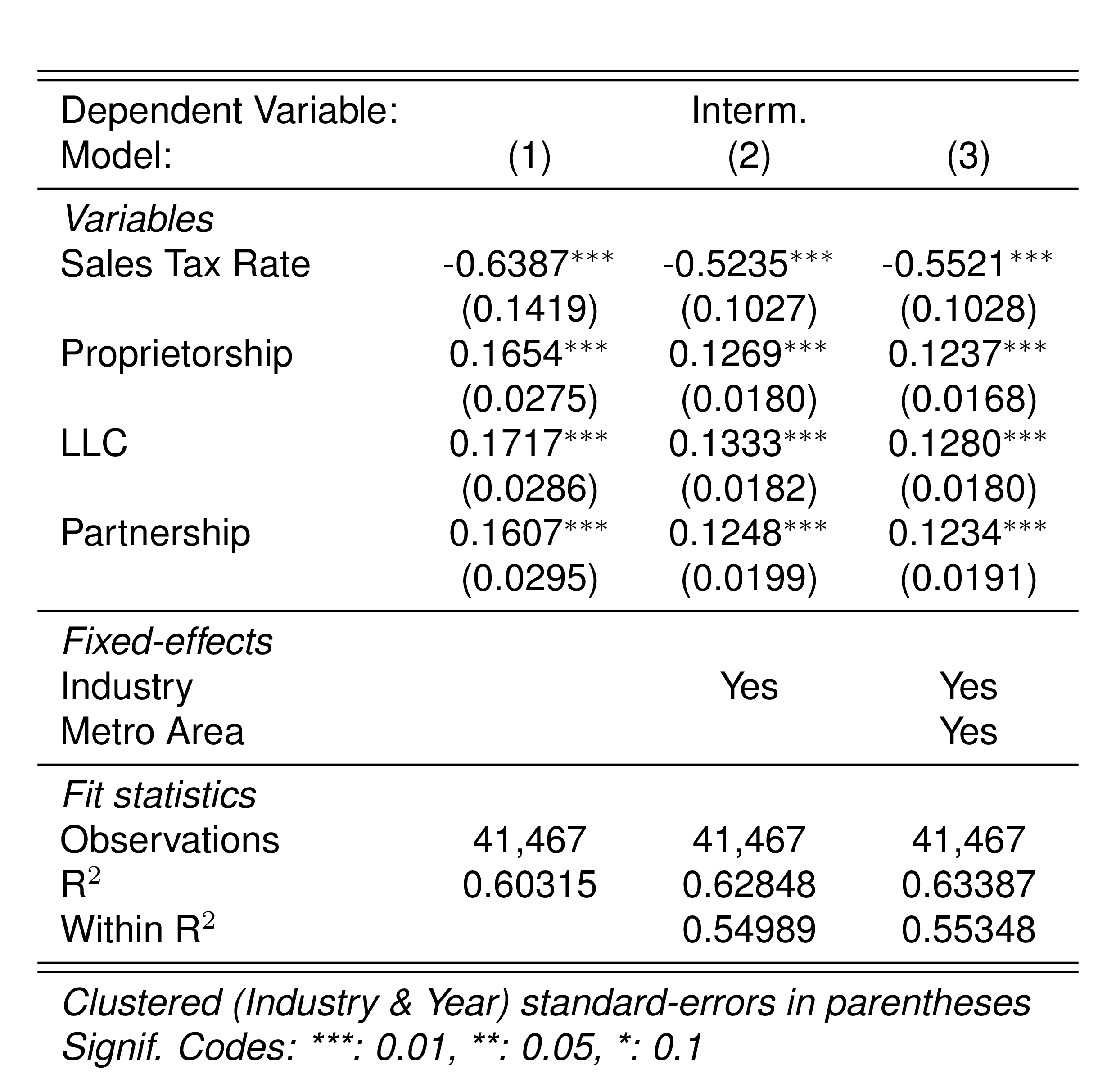

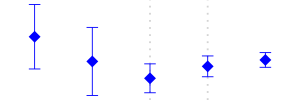

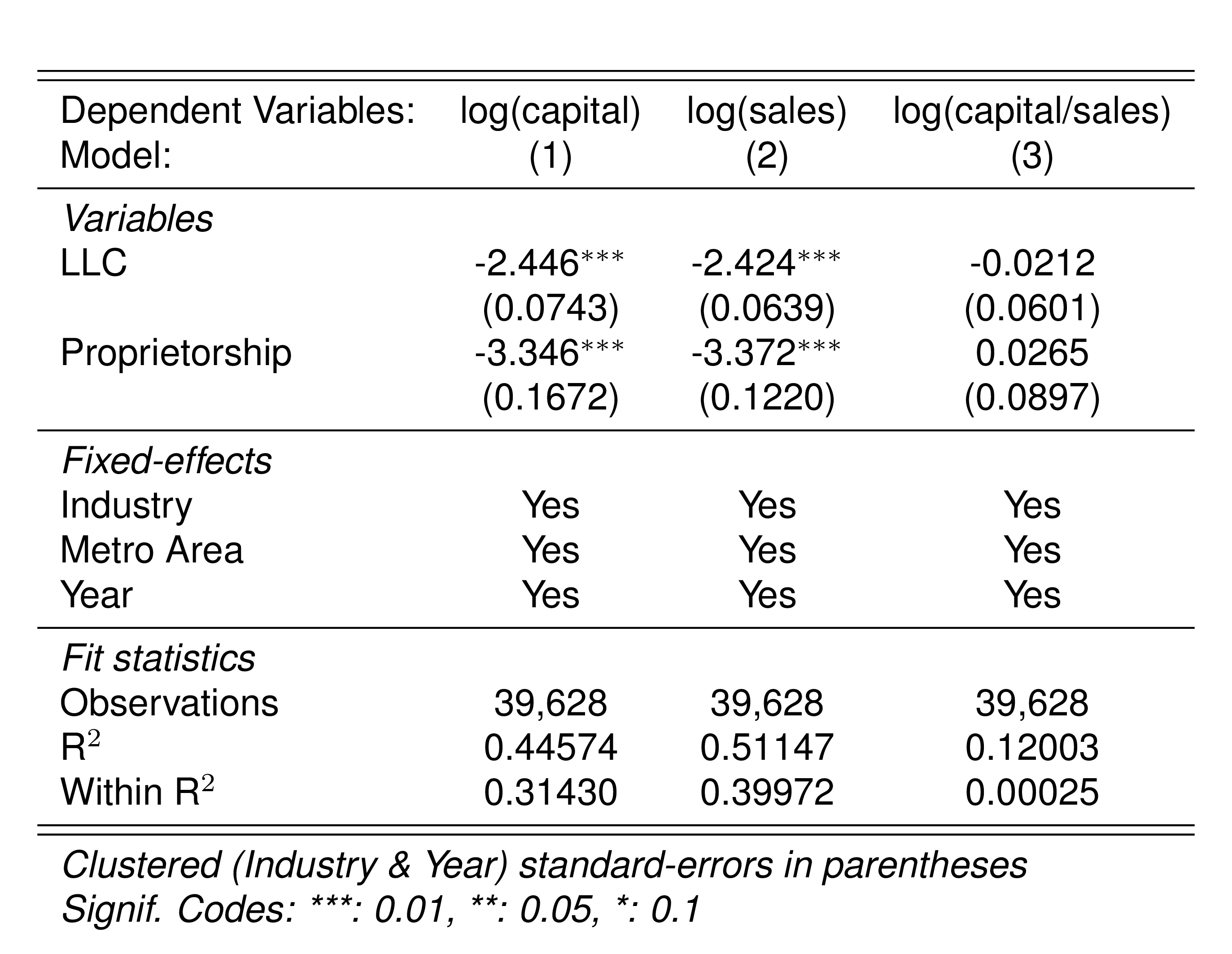

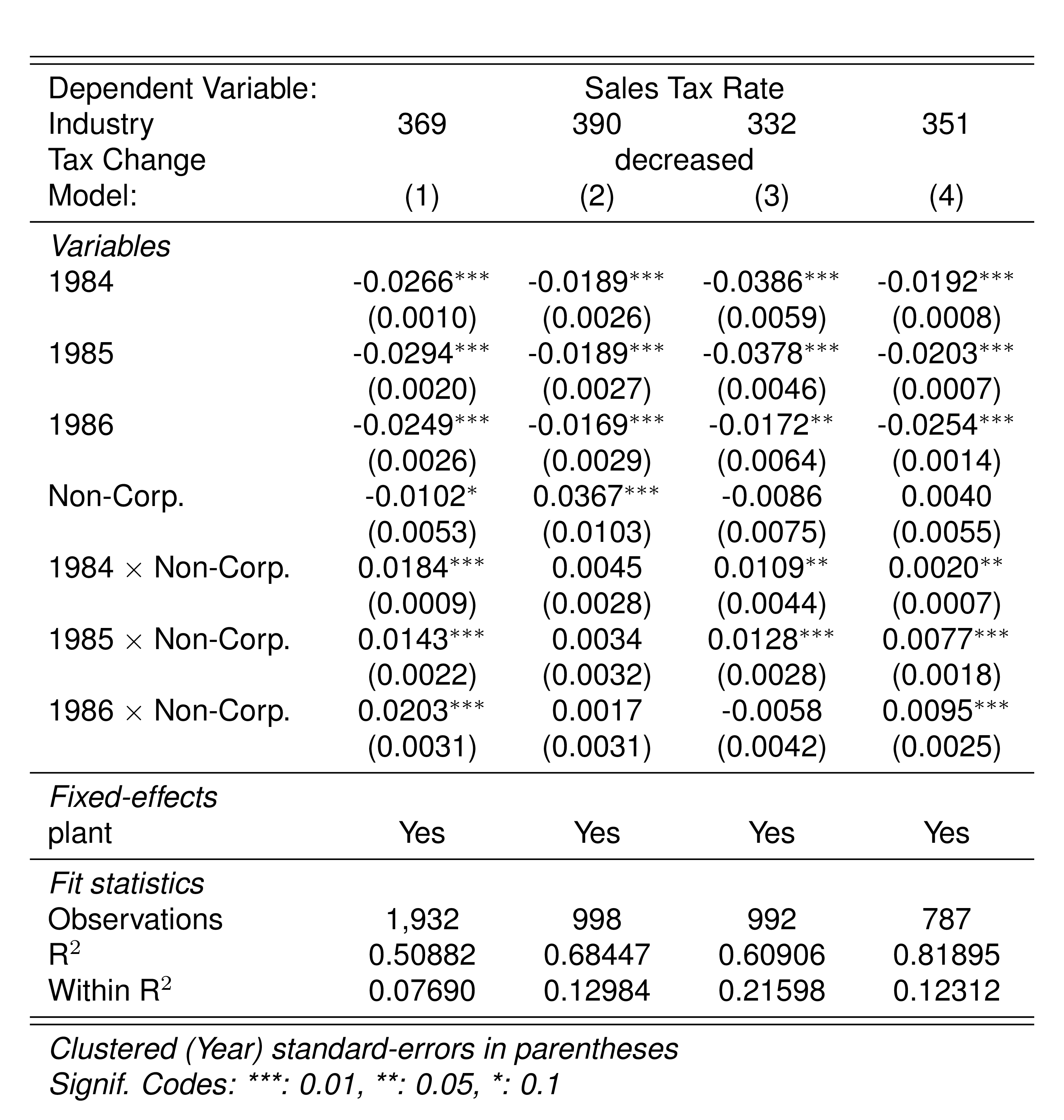

Finally, in a preliminary empirical assessment, I observe that the sales tax rate is a significant determinant of the log share of revenue and that non-corporations consistently use 13-17 percent more intermediates than Corporations for a rich set of controls Table 7. The results were estimated following Equation 8

\[ log(s_{it})= \alpha_1Tax_{it}+\beta_1'JurOrg_i + \beta_2'JurOrg_i\times\gamma_t+ \gamma_t + \gamma_{ind} +\gamma_{metro} + \beta_3'Z+ \varepsilon_{it} \tag{8}\]

Although this is not deterministic evidence, it does not contradict the hypothesis that firms other than corporations have incentives to overreport intermediates to evade taxes and that the higher the taxes the higher the incentives to evade by misreporting.

4.4 The Fiscal Reform of 1983 by Industry

| SIC | Industry | P&T (1990) | Change | Change Year | Annual Sales Tax (82-86) |

|---|---|---|---|---|---|

| 311 | Food Manufacturing | Exempt |  |

||

| 312 | Food Manufacturing | Exempt |  |

||

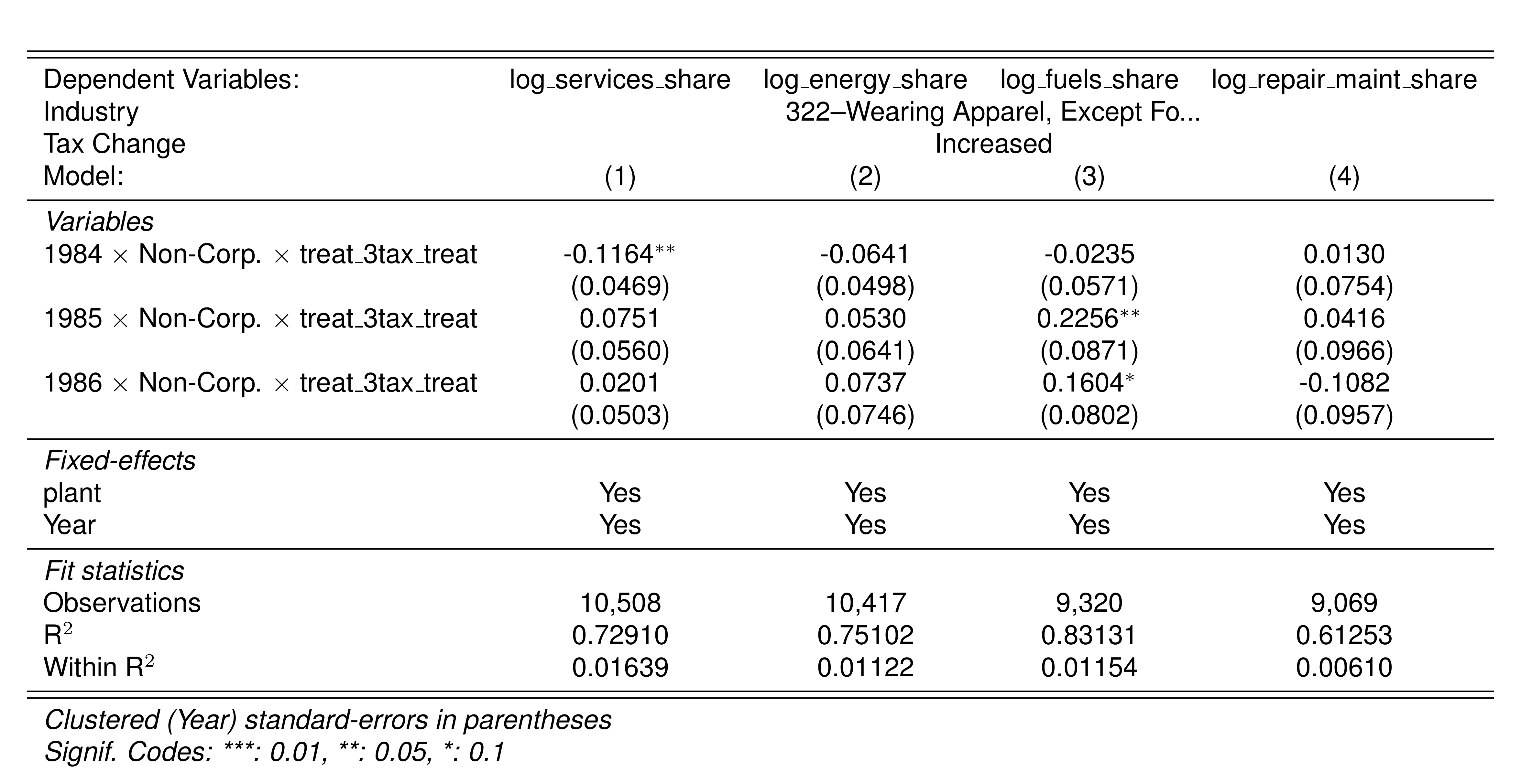

| 322 | Wearing Apparel, Except Footwear | Increased | 84 |  |

|

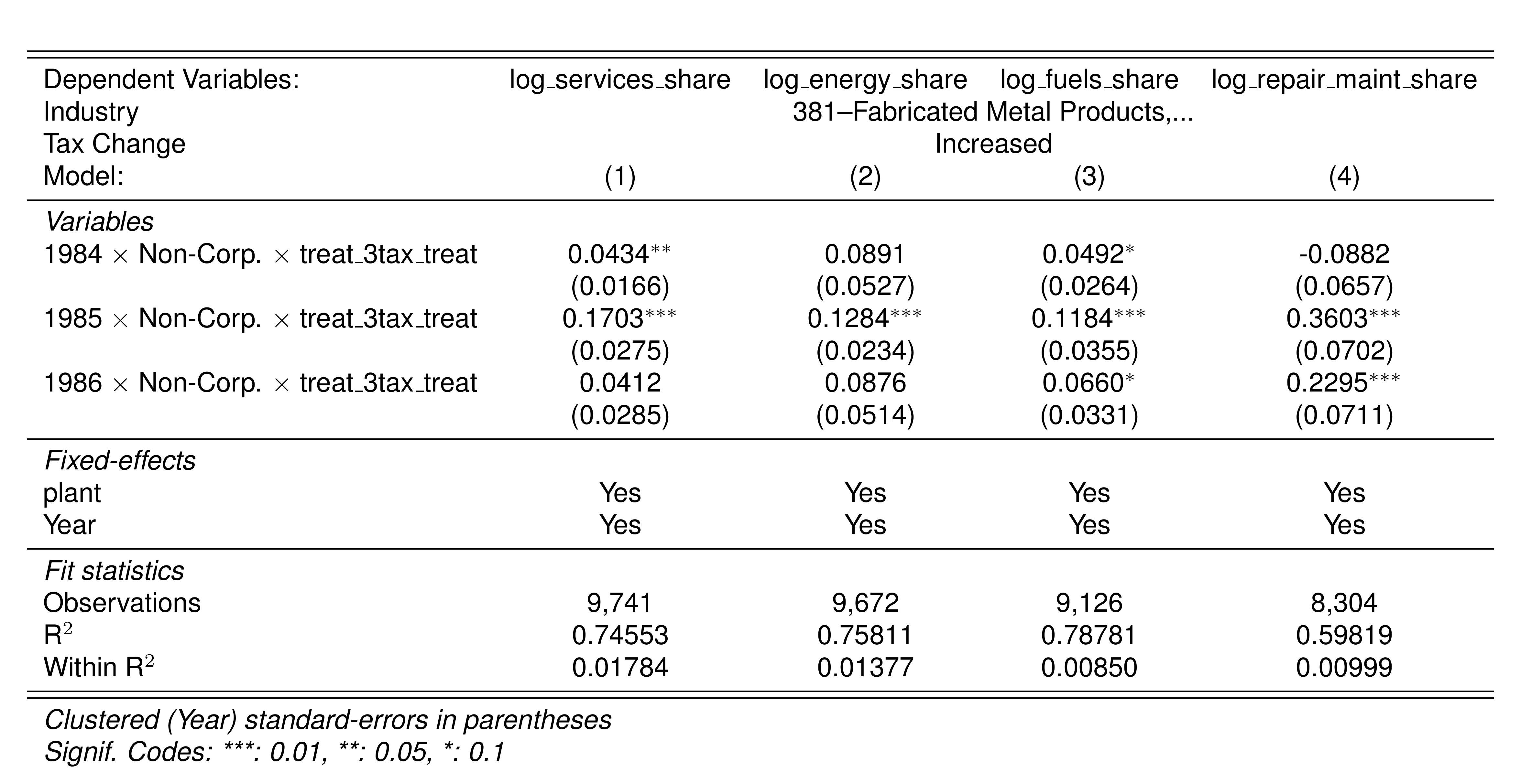

| 381 | Fabricated Metal Products, Except Machinery and Equipment | Increased | 85 |  |

|

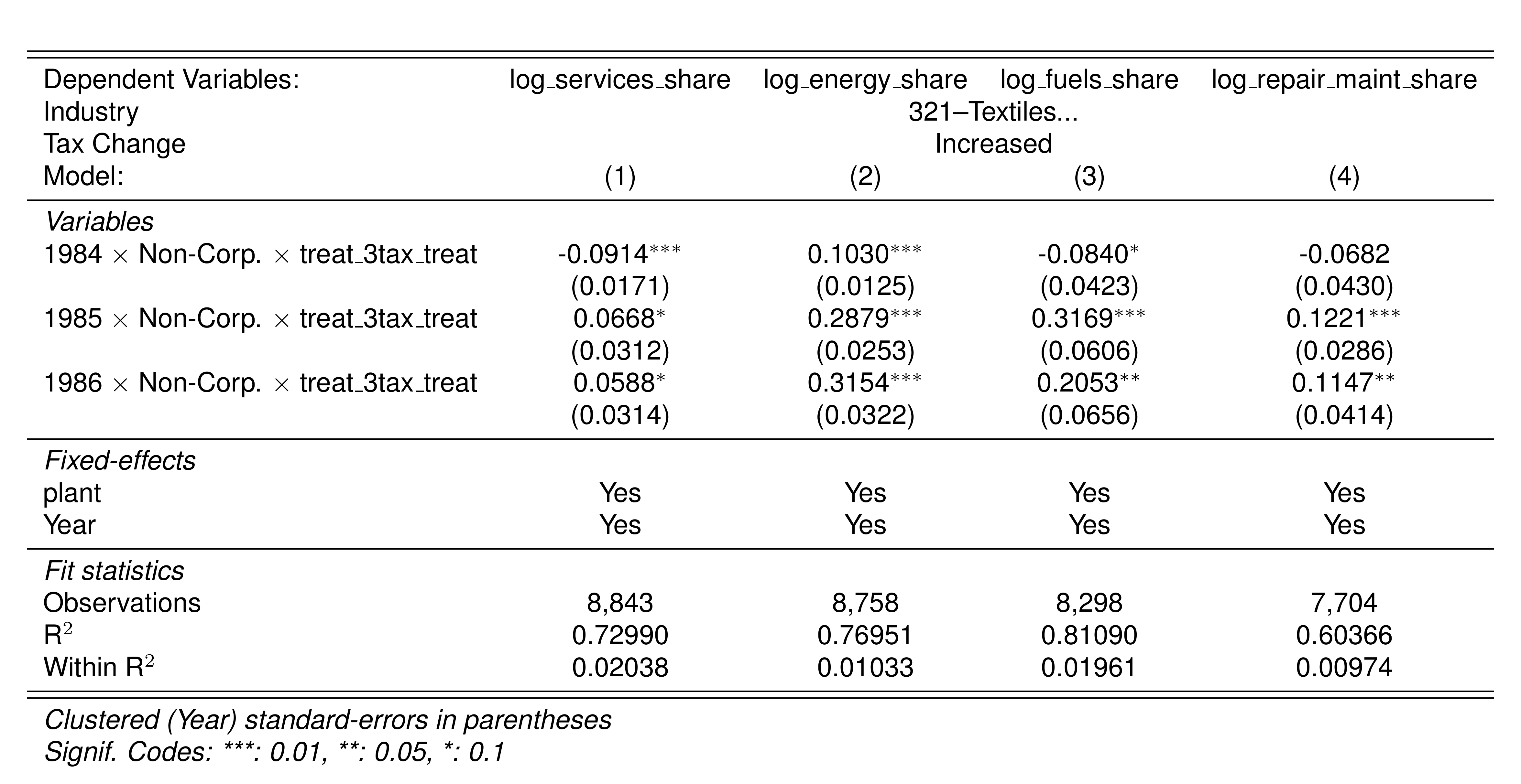

| 321 | Textiles | 6 to 10 | Increased | 84 |  |

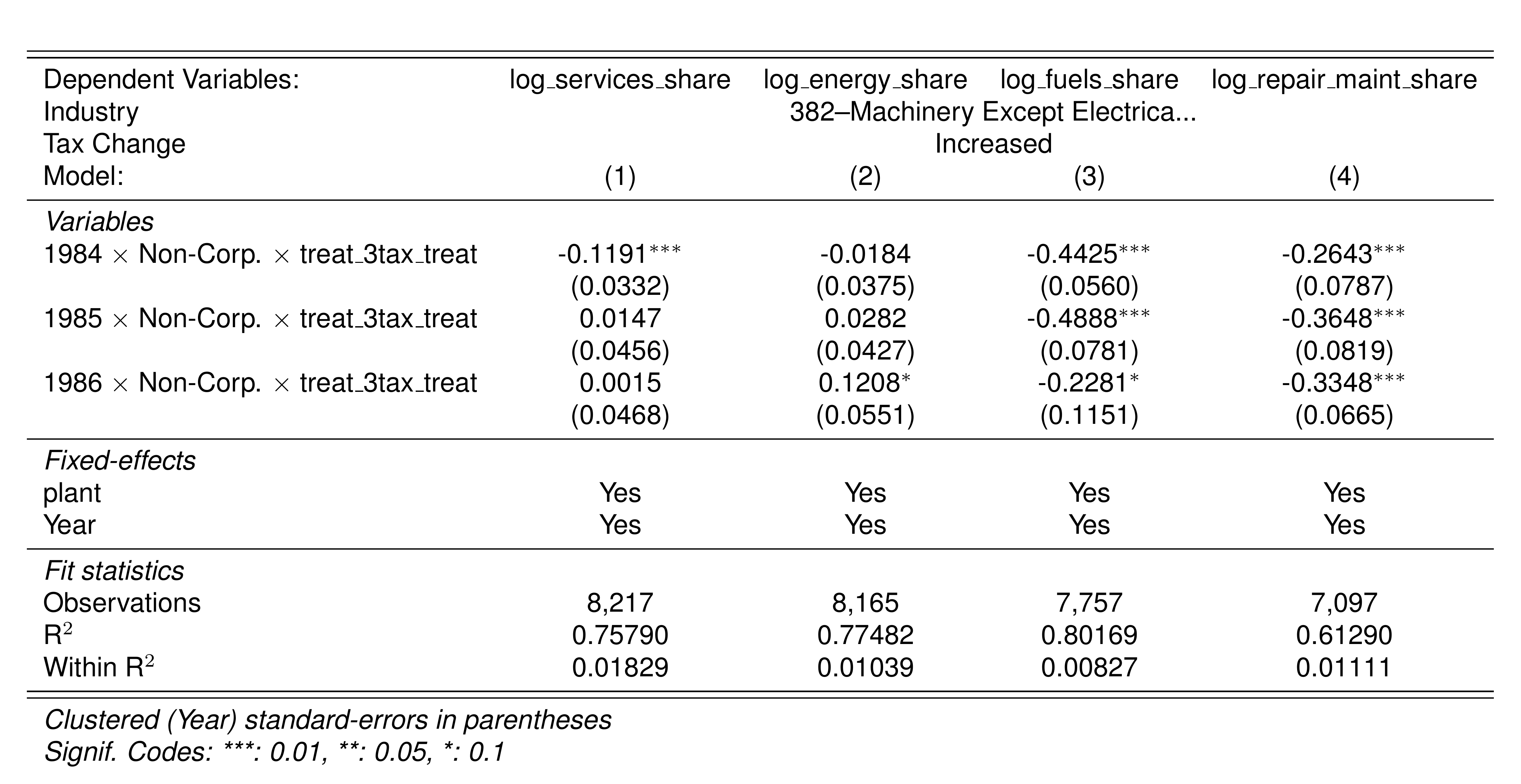

| 382 | Machinery Except Electrical | 6 to 10 | Increased | 85 |  |

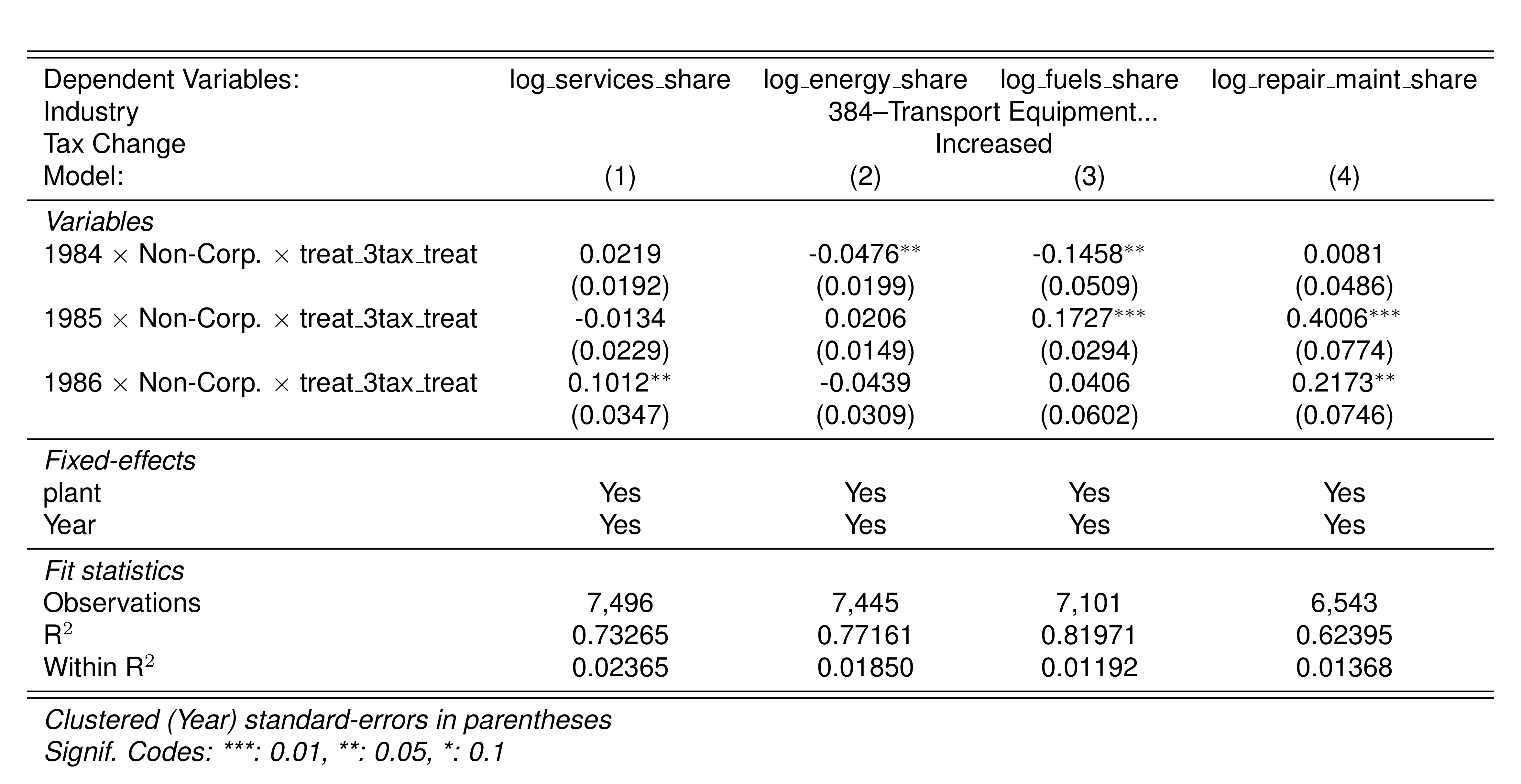

| 384 | Transport Equipment | 6 to 10 | Increased | 85 |  |

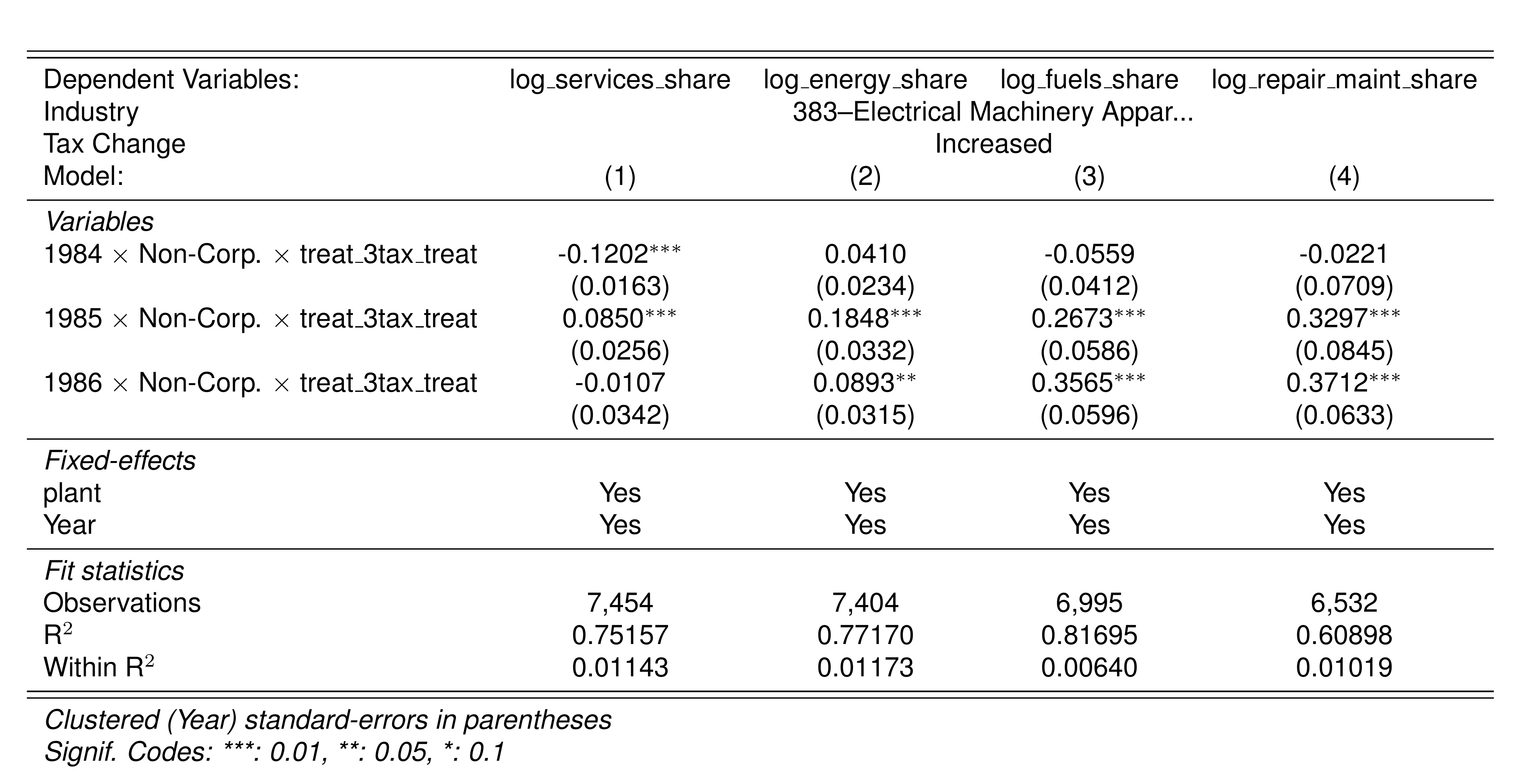

| 383 | Electrical Machinery Apparatus, Appliances and Supplies | 6 to 10 | Increased | 85 |  |

| 313 | Beverage Industries | - to 35;10 | Increased | 85 |  |

| 341 | Paper and Paper Products | 15 to 10 | Increased | 84 |  |

| 324 | Footwear, Except Vulcanized or Moulded Rubber or Plastic Footwear | Increased | 84 |  |

|

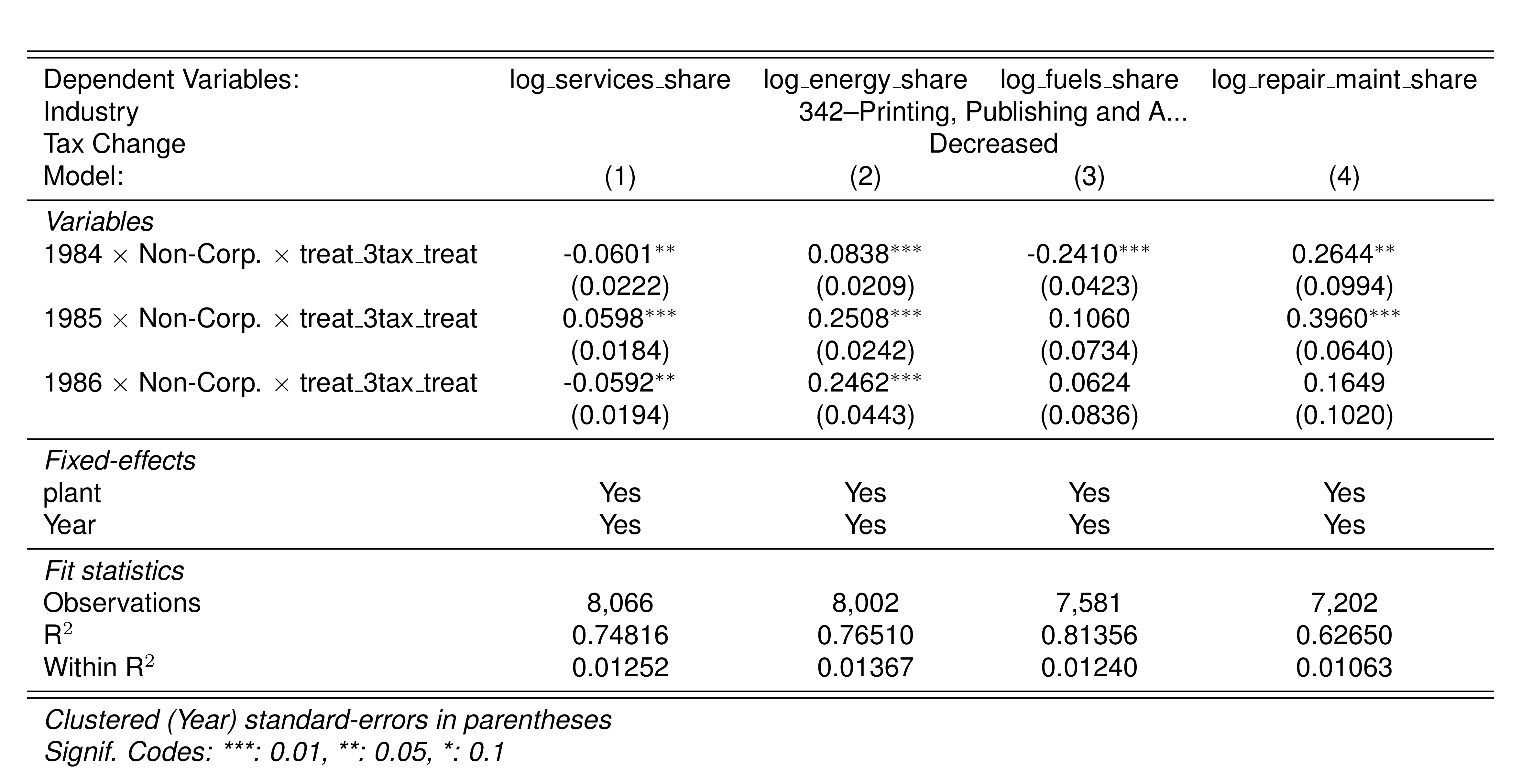

| 342 | Printing, Publishing and Allied Industries | Decreased | 84 |  |

|

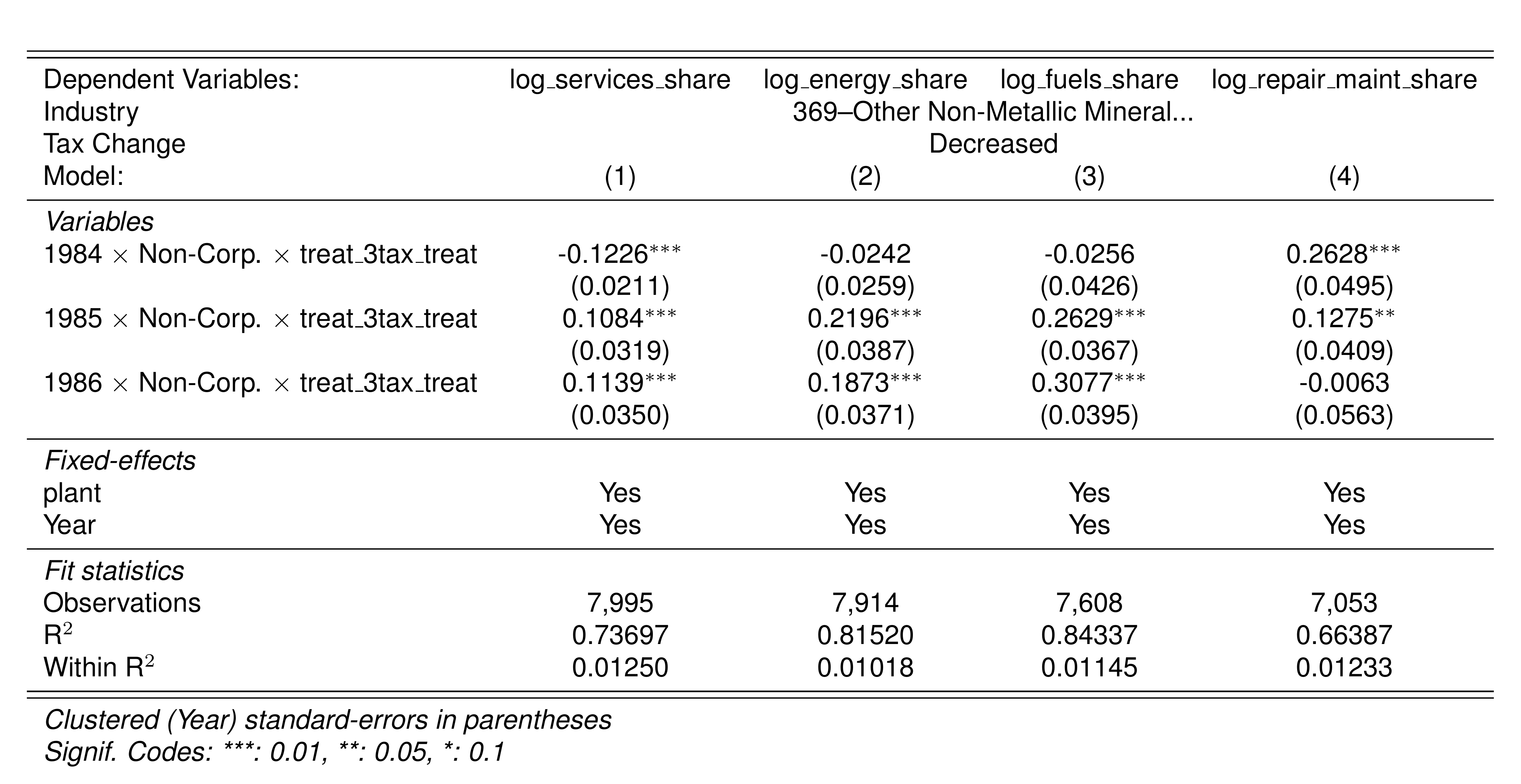

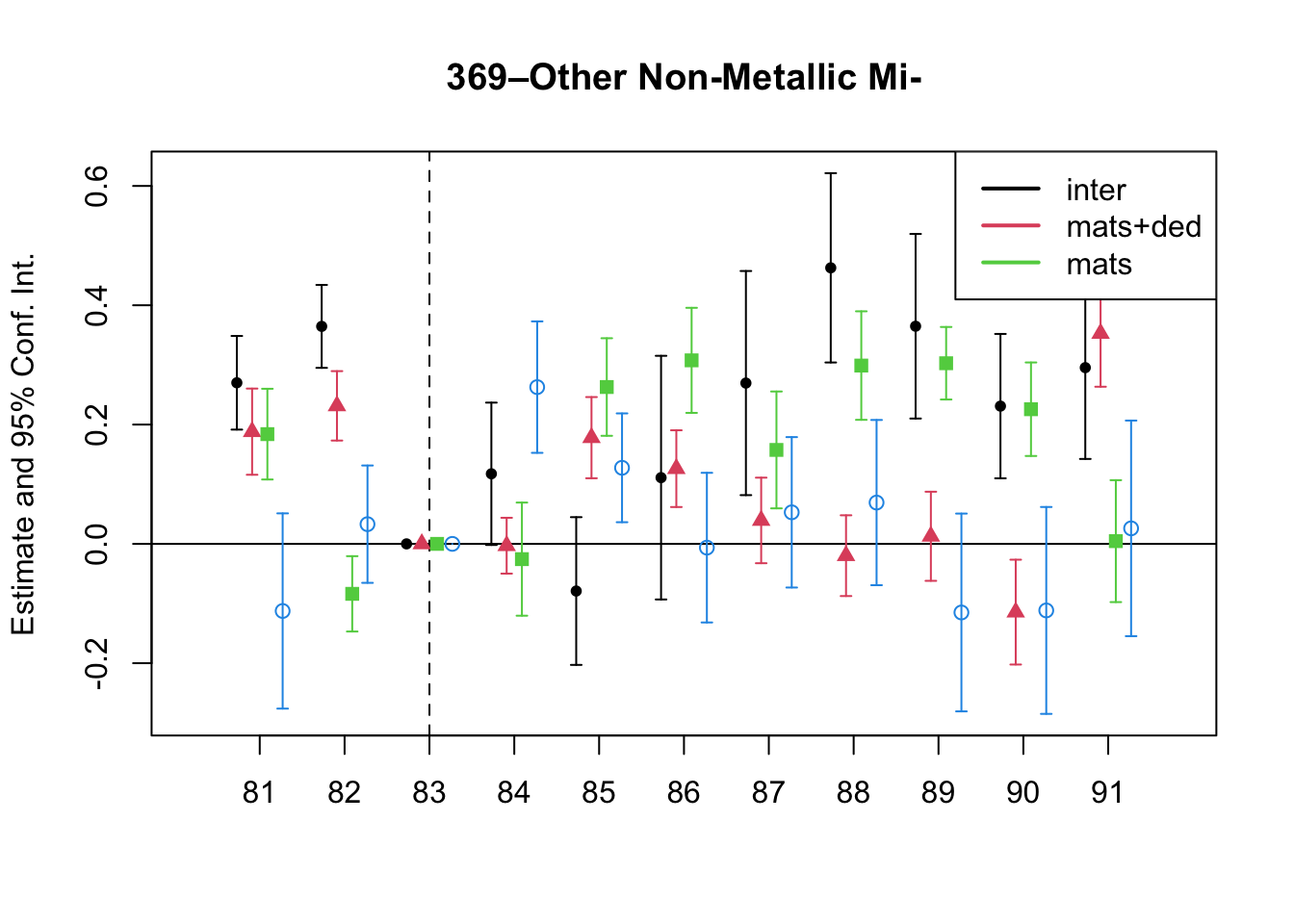

| 369 | Other Non-Metallic Mineral Products | Decreased | 84 |  |

|

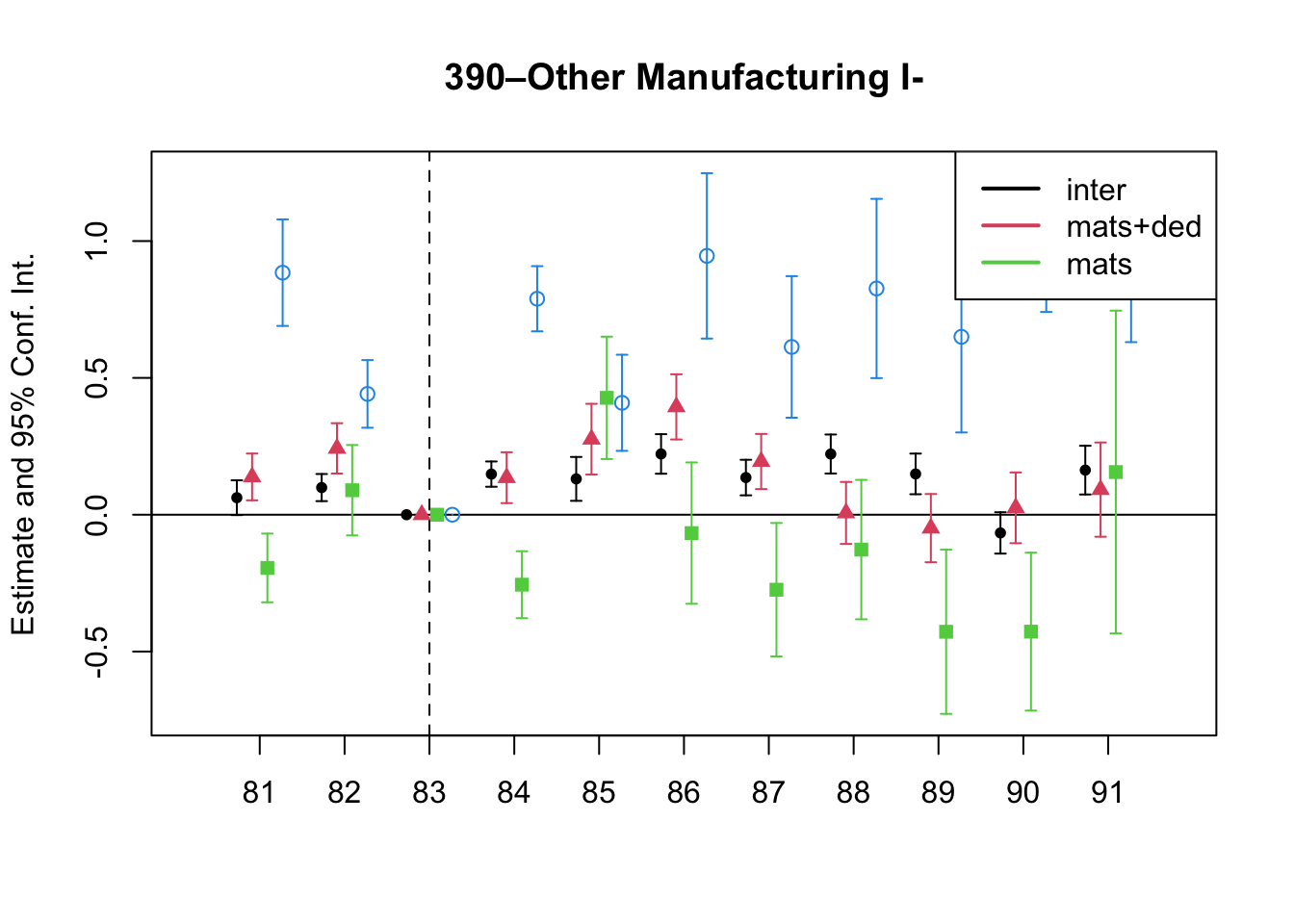

| 390 | Other Manufacturing Industries | Decreased | 84 |  |

|

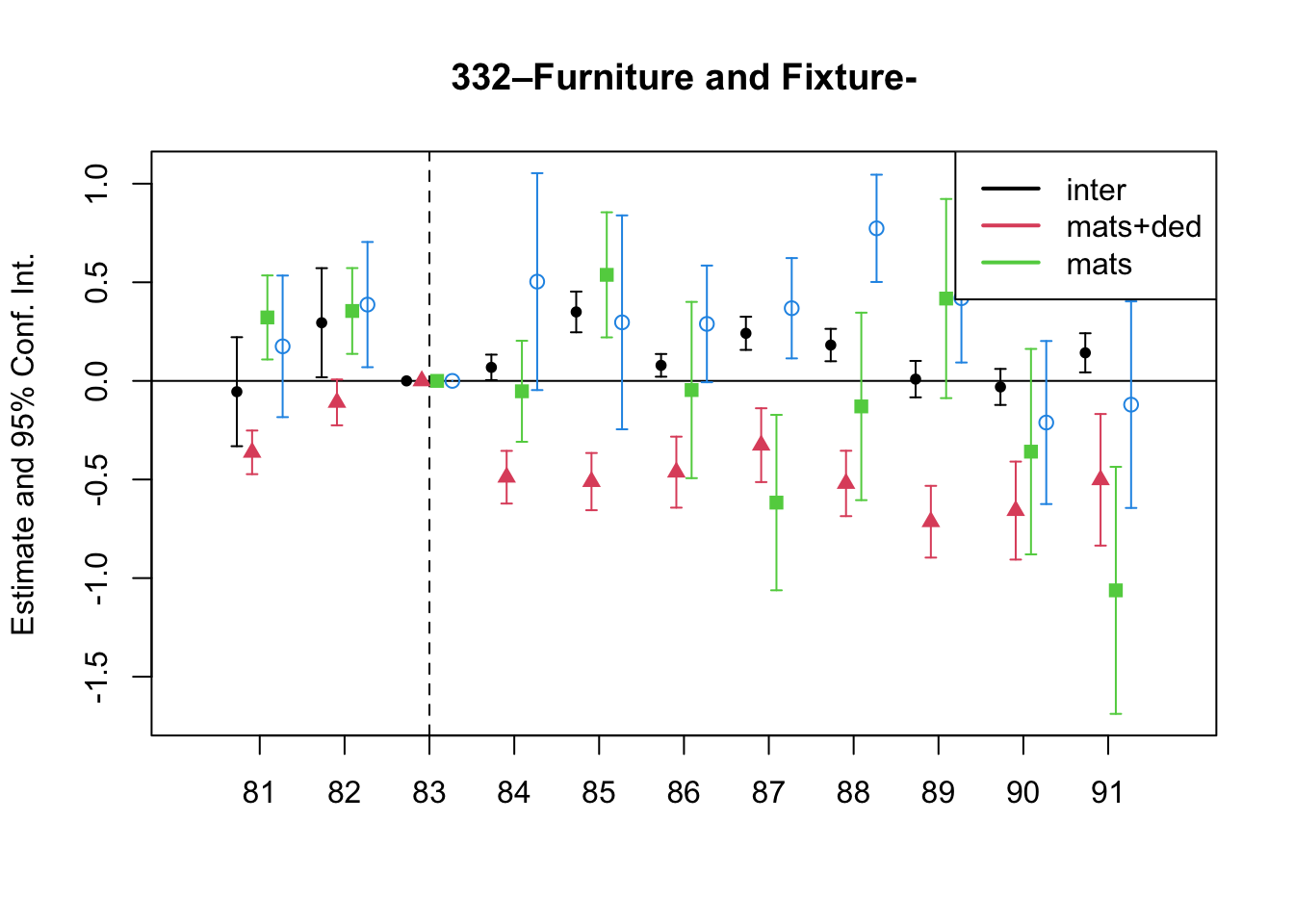

| 332 | Furniture and Fixtures, Except Primarily of Metal | Decreased | 84 |  |

|

| 351 | Industrial Chemicals | 15 to 10 | Decreased | 84 |  |

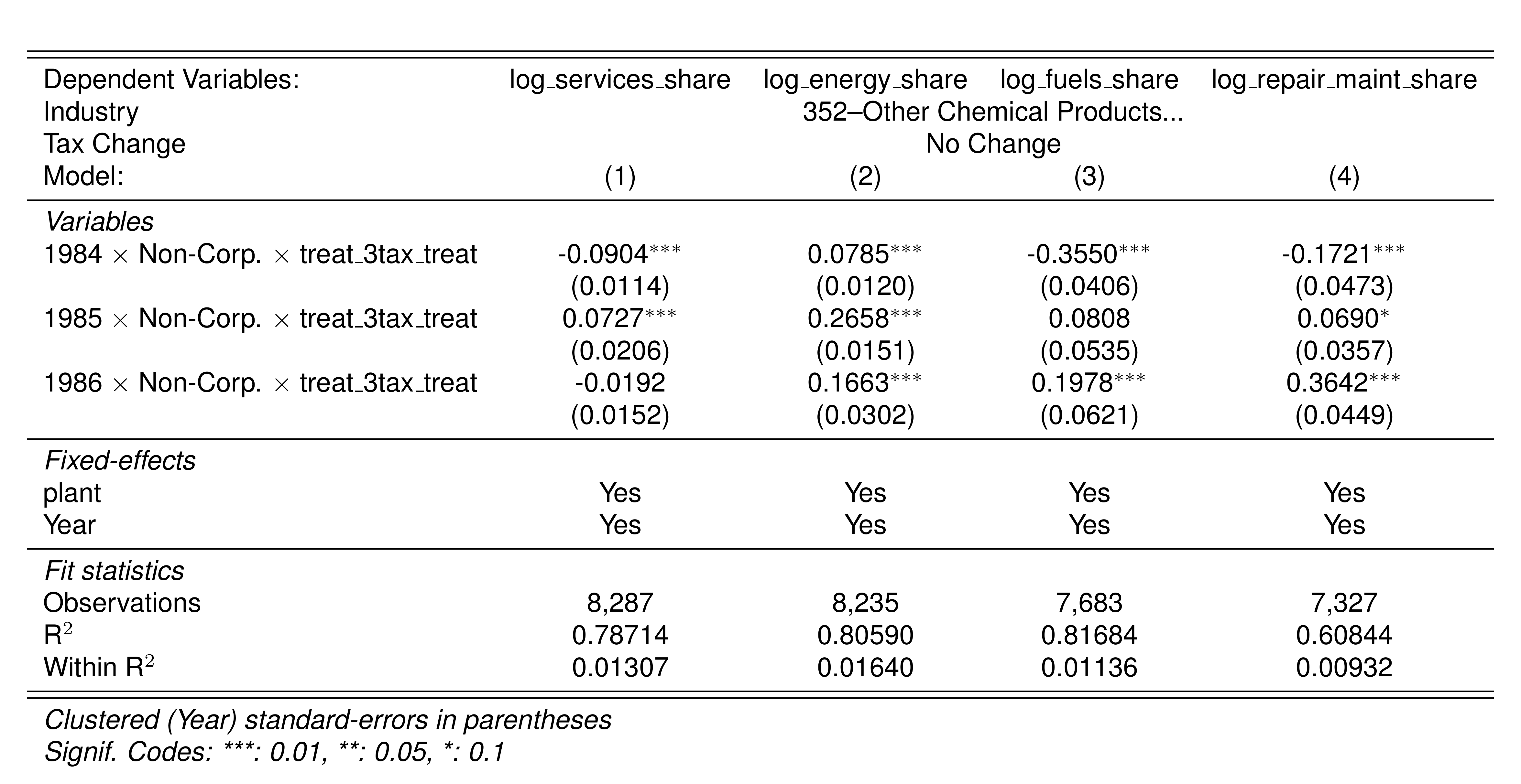

| 352 | Other Chemical Products | 6;15 to 10 | No Change |  |

|

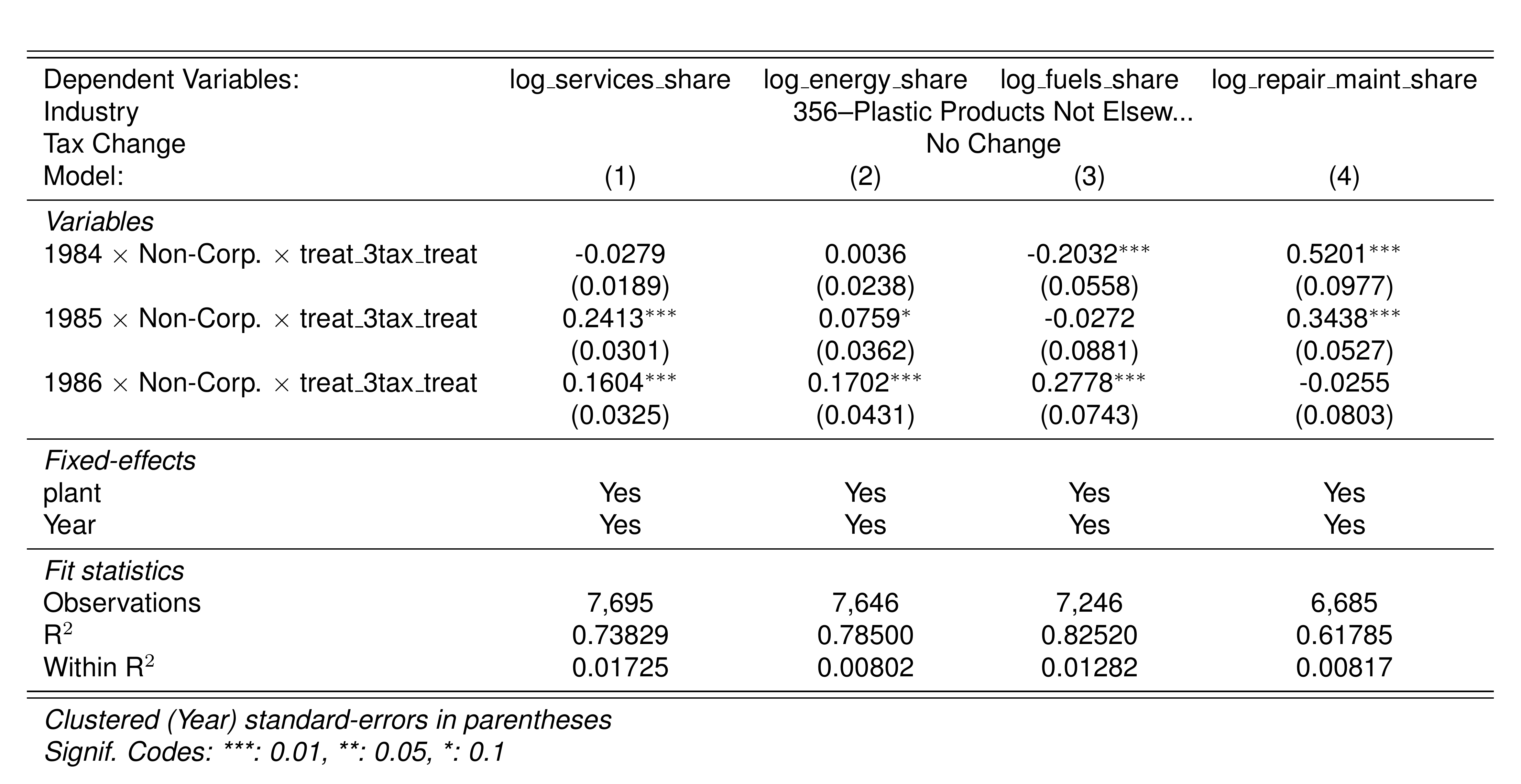

| 356 | Plastic Products Not Elsewhere Classified | 15 to 10 | No Change |  |

|

| 331 | Wood and Wood and Cork Products, Except Furniture | No Change |  |

||

| 323 | Leather and Products of Leather, Leather Substitutes and Fur, Except Footwear and Wearing Apparel | No Change |  |

5 Empirical Application

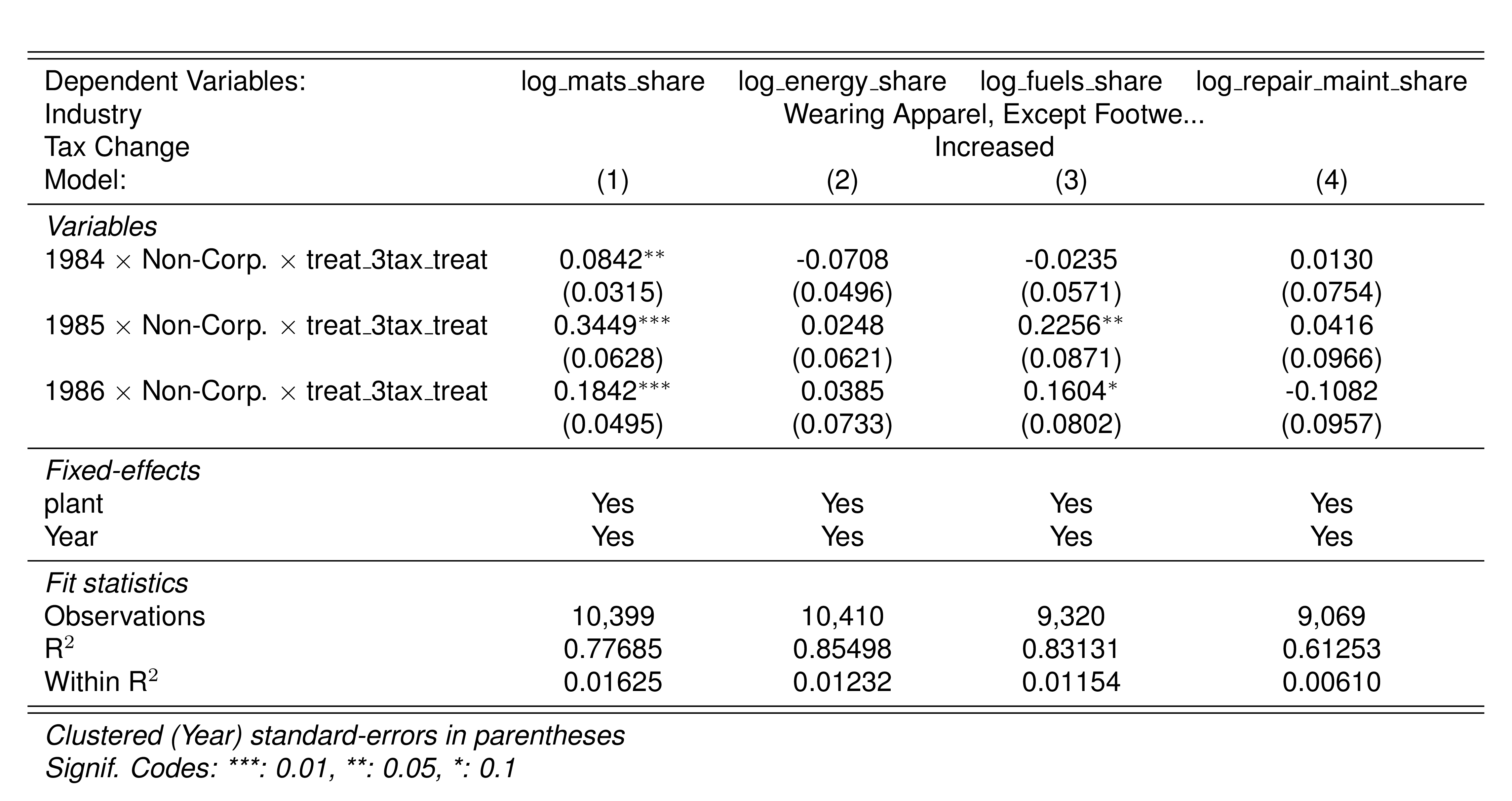

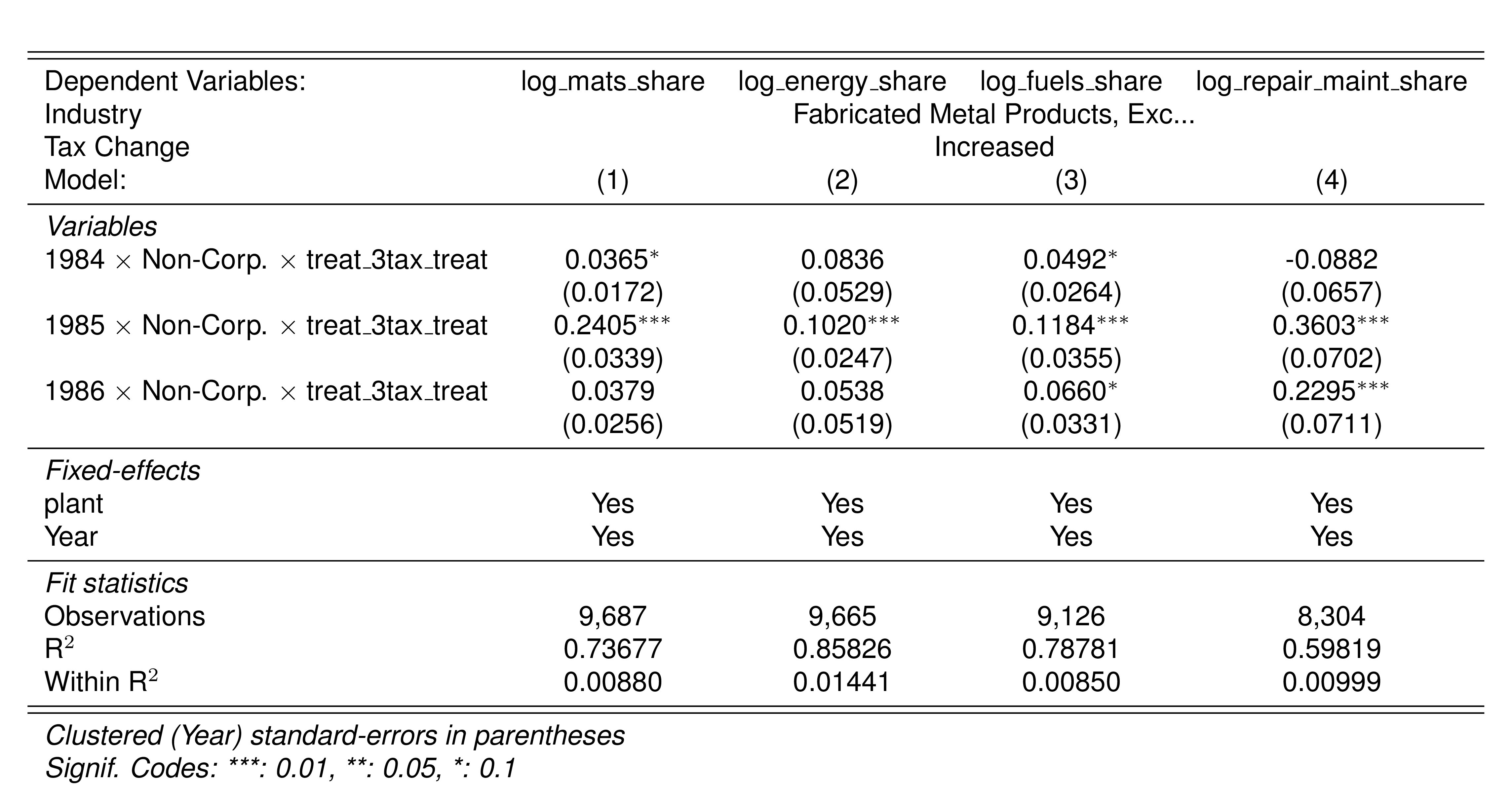

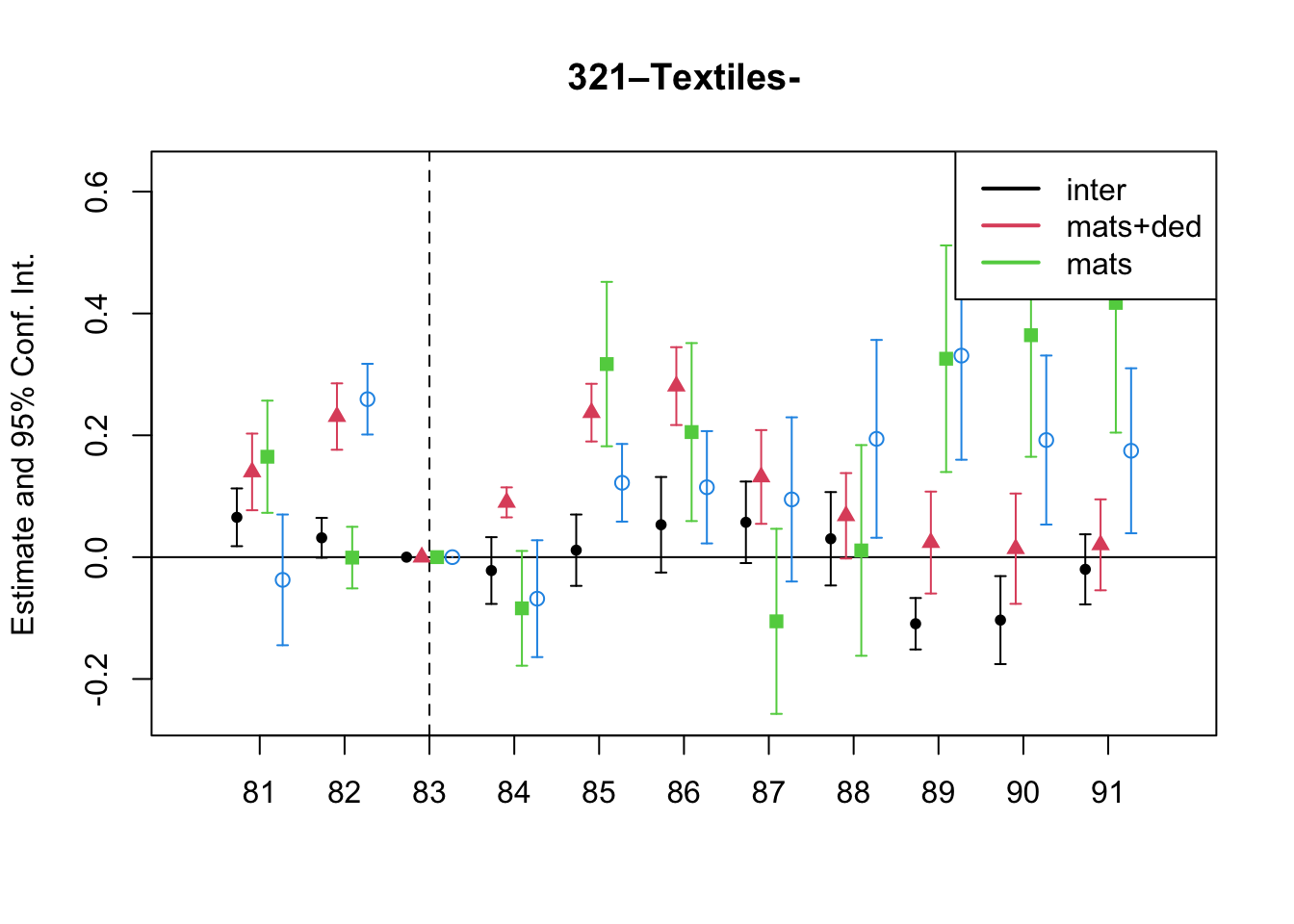

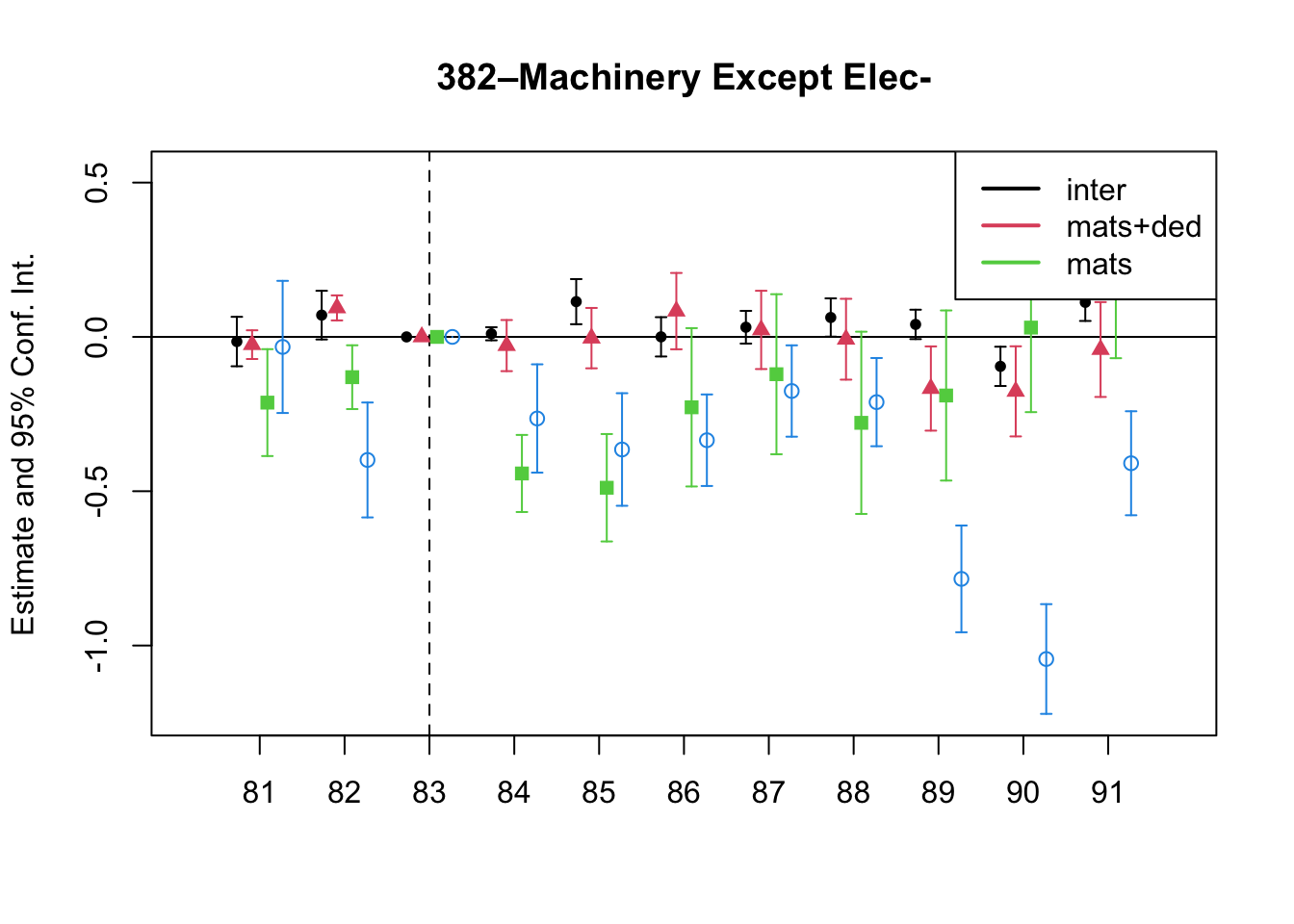

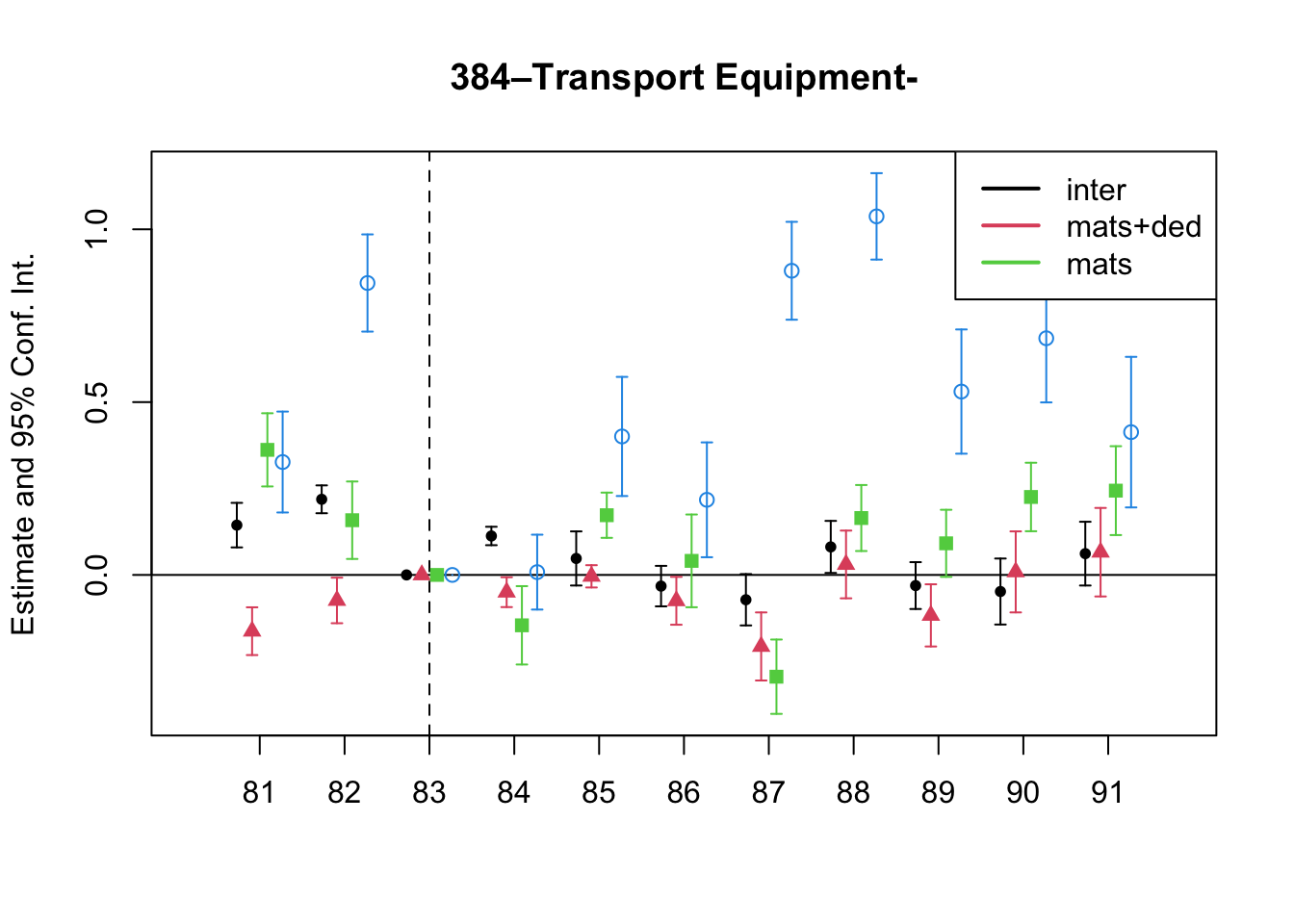

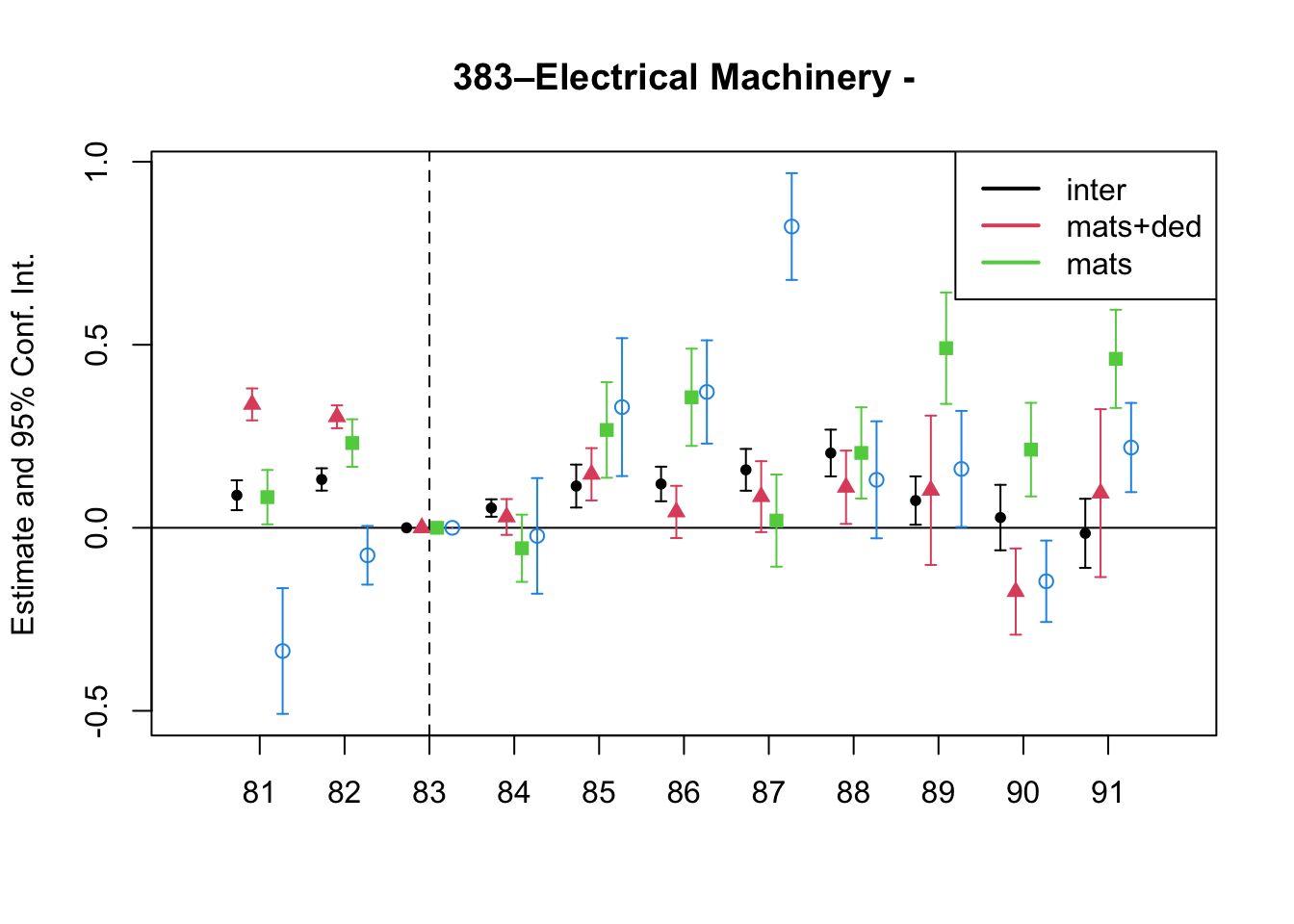

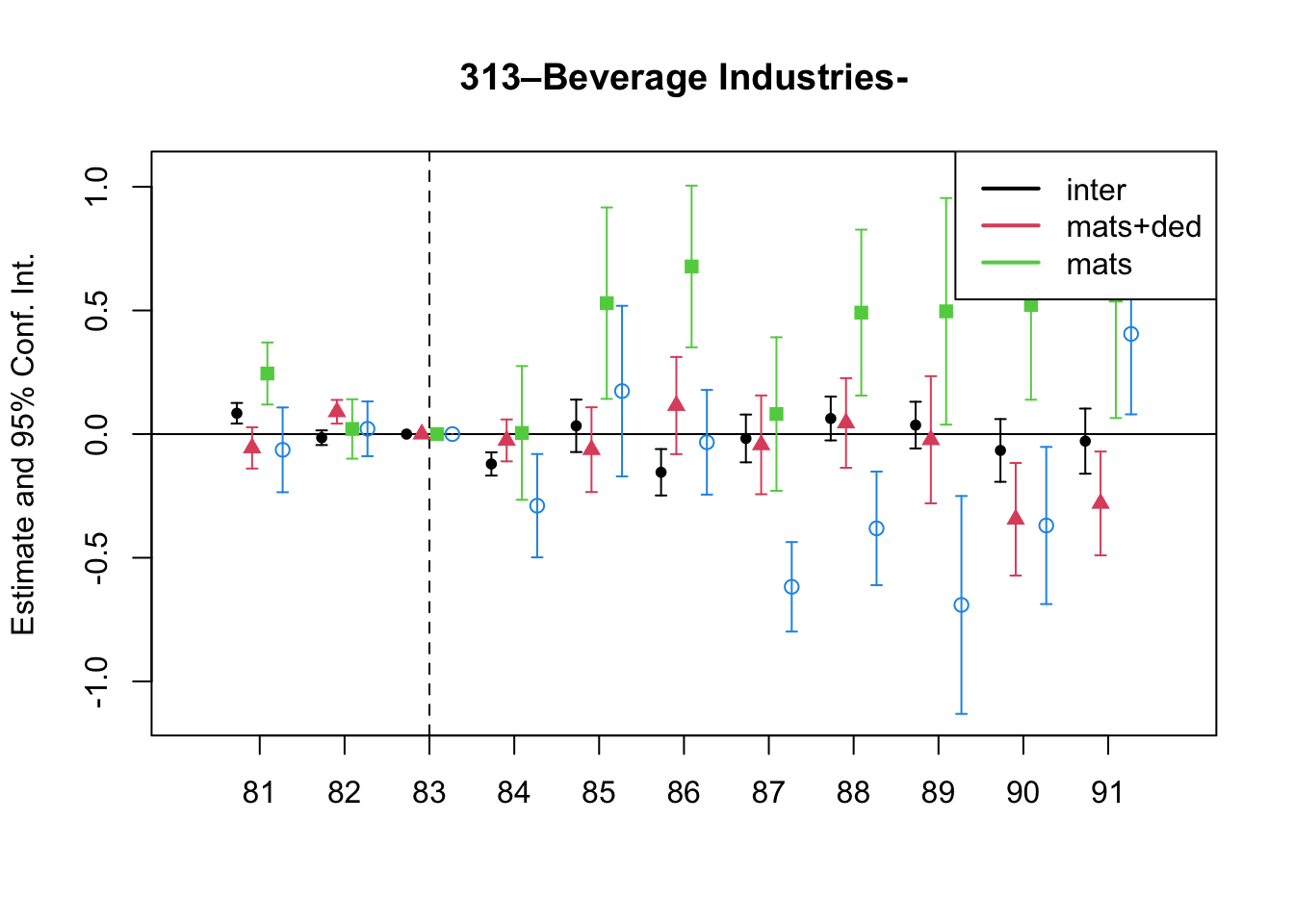

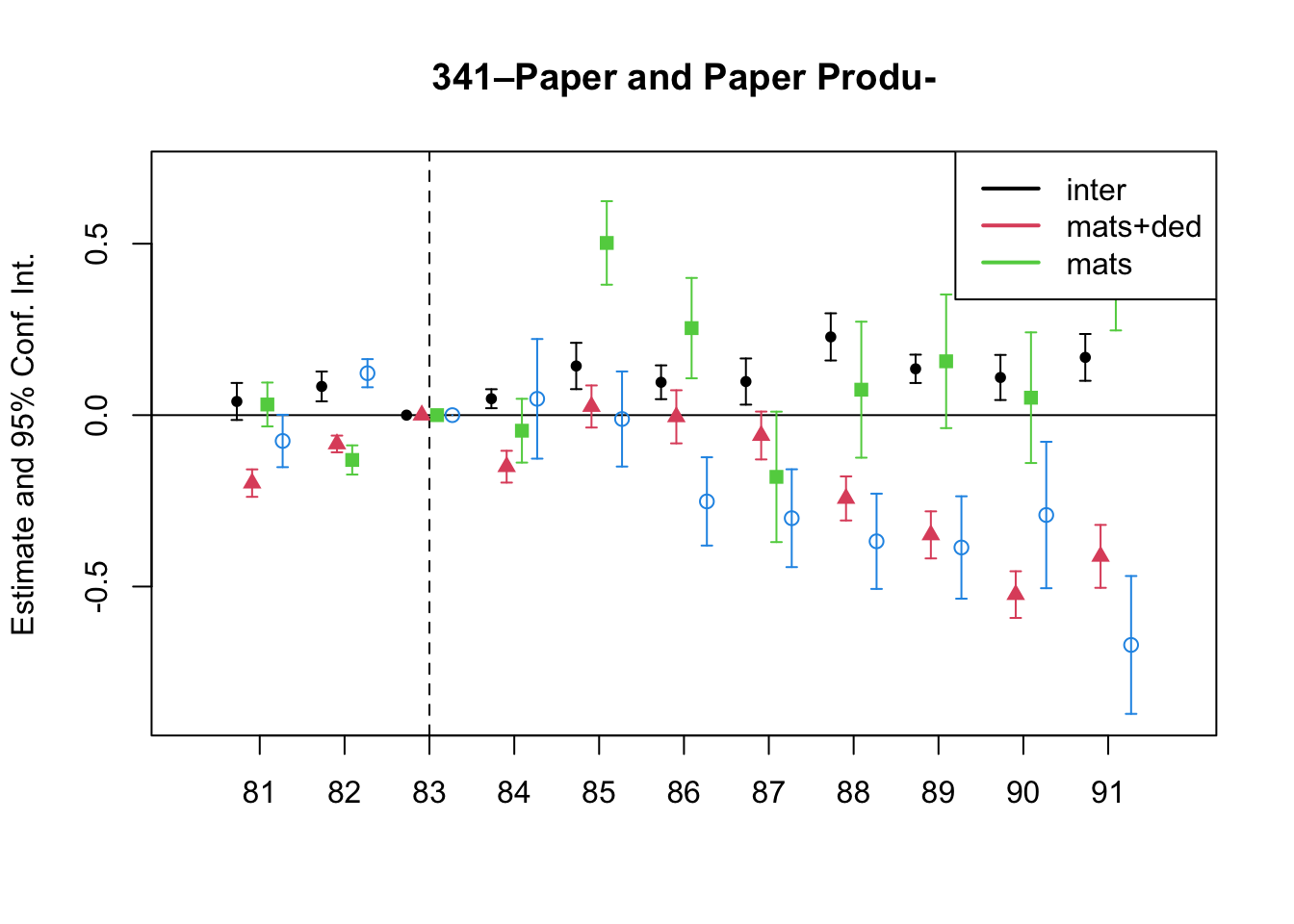

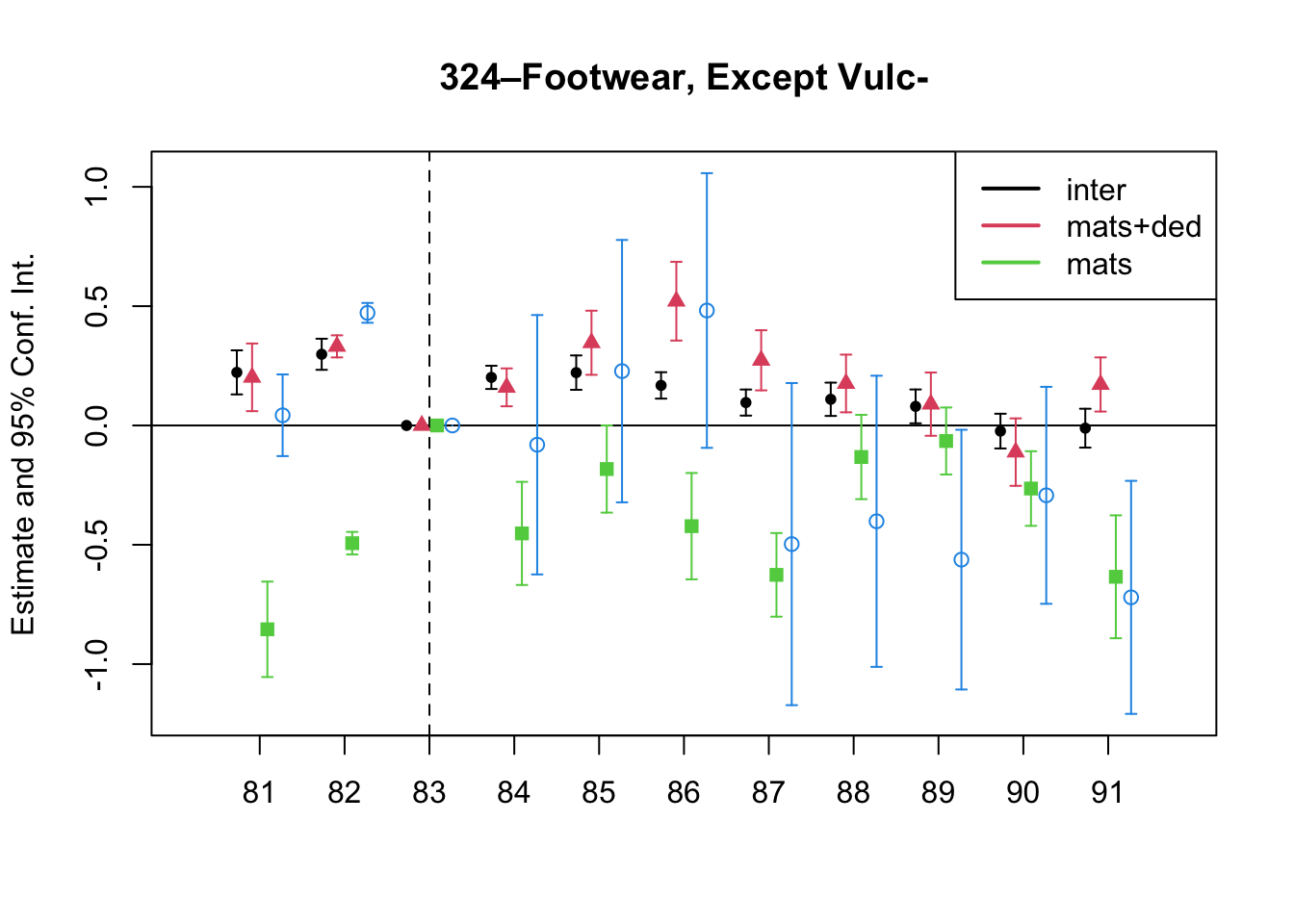

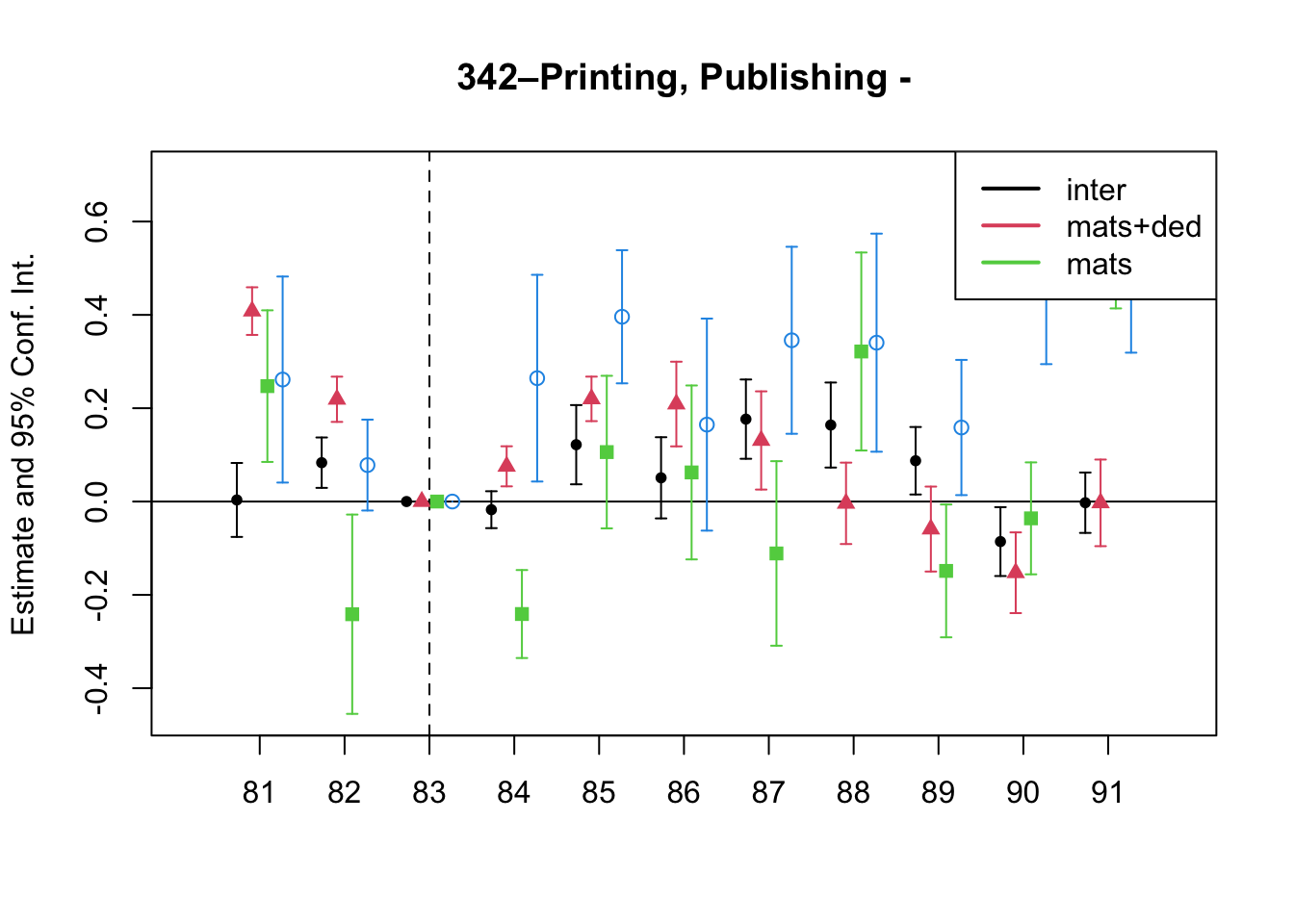

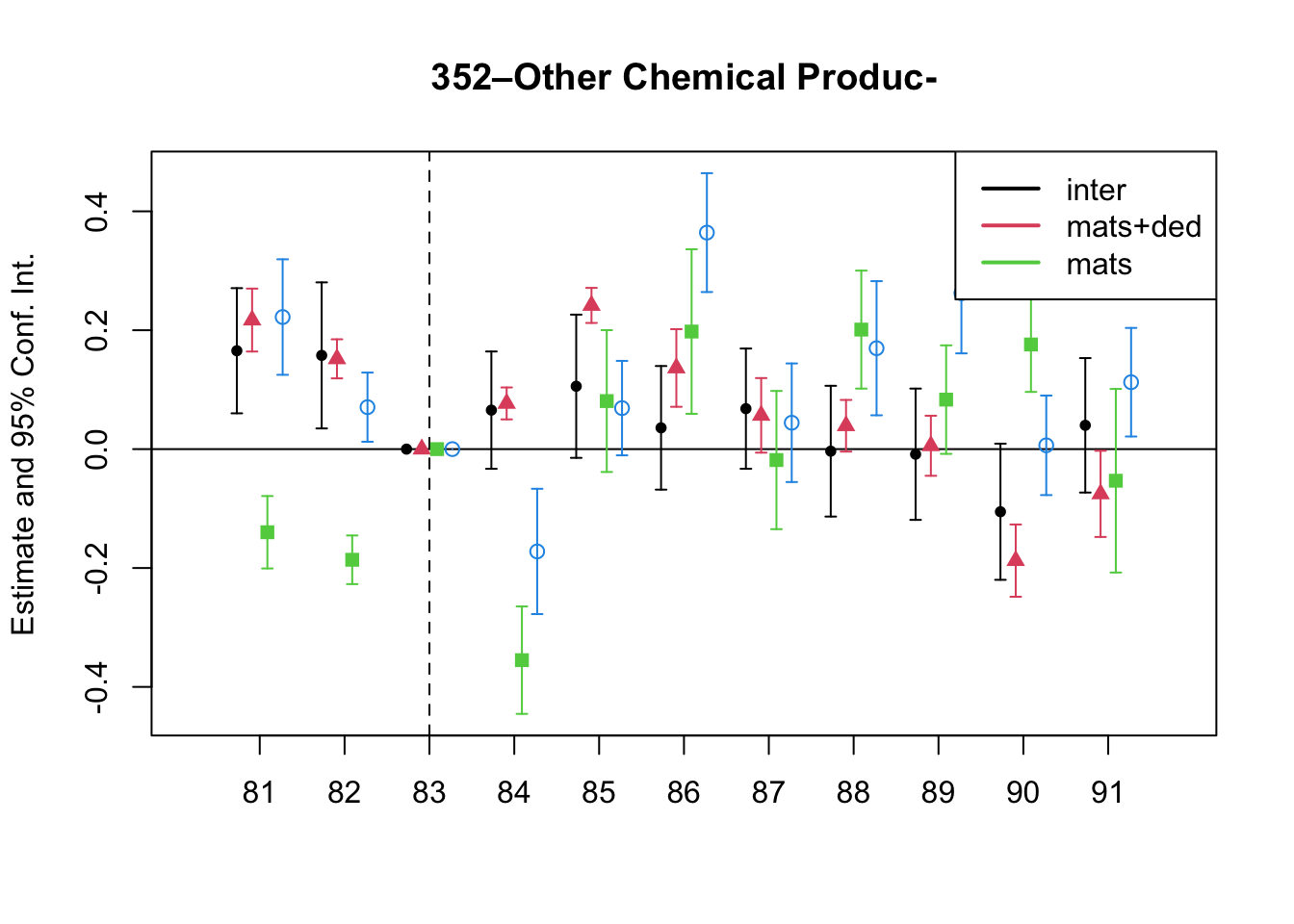

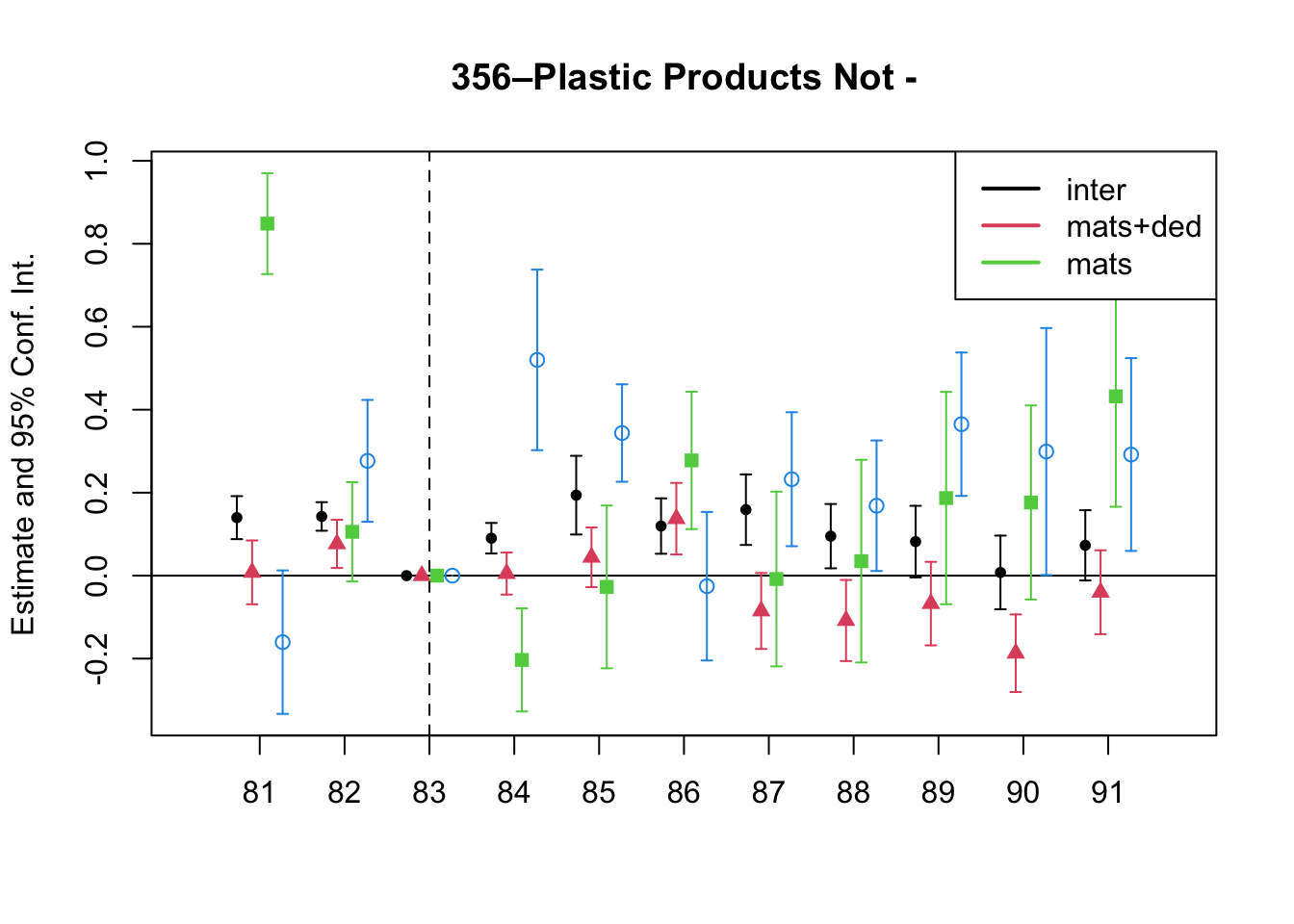

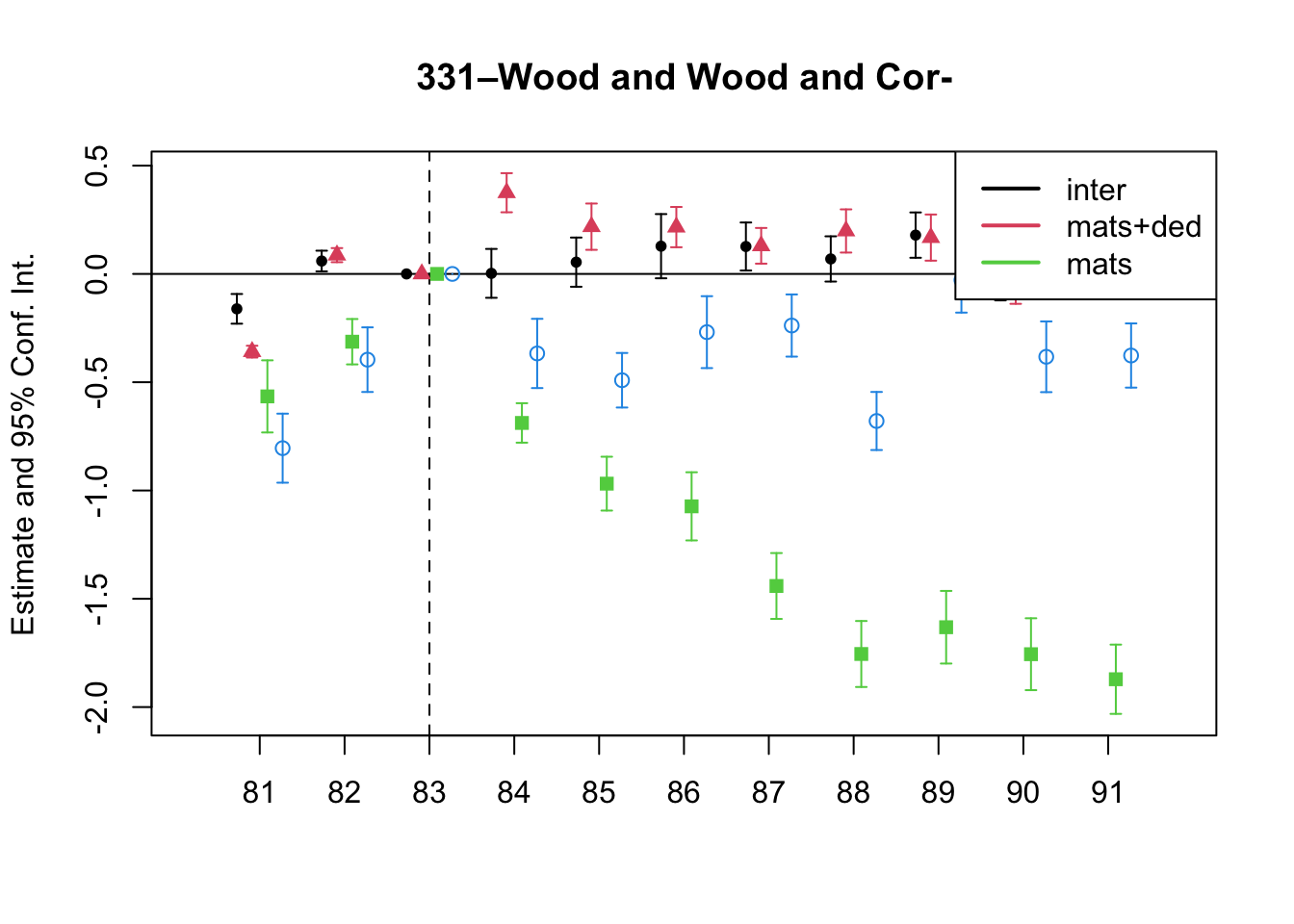

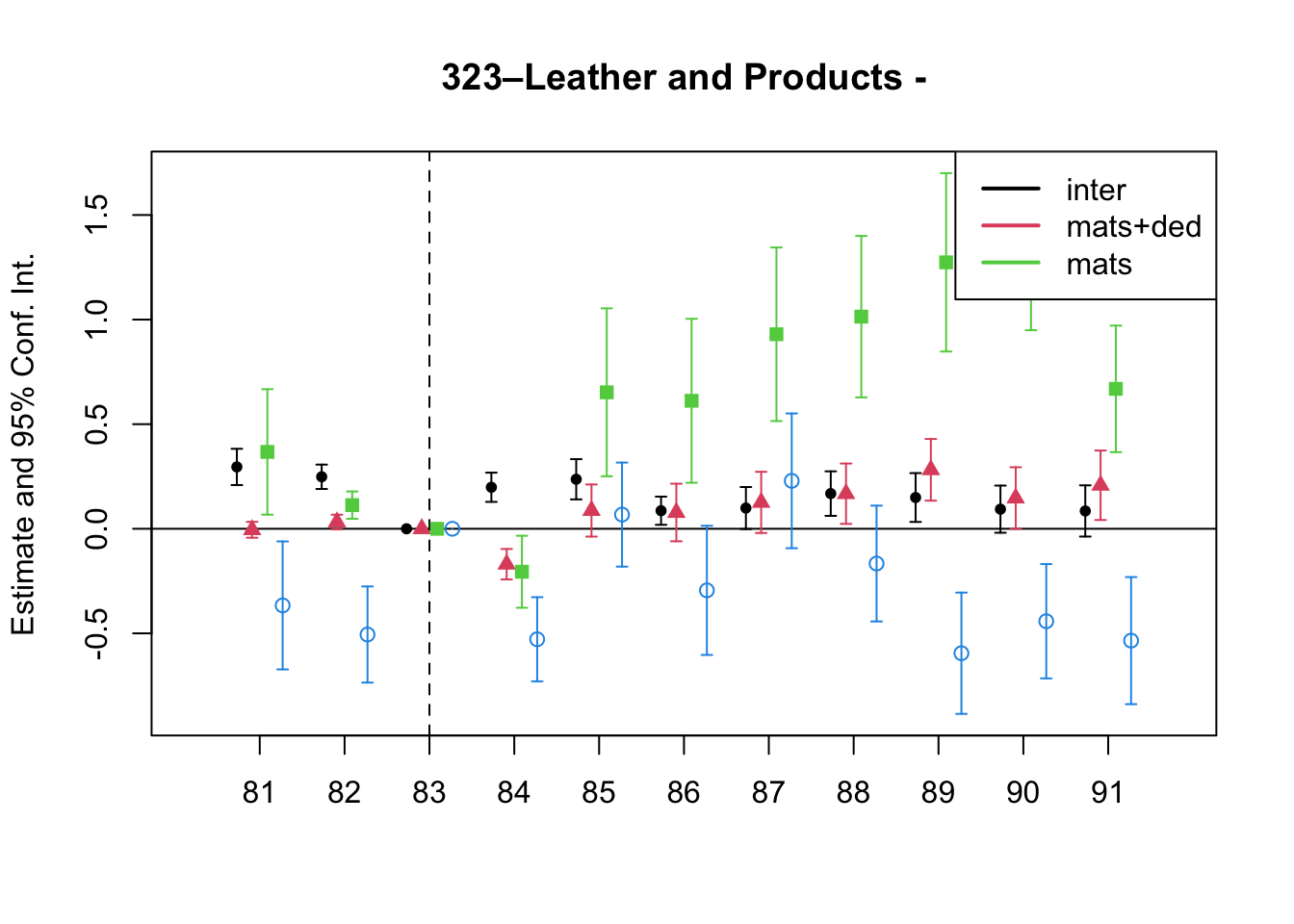

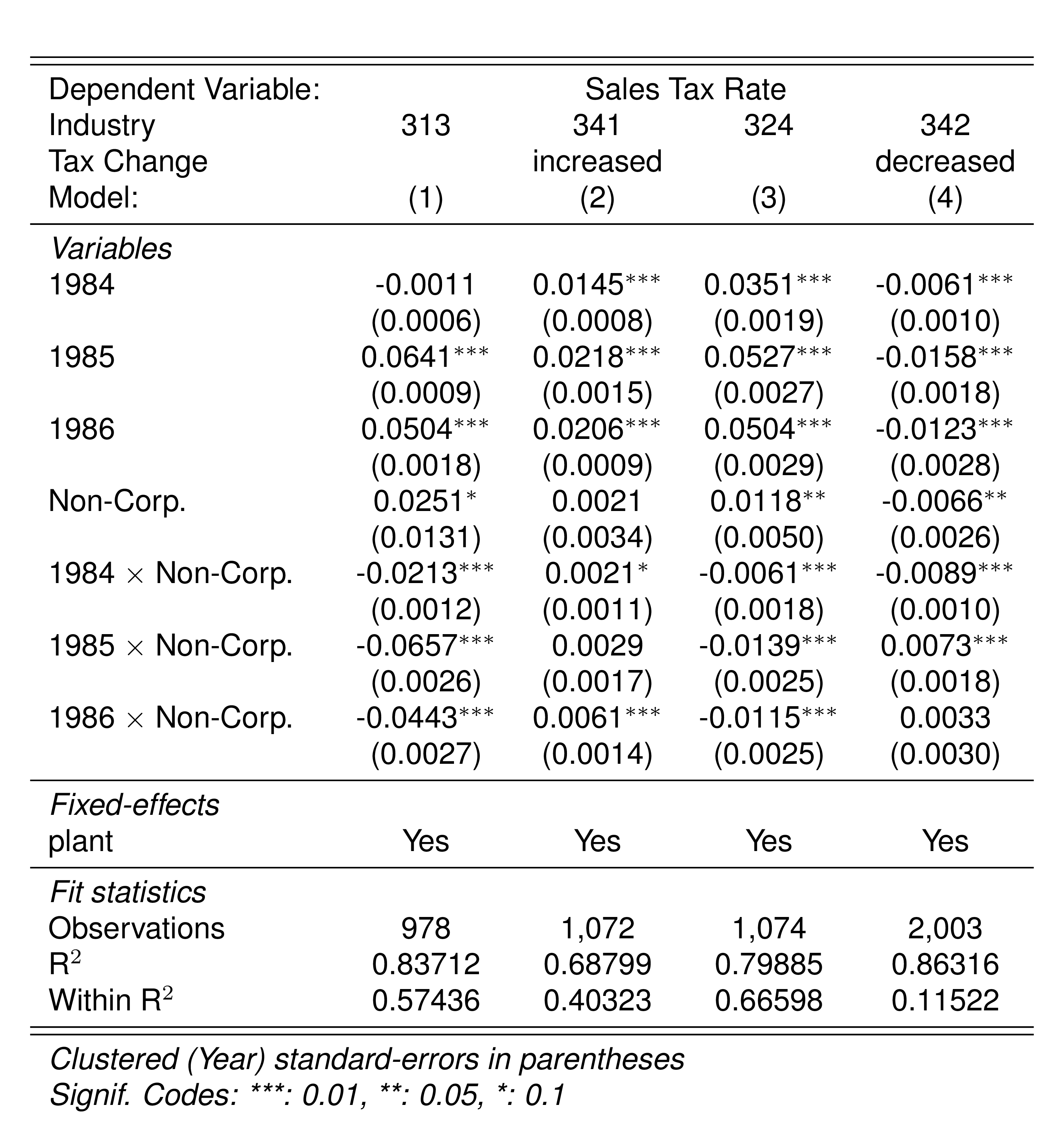

Given the fiscal reforms of 1983 and 1986 in Colombia, it is natural to think in a difference-in-difference empirical application to test if the fiscal reforms induced any change in the tax evasion behavior of the firms. We can expect that an increase in either the sales tax or corporate income tax rate would lead to higher levels of evasion.

Among other changes, the fiscal law of 1983 tried to homogenize the sales taxes of the manufacturing industry. The reform reduced from 15 to 10% for some industries; for others, it increased the sales tax from 6 to 10%. Still, some others, like the Food Products industry were exempt and certain others were not affected. See Table 3 for a description of the changes documented in Perry and Triana (1990).

The 1983 reform also adjusted the income tax rates for limited liability companies and individuals. For individuals, the income tax rate increased by 8% in most scales, while the maximum was reduced from 56 to 49%. For limited liability companies, the CIT was reduced from 10 to 18%.

To evaluate the change in tax evasion by input cost overreporting due to the change in the sales tax, I apply a triple difference approach. I use corporations in the industries exempted from sales taxes the year before the policy change as the control group.

Formally, non-corporations in industry \(k\), which might have received an increment or decrement in their sales tax rate,

\[ s_{1,j,t}^k=\lambda^k_t+\mu^k_1+e^{VAT}_{j,t}+e^{CIT}_{j,t}+\varepsilon_{jt} \]

Corporations in industry \(k\), \[ s_{0,j,t}^k=\lambda^k_t+\mu^k_0+\varepsilon_{jt} \]

Likewise, Non-corporations and Corporations in an industry exempt from sales taxes

\[ \begin{aligned} s_{1,j,t}^{E}&=\lambda^{E}_t+\mu^E_1+e^{CIT}_{j,t}+\varepsilon_{jt}\\ s_{0,j,t}^E&=\lambda^E_t+\mu^E_0+\varepsilon_{jt} \end{aligned} \]

Taking the difference between time \(t'\) and \(t\) in industry \(k\) for both, corporations and non-corporations,

\[ \begin{aligned} \mathbb{E}[s_{1,j,t'}^k]-\mathbb{E}[s_{1,j,t}^k]&=\Delta_\lambda^k+\Delta_e^{VAT}+\Delta_e^{CIT}\\ \mathbb{E}[s_{0,j,t'}^k]-\mathbb{E}[s_{0,j,t}^k]&=\Delta_\lambda^k \end{aligned} \]

The diff-in-diff method will recover the joint effect of both policy changes, \[ \mathbb{E}[s_{1,j,t'}^k]-\mathbb{E}[s_{1,j,t}^k]-\left(\mathbb{E}[s_{0,j,t'}^k]-\mathbb{E}[s_{0,j,t}^k]\right)=\Delta_e^{VAT}+\Delta_e^{CIT} \]

The joint effect might be ambiguous because an increase in the sales tax rate will increase the incentive to overreport inputs cost but a decrease in the CIT might decrease the incentive.

To recover the effect of the change in the sales tax rate, we can use the firms of the industries that are exempted from the sales tax. Intuitively, exempted firms would not react to the change in the sales tax —which is industry-specific—, but only to the CIT —which affects all industries.

So we have,

\[ \begin{aligned} \mathbb{E}[s_{1,j,t'}^k]&-\mathbb{E}[s_{1,j,t}^k]-\left(\mathbb{E}[s_{0,j,t'}^k]-\mathbb{E}[s_{0,j,t}^k]\right)\\ &- \left[\mathbb{E}[s_{1,j,t'}^{E}]-\mathbb{E}[s_{1,j,t}^{E}]-\left(\mathbb{E}[s_{0,j,t'}^{E}]-\mathbb{E}[s_{0,j,t}^{E}]\right)\right]=\Delta_e^{VAT} \end{aligned} \]

In regression form,

\[ s_{jt}=\alpha \left[ \mathbb{1}\{t=t'\}\times\mathbb{1}\{\text{treat}=\text{Non-Corp}\}\times\mathbb{1}\{k\not=E\} \right]+\beta'_ZZ_{jt}+\gamma_j+\gamma_t+\varepsilon_{jt} \]

NULL

5.1 Changes in Composition of Total Expenditure

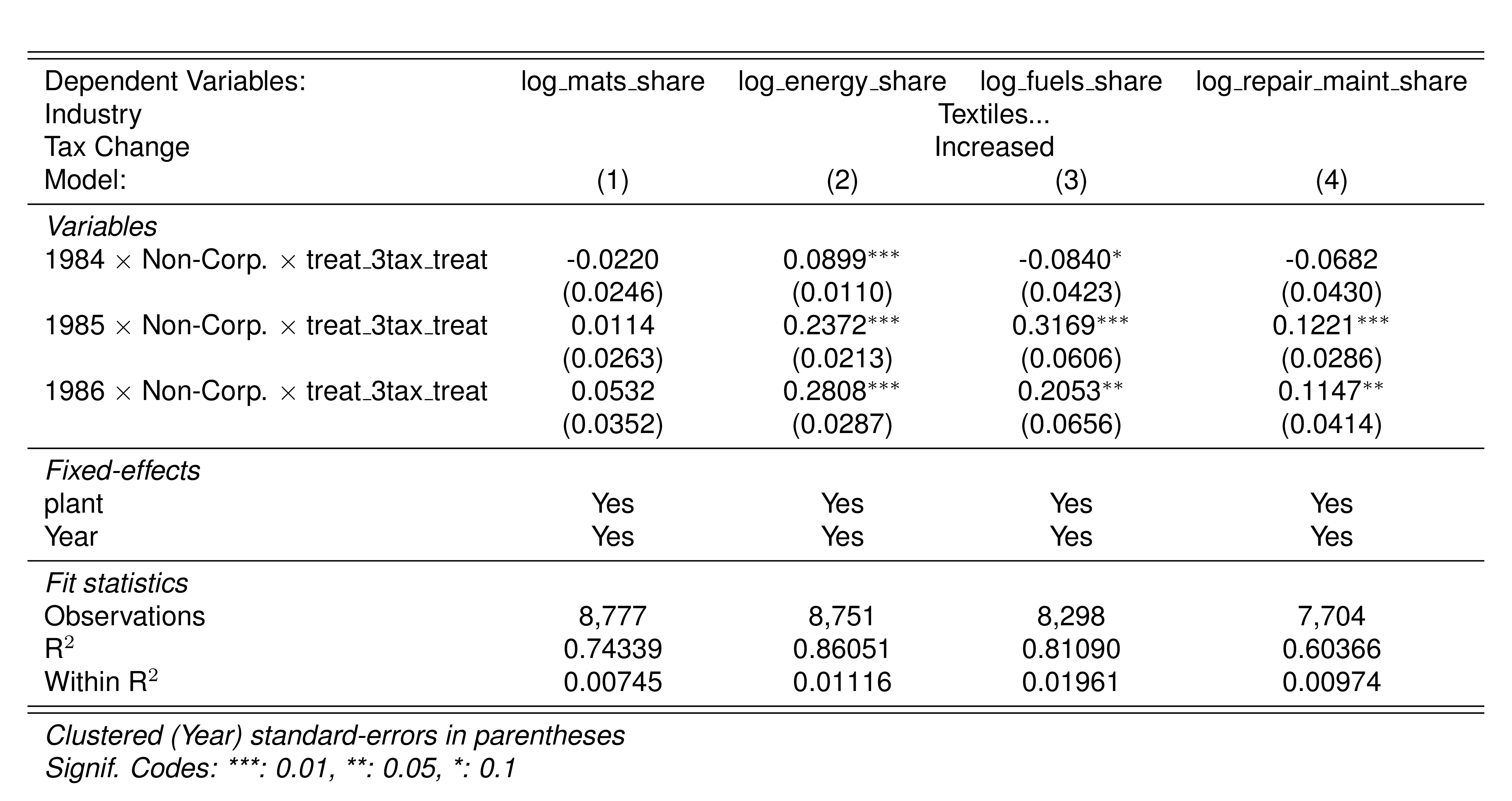

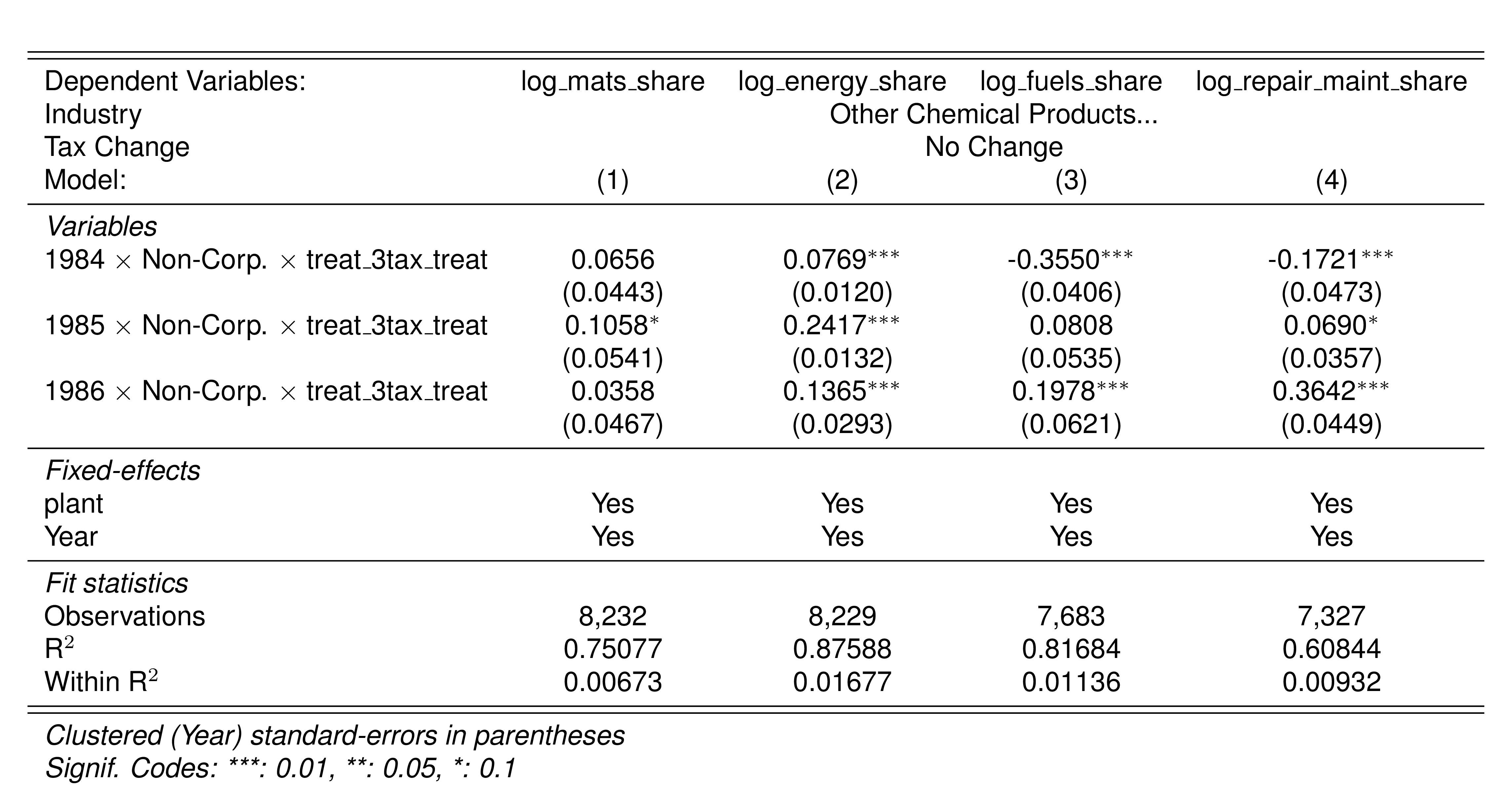

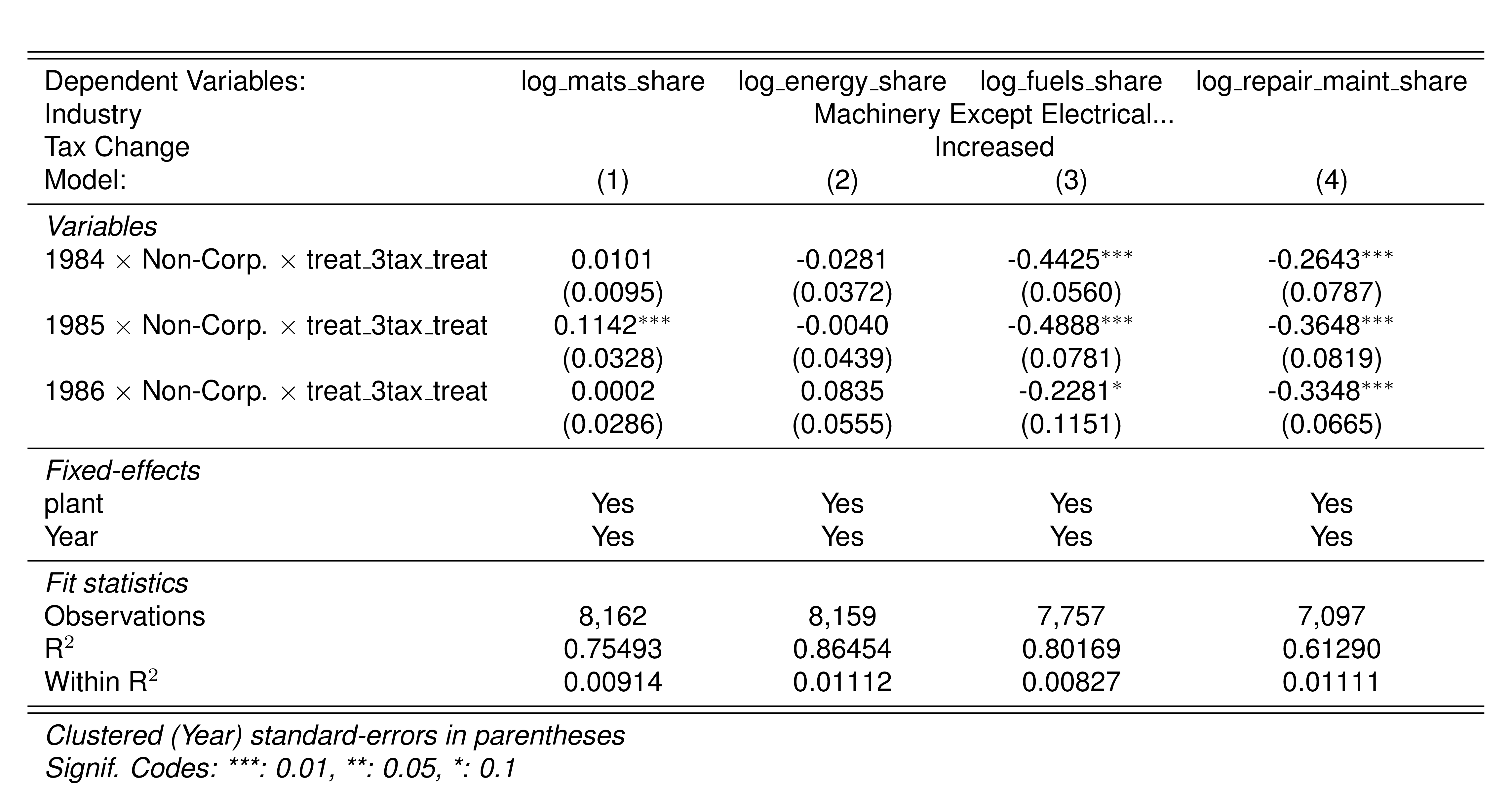

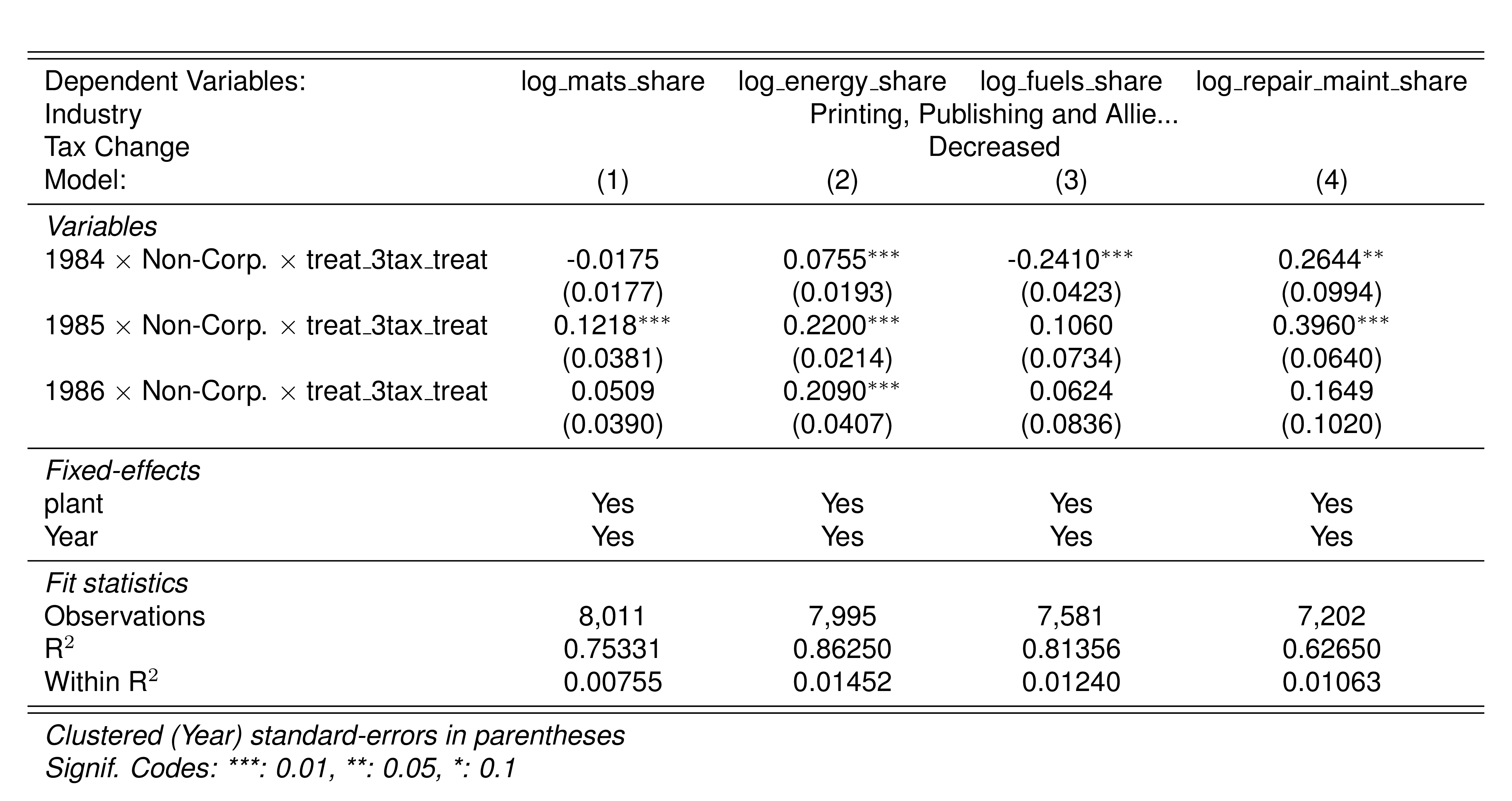

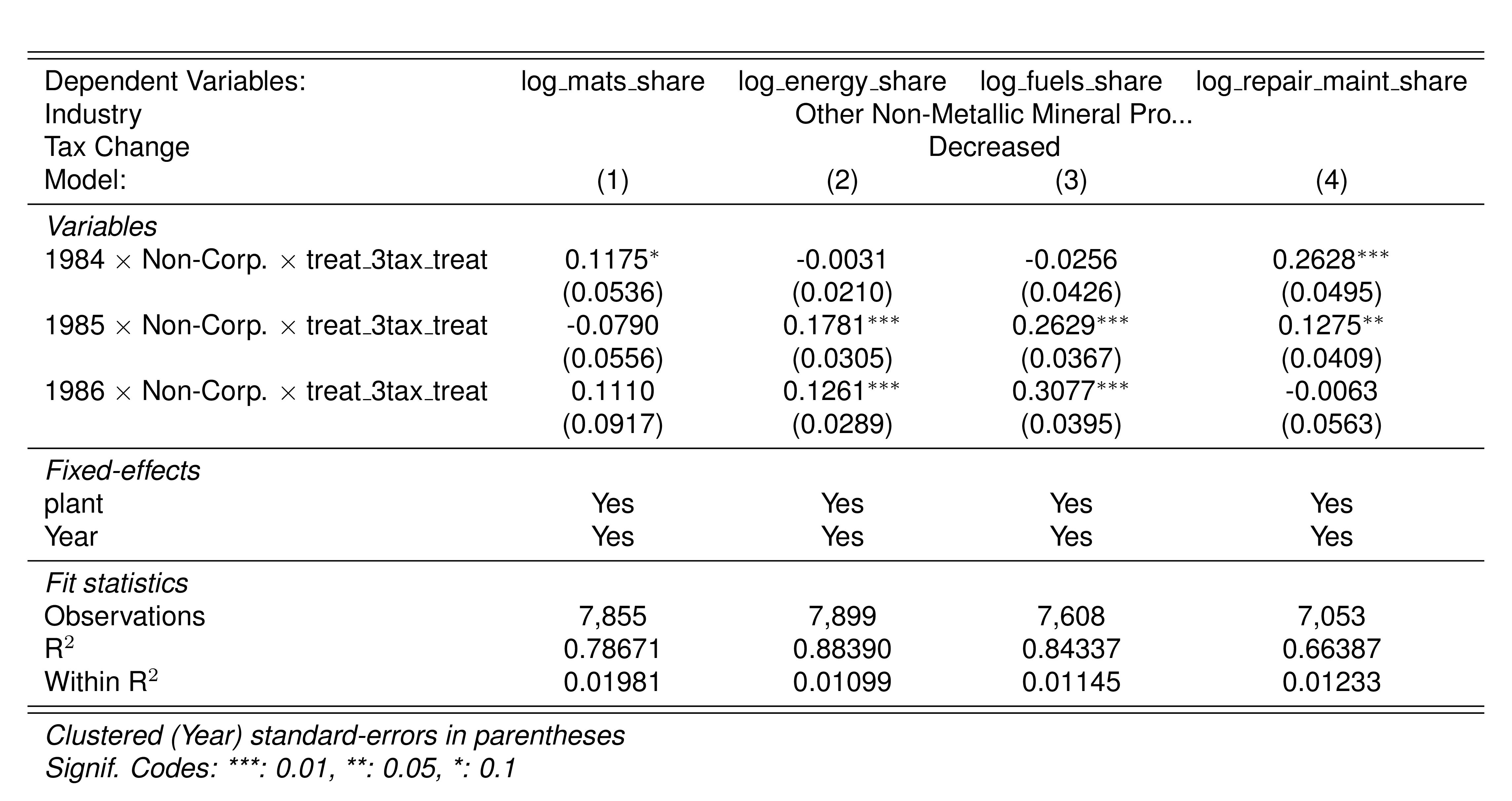

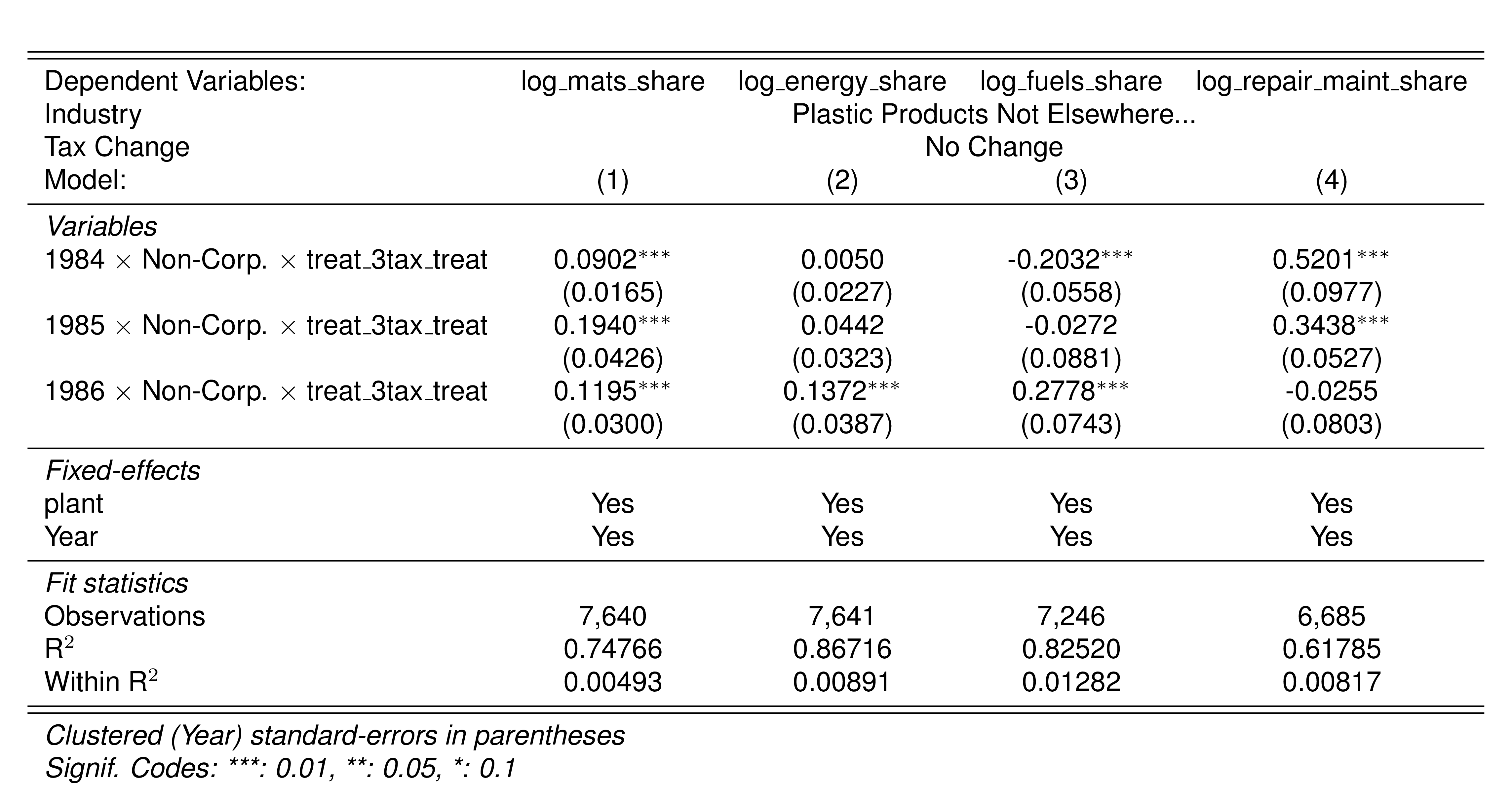

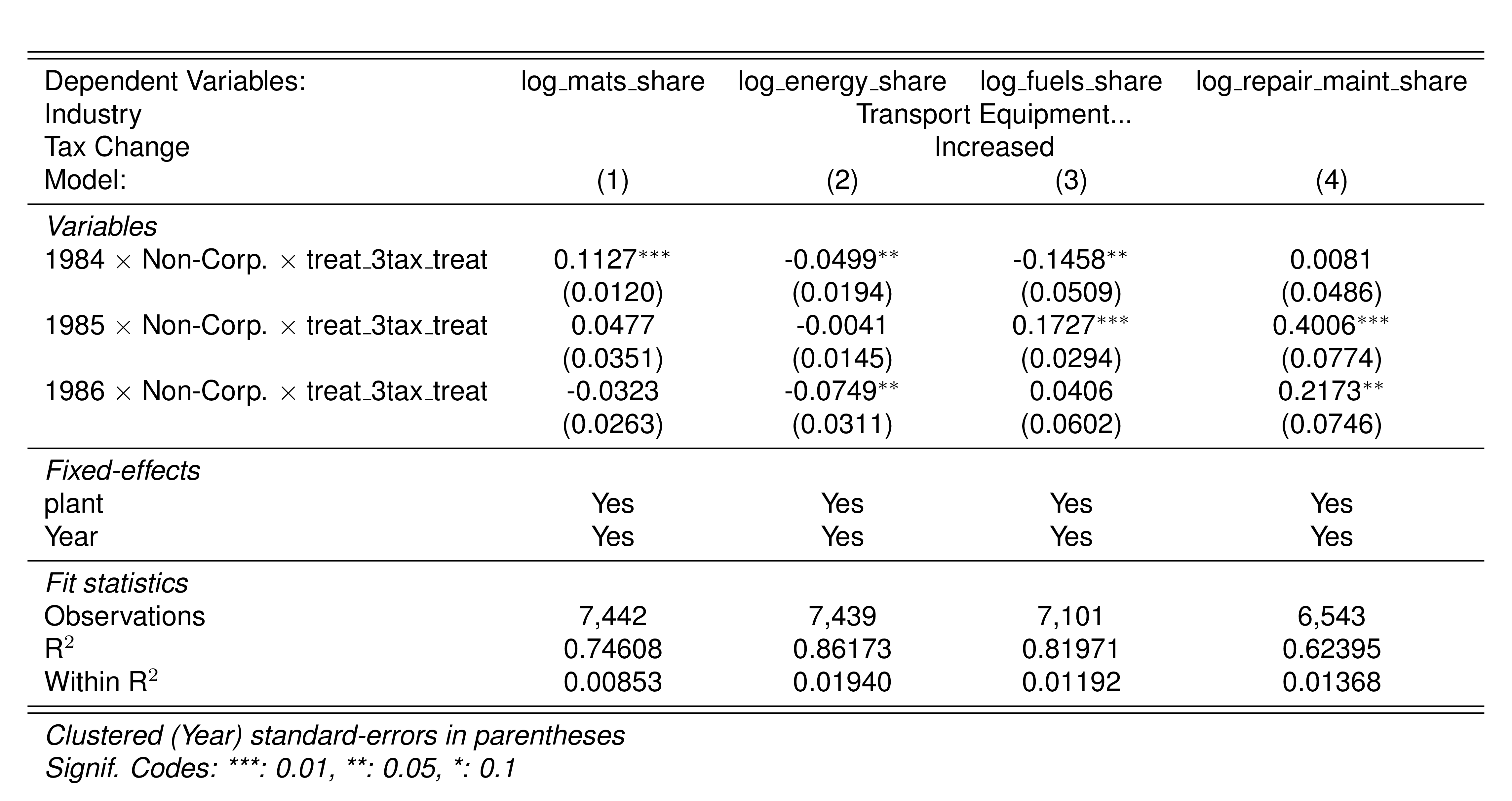

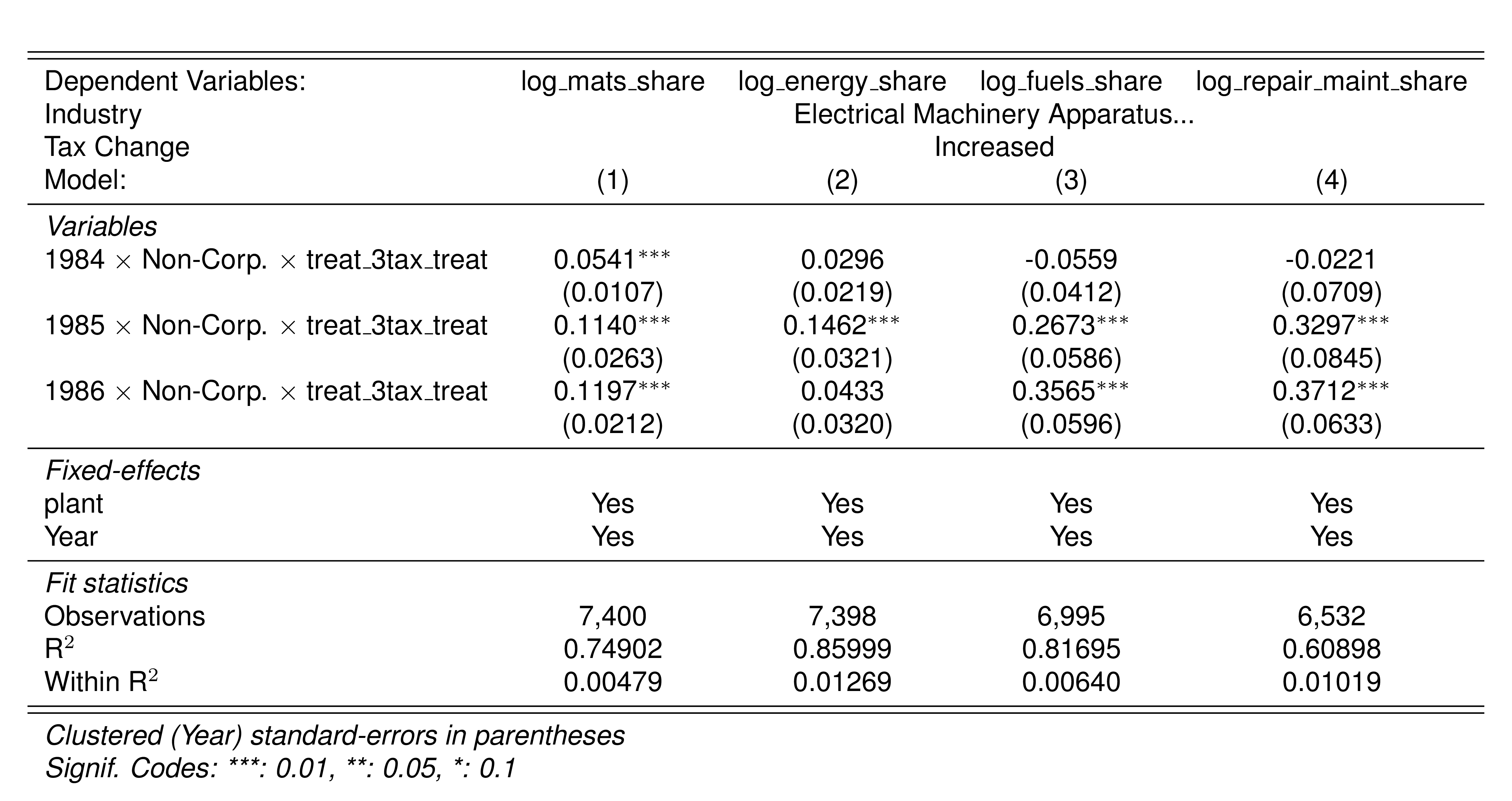

Depending on the industry, firms might be adjusting different margins, raw materials or other expenses. For example, firms in the non-metallic mineral products industry might not fake raw materials but they can adjust deductible expenses. Another example might be the textile industry. Although the available records and data might not allow for separating expenditures precisely, the evidence shows that firms are significantly adjusting these margins.

Gandhi et al. (2020) defines services as general expenditures minus machinery rental and interest payments. The Colombian survey uses industrial expenditure to calculate intermediate consumption. I identified potentially deductible expenses with information from Perry and Triana (1990).

| Expenditure | Code | Services | Industrial | Deductible |

|---|---|---|---|---|

| Purchases of accessories and replacement parts of less than one year duration | c1 | $+$ | ||

| Purchases of fuels and lubricants consumed by the establishment | c2 | $+$ | $+$ | |

| Payments for industrial work by other establishments | c3 | $+$ | ||

| Payment of domestic workers | c4 | $+$ | ||

| Payments of third parties for repairs and maintenance | c5 | $+$ | $+$ | |

| Purchases of raw materials and goods sold without transformation | c6 | $+$ | $+$ | |

| TOTAL Industrial Expenditures (c1:c6) | c7 | |||

| Rent of fixed property | c8 | $+$ | ||

| Payments for professional services | c9 | $+$ | ||

| Machinery rental | c10 | $+$ | ||

| Insurance, excl. employe benefits | c11 | $+$ | $+$ | |

| Water, mail, telephone, etc. | c12 | $+$ | $+$ | |

| Publicity and advertising | c13 | $+$ | ||

| Interest payments | c14 | |||

| Royalty payments | c15 | $+$ | ||

| Other expenditures | c16 | $+$ | ||

| TOTAL General Expenditures (c8:c16) | c17 | |||

| TOTAL Expenditure (c7+c17) |

NULL

5.2 Parallel Trends

7 Changes in Relative Prices

An alternative hypothesis is that changes in the sales taxes change the relative prices of inputs. It could be that the regressions are capturing not the changes in evasion by overreporting but the changes in relative prices.

Suppose we have two flexible inputs \(M\) and \(L\). \(M\) is deductible but \(L\) is not. Equation 2 becomes then,

\[ \begin{aligned} \max_{M_{it}, L_{it},e_{it}\in [0,\infty), } [1-q(e_{it}|\theta_{it})]&\left[P_t\mathbb{E}[Y_{it}]-\rho_{t} M_{it}-w_{t} L_{it}-\tau\left(P_t\mathbb{E}[Y_{it}]-\rho_{t} (M_{it}+e_{it})\right)\right]\\ +q(e_{it}|\theta_{it})&\left[P_t\mathbb{E}[Y_{it}]-\rho_{t} M_{it}-w_{t} L_{it}-\tau\left(P_t\mathbb{E}[Y_{it}]-\rho_{t} M_{it}\right)-\kappa(e)\right] \\ \text{s.t. }\; Y_{it}=G(M_{it},L_{it})&\exp(\omega_{it}+\varepsilon_{it}) \end{aligned} \tag{9}\]

In the case of Colombia, \(\theta\) is their juridical organization. Assume firms choose their \(\theta\) before the start of the period. I’ll come to this decision later, but for now, it follows that \(q(e|\theta)=q(e)\). In other words, firms cannot affect their detection probability when choosing inputs.

The first-order conditions now yield the following. For deductible flexible inputs, the optimality condition remains the same as Equation 6,

\[ G_M(M_{it}, L_{it})\exp(\omega_{it})\mathcal{E}=\frac{\rho_{t}}{P_t} \tag{10}\]

However, for non-deductible flexible inputs, the sales tax induces a distortion in the optimality condition.

\[ G_L(M_{it}, L_{it})\exp(\omega_{it})\mathcal{E}=\frac{w_{t}}{(1-\tau)P_t} \tag{11}\]

Finally, the optimality condition for tax evasion becomes,

\[ [1-q(e_{it})]\frac{\rho_t}{P_t}\tau-q(e_{it})\kappa'(e_{it})=q'(e_{it})\left[\frac{\rho_t}{P_t}\tau e_{it} + \kappa(e_{it})\right] \tag{12}\]

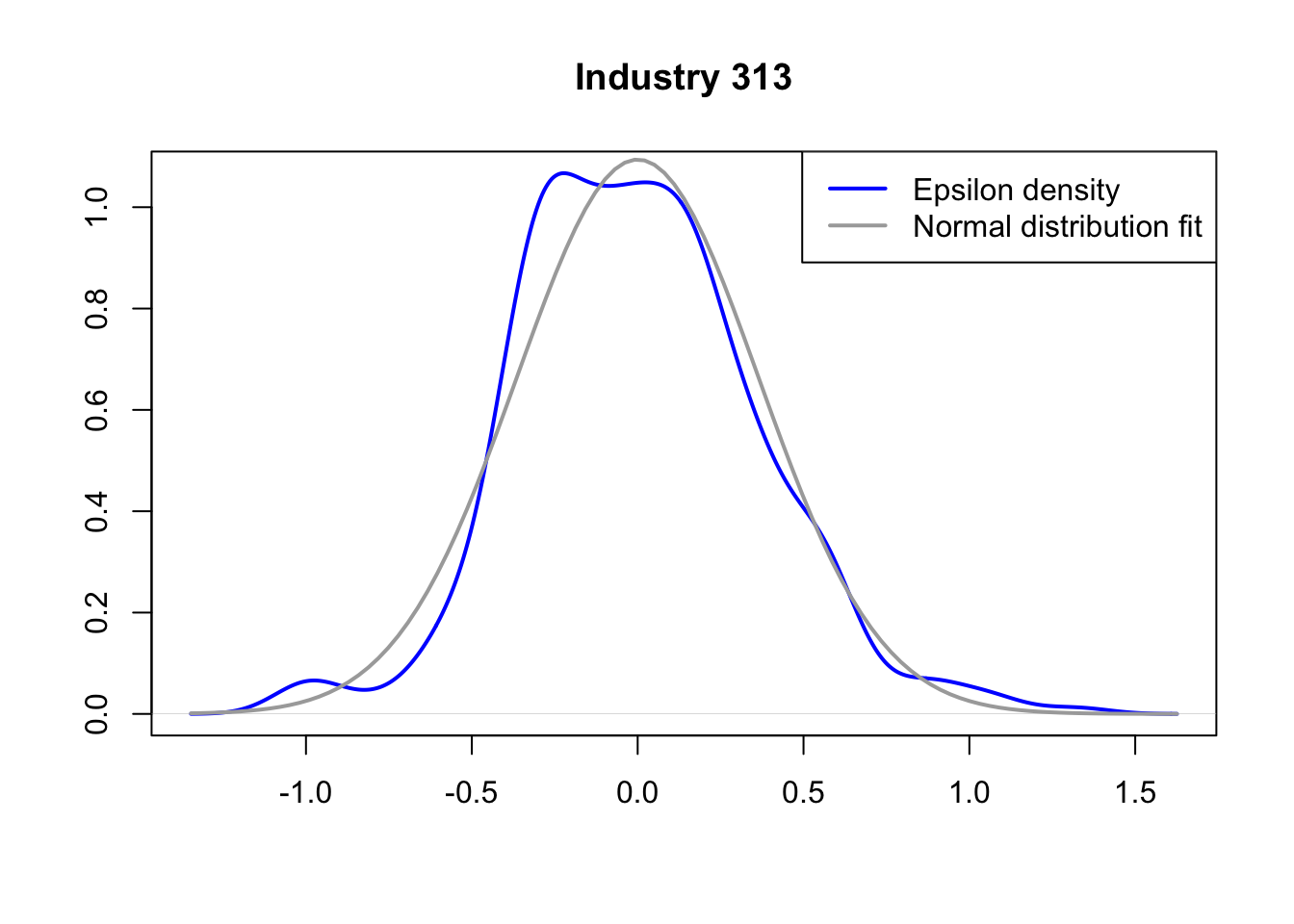

What can we conclude? First, if the production function is a Cobb-Douglas, then we can independently solve for each input. In this case, changes in VAT or CIT would not affect the optimality condition of deductible flexible inputs because it would not affect the relative prices. Therefore, changes in the consumption of deductible flexible inputs due to changes in VAT or CIT can only be explained by an increase in the incentives to evade taxes by overreporting.

On the other hand, an increase in the VAT or CIT would increase the relative prices of non-deductible flexible inputs, leading to a decrease in their consumption.

Alternatively, if non-deductible flexible inputs become deductible the distortion in the optimality condition induced by the VAT and CIT would be eliminated. Eliminating the distortion would lead to a reduction of the relative prices inducing a higher consumption of these inputs.

Second, if the production function is not Cobb-Douglas, then the firm has to solve the system of equations. Theoretically, the changes in the relative prices of the non-deductible flexible inputs might affect the consumption of the deductible flexible inputs depending on whether these inputs are complements or substitutes.

Empirically, however, if I can observe deductible inputs separately from non-deductible inputs, I can still be able to run the share regression to recover the input elasticity of output. The observed consumed non-deductible inputs will capture the changes in relative prices.

If I want to run the share regression using the non-deductible flexible inputs, I have to be careful to account for the distortion induced by the changes in taxes. If I observe the sales taxes, I can still be able to control for changes in sales taxes and run this regression.

Theoretically, we would have,

\[ \begin{aligned} \ln\left(\frac{\rho_{t}M_{it}}{P_tY_{it}}\right)&=\ln D^{\mathcal{E}}_M(M_{it}, L_{it})-\varepsilon_{it} \\ \ln\left(\frac{w_{t}L_{it}}{(1-\tau)P_tY_{it}}\right)&=\ln D^{\mathcal{E}}_L(M_{it}, L_{it})-\varepsilon_{it} \end{aligned} \]

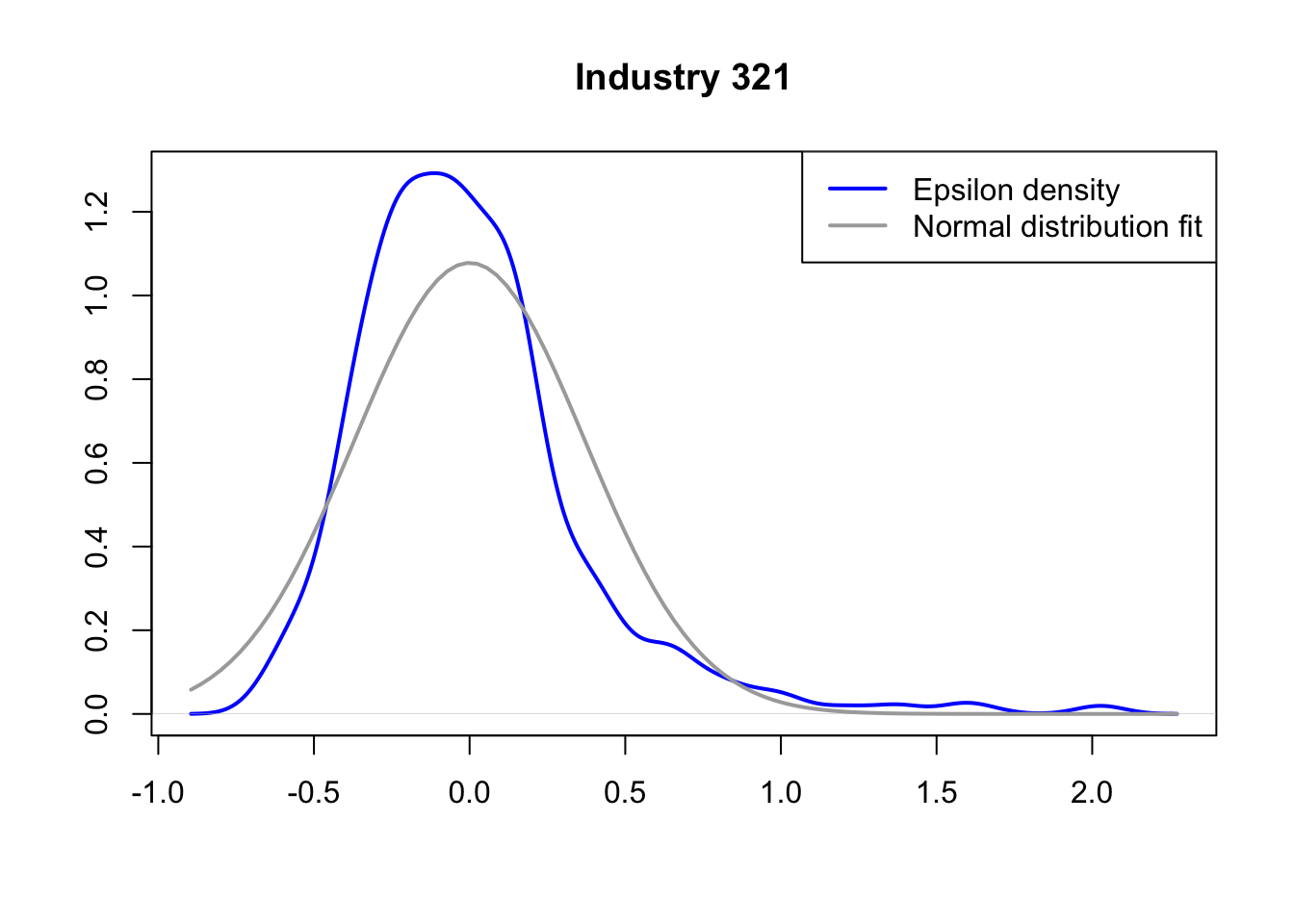

Note that while we can use the gross revenue of sales for deductible flexible inputs, we would have to use the net of tax sales revenues for non-deductible flexible inputs.

More imporantly, note that the practicioner observes only \(\ln M^*=\ln M+e\) but not \(M\). In section Section 11, I show how to recover these functions.

8 Do Corporations in Colombia have different technologies than other juridical organizations?

An implicit assumption in the identification strategy is that the subset of non-evaders has the same common technology as evaders. In the case of Colombia, this implies that Corporations have the same common technology as Proprietorships, Limited Companies, and Partnerships. However, we can think that firms with better technology are self-selecting into corporations, and thus, firms with low-performance technology will be mislabeled as evaders.

The key question is how firms are choosing their juridical organization, and in particular, how firms are choosing to become corporations. I argue that choosing the juridical organization is a result of the capital needs of the firm and it is affected by the preferences of the owners over their corporate liability and their social connections.

From the definitions of the juridical organizations, we can expect corporations to be the largests in terms of capital, followed by LLCs and Partnerships, and Proprietorships to be smallest. The reason is simply that more people can participate by contributing their capital to the firm. This ordering in turn would suggest a growth path for the firms.

Turning to the data, I find some firms change their juridical organization type. I build a juridical organization transition matrix from the previous year to the next one at the firm level. Table 13 shows the transition matrix. Although the transition matrix suggests that firms mostly stay in their juridical organization, a growth trend emerges. It looks like proprietorships turn into LLCs, and LLCs into Corporations.

| Proprietorship | Partnership | Ltd. Co. | Corporation | Total | |

|---|---|---|---|---|---|

| Proprietorship | 94.8 | 0.7 | 4.5 | 0.1 | 4404 |

| Partnership | 0.5 | 92.7 | 5.6 | 1.3 | 1241 |

| Ltd. Co. | 0.2 | 0.1 | 98.6 | 1.0 | 22154 |

| Corporation | 0.0 | 0.1 | 0.5 | 99.4 | 7805 |

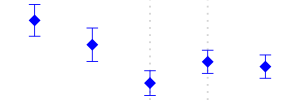

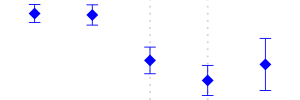

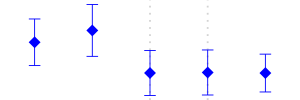

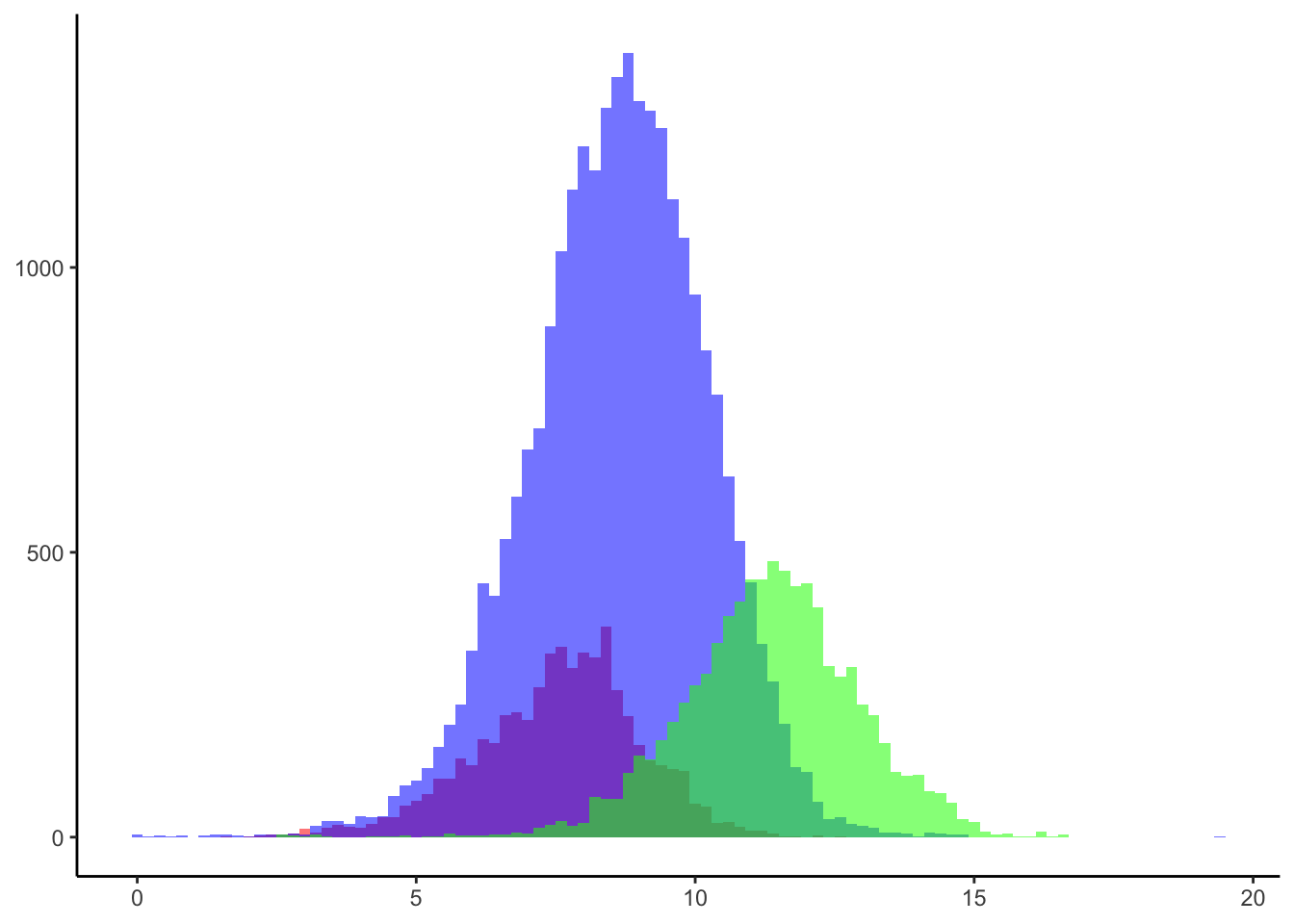

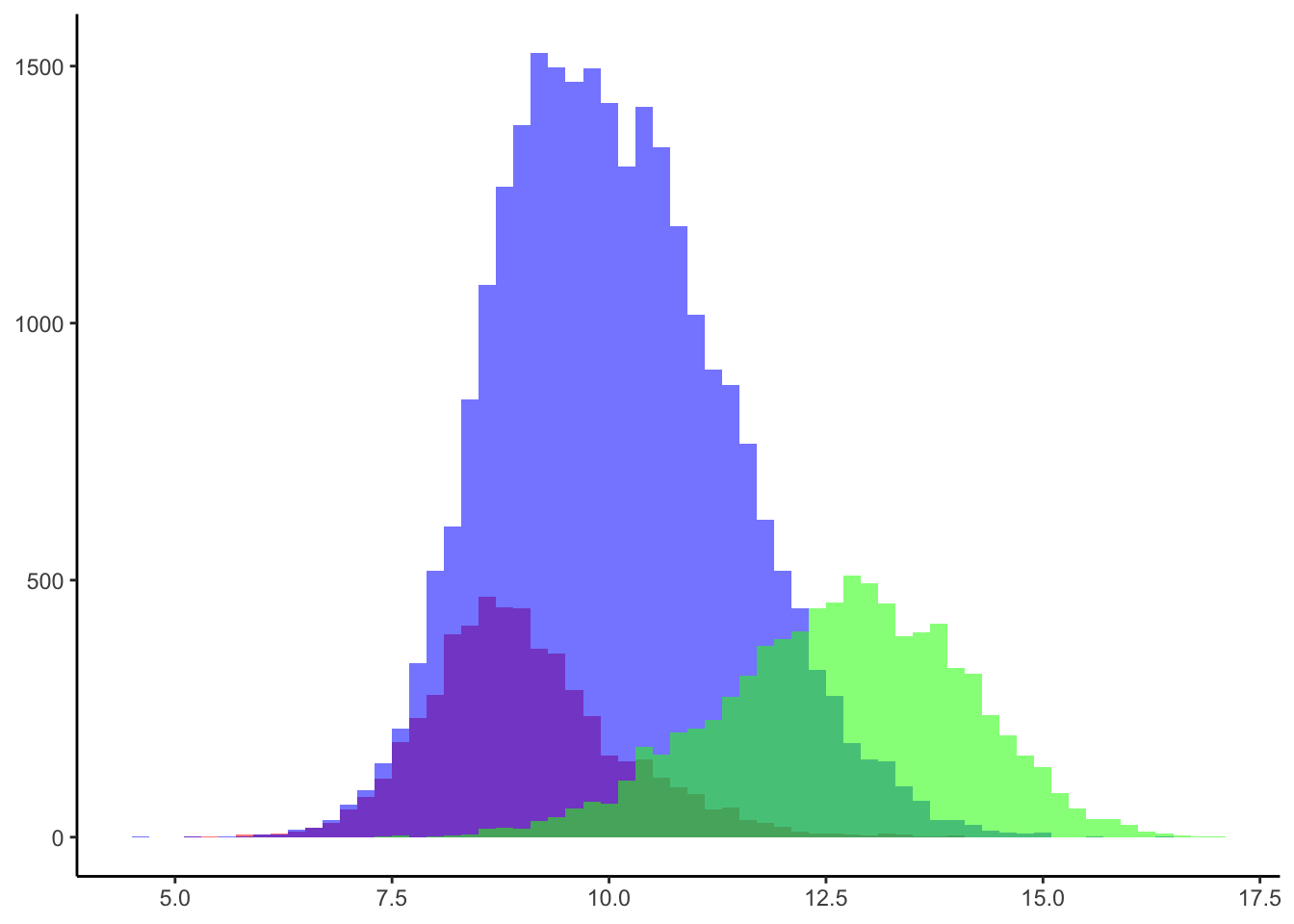

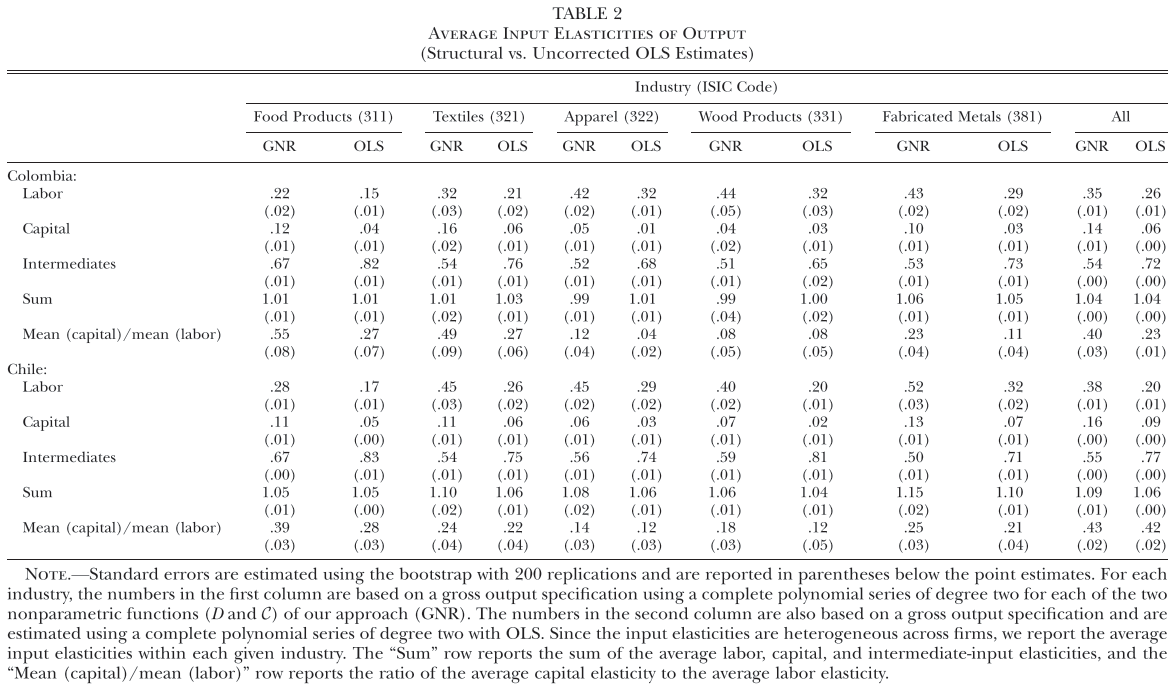

Looking into the capital distributions of proprietorships, LLCs, and corporations we find that corporations are the largest, followed by LLCs, and proprietorships are the smallest Figure 5 (a). However, there are considerable overlaps. The same is true for revenues (in logs) Figure 5 (b). This is not surprising, as the need for larger capital increases, the more people would need to participate.

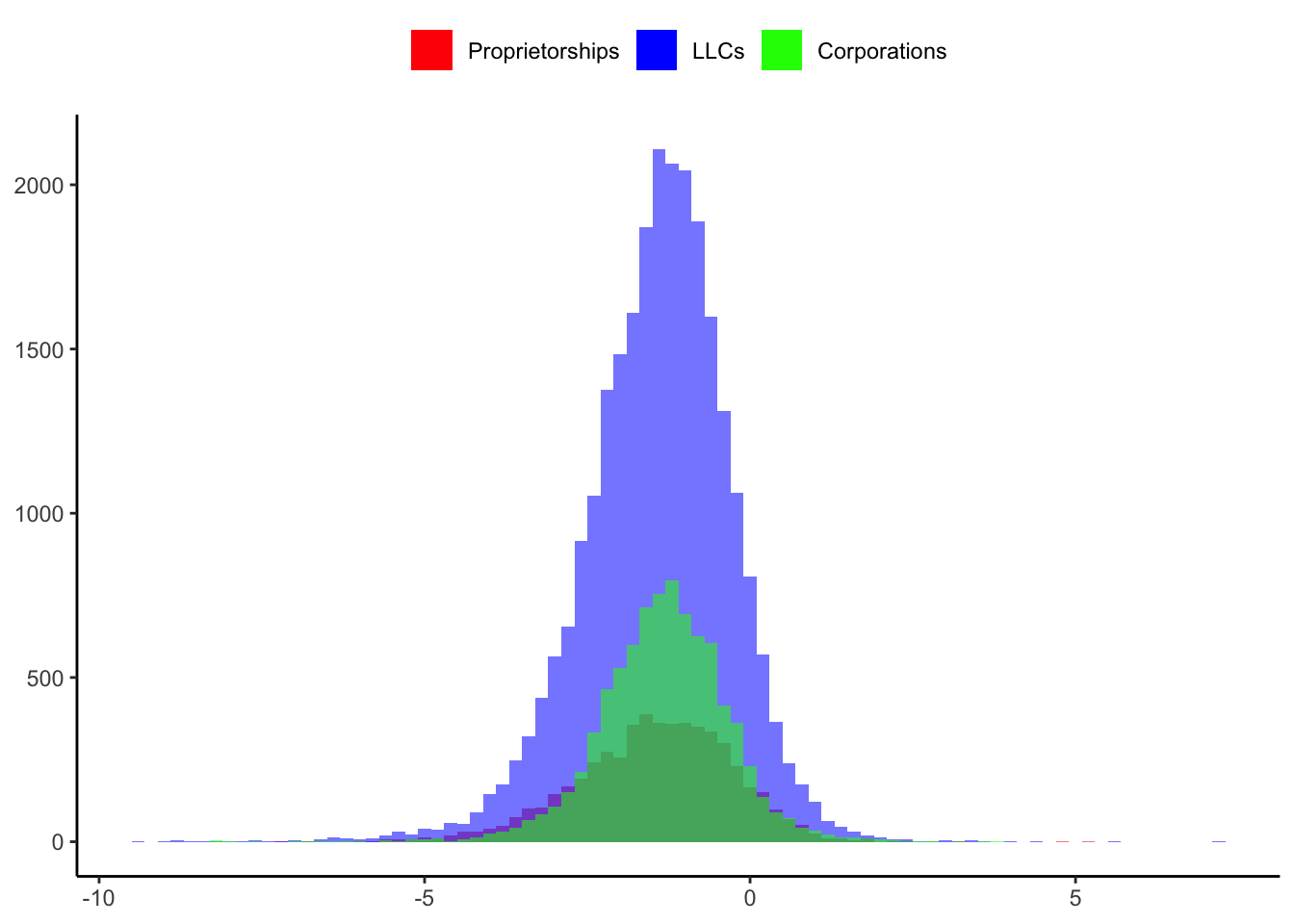

However, when we look at the frequency distributions of the capital over revenue ratio in logs, the distributions perfectly overlap Figure 5 (c). If corporations had different technologies we would expect to see two different distributions. In particular, the distribution of corporations would have been farther to the right than the distributions of proprietorships and LLCs.

These patterns remain even after controlling for industry, metropolitan area, and year Table 14.

8.0.1 Model of firm (capital) growth (sketch)

A limited liability company looking to acquire more capital had three options.

First, partners can increase their capital participation, using personal wealth or through a bank credit. This option however will increase the partners’ liability. The more capital I bring the greater my liability is.

Second, the LLC might increase its capital by inviting additional partners. As the firm increases its capital, inviting more partners will become more difficult. The funding partners risk losing control of their firm, as more people participate in the firm’s management and decision-making.

Third, the firm can incorporate. This will bring capital to the firm. Anyone in the market for the shares of the firm can participate. Shares can be traded. A CEO reporting to the shareholders might be appointed. Liability is limited to shares.

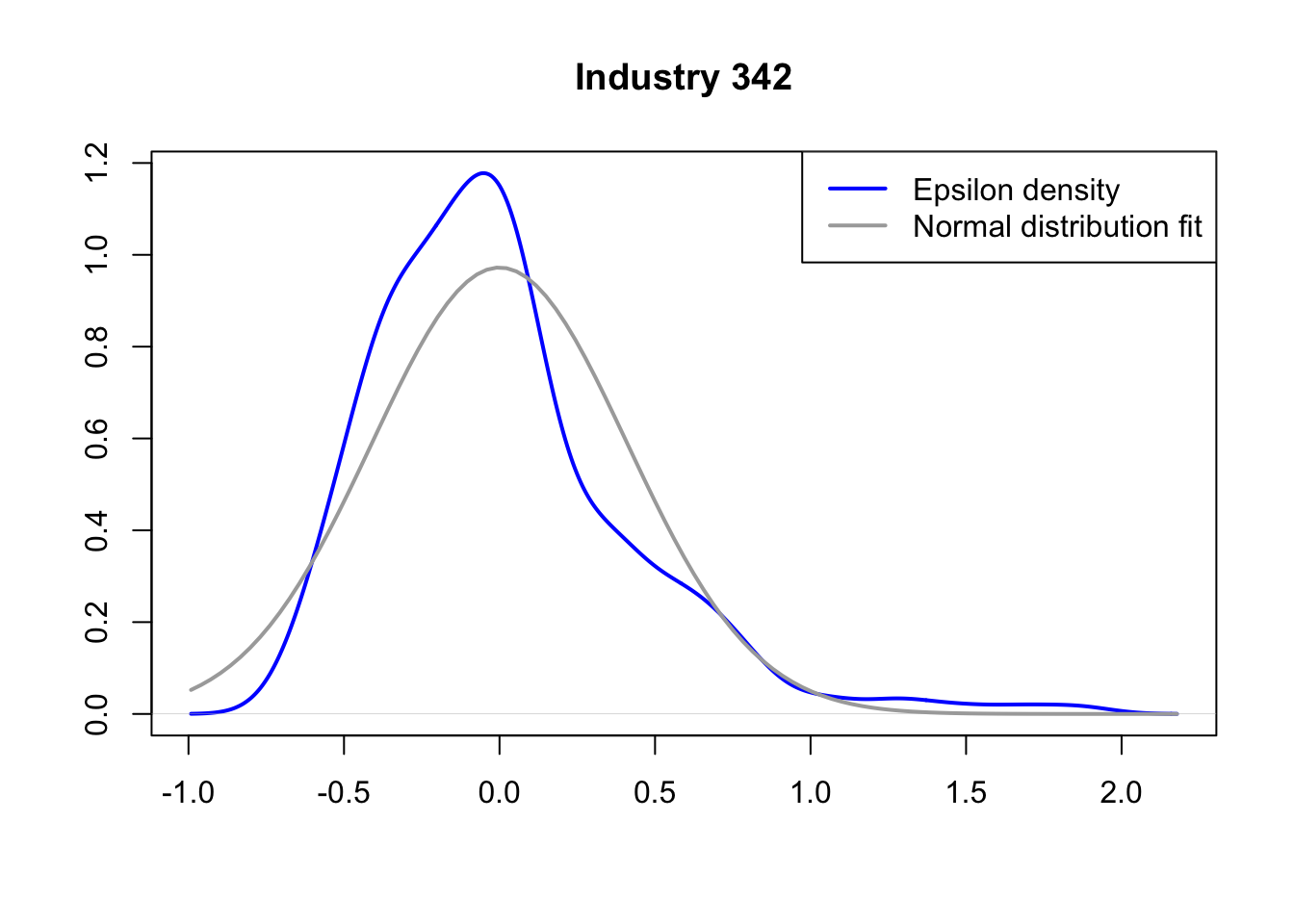

The decision to incorporate is a decision on how to acquire capital. Firms still need to consider the stream of future productivity shocks, but the decision also depends on other unobservables such as risk-aversion (increasing the partners’ liability), the partners’ ability to convince more partners to join the LLC, and preferences over the control of the firm’s management.

Assume there’s an unobserved scalar \(\zeta_i\) that captures all of the owners’ heterogeneity in preferences over liability risk, access to networks of potential investors, and preferences over the control of the firm’s management. Let a higher value of \(\zeta\) capture less risk aversion, a wider network of potential investors, or a higher preference for retaining control over the firm. Consider the case in which two LLCs firms are looking to optimally increase their capital by the same quantity, but the owners are different in \(\zeta\). In particular, let the owner of firm 1 have a higher \(\zeta_1>\zeta_2\) than the owner of firm 2. The firms also have the same technology and productivity shocks. The owner of firm 1 \(\zeta_1\) would be able to convince additional investors to join their LLC, but the owner 2 \(\zeta_2\) would not. \(\zeta_2\) owner would have to choose to incorporate to get the capital for his firm or forgo growth.

The 20 pp difference in CIT rate between LLCs and Corporations might have deterred firm growth. The CIT was homogenized to 30% in 1986. What was the capital misallocation due to the tax rate differential? Are more firms incorporating after the reform?

8.0.2 Evasion vs. Production Technology

Production technology is industry-specific, but evasion technology is the same across industries.

Take the face value of the regressions and assume, without conceding, that corporations have different technologies. This will imply that corporations have technologies that are consistently 15% more productive than non-corporations regardless of the industry. In other words, it does not matter if the firms produce canned food, shoes or furniture, corporations have technologies consistently more productive. However, this is difficult to believe because there could be industries in which such an improvement in technology is difficult to imagine. For example, coffee grain mills (food products), steel foundries (steel basic products), plastic molding and extrusion (plastic products), or cement (non-metallic mineral products).

However, these cross-sectional differences across industries could be better explained by the evasion technology. We would expect the evasion technology to be the same across industries. It does not matter what I produce and what technology my firm employs, to overreport inputs all that is needed is a fake invoice.

9 Intermediate Inputs

What are intermediate inputs? Intermediate inputs are flexible and in our case firms should have incentives to overreport them. Raw materials, electricity, fuels, and services are what researchers have in mind when they refer to intermediates. In the context of tax evasion in Colombia, materials are the input of interest for several reasons.

| Study | Intermediates |

|---|---|

| Levinsohn and Petrin (2003) | Materials, Electricity, and Fuels |

| Gandhi, Navarro, & Rivers (2020) | Materials, Energy (Electricity and Fuels), and Services |

First, firms have incentives to overreport production expenses to evade CIT, but only VAT deductible intermediates reduce their VAT burden. In fact, Colombia used system of refunds to companies with VAT tax balances in their favor. Raw materials are VAT deductible during the whole period of out data, 1981-1991. In addition, materials are the greater share of the firm’s expenses among the other intermediate inputs.

Electricity was mainly provided by government companies during this period. Even though there were private participation in the market, the data shows that corporations sold most of the private electricity. In our paper, we argue that Corporations are the firms with the lowest incentives to misreport their commercial activity. Therefore, it could have been relatively riskier to fake an electric bill than other inputs. Why? Because any electricity bill not coming from a Corporation or a Government company might look suspicious. In addition, it is unclear that firms could deduct from their taxes their electric bill. Finally, electricity is a small share of the firm’s expenses in the data.

Fuels consumed in production were deductible however these represent a non-significant share of the firms’ expenses.

Finally, only repair and maintenance services were taxed from the beginning during this period. The authority gradually introduced services they could control easily like telephone and telecommunication, insurances, airline tickets, and parking, among others. The rest of the services look more like fixed costs and not like intermediate inputs for production, or at least they do not necessarily increase with production. Take for instance, telephone bills. They might increase if an increase of output comes from handling more clients, but they might keep the same and production might increase if current clients increase their volume of demanded products.

10 Industries

Given that I’ll focus on materials, the industries I pick would have to make sense. Meaning, that firms should have nontrivial incentives to overreport raw materials to evade taxes and raw materials should represent a nontrivial share of their total production expenses.

To start, unprocessed primary goods such as mining, agricultural, fishing, and forestry were exempt of sales taxes. If the main raw materials of an industry is a primary good, then firms in that industry would have no incentive to overreport their raw materials because they are not paying sales taxes on their raw material that could be credited towards the taxes they have to pay for their sales. Industries like concrete and clay used in construction (369-Non-Metallic Minerals) and leather products (323-Leather tanning and dyeing, Fur skins) might fall into this category.

For other industries, few specialized suppliers provide their main raw materials. These firms might have to import a non-trivial share of their materials. It would be highly suspicious to fake invoices for raw materials that come from few known local and international suppliers. For example, plastic pellets the main raw material in injection molding and plastic products (356) are supplied internationally by a handful of suppliers located in the US and Europe.

Likewise, industries exempt of sales tax would have relative lower incentives to evade than non-exempt. In Colombia, firms producing foodstuffs (311 and 312), drugs, textbooks, transportation equipment (384), agricultural machinery (382-Non-Electrical Machinery including Farm Machinery), and equipment (383-Electrical Equipment) were exempt of sales taxes since 1974. Exemption to Agricultural machinery and transportation equipment was eliminated in 1984. Almost half-way through the data.

(In addition, exporters were exempted from sales taxes. )

Lastly, it would be better to avoid industries selling a significant share of their output directly to consumers and retailers. Tax evasion through underreporting of sales severely affected Colombia during this time (Perry and Triana 1990). It has been documented elsewhere that revenue underreporting is most significant for firms selling directly consumers. Why? Firms might offer consumers a discount if they do not request an invoice. Since the consumer is the final payer of the sales tax, they are more like to cooperate. On the other hand, firms selling to other firms face counterincentives. The firm buying the product is interested in having an invoice to report the sales tax pay to reduce the balance of the sales tax they collect when selling. In addition, during this period there was a tendency to create fictitious distributors to reduce the tax base.

A report based on a sample from that period in Perry and Triana (1990) reveals that industries 322 (Wearing Apparel — 67.5%), 324 (Footwear — 49%), 342 (Publishing — 53.9%), 369 (Non-Metallic — 50%), and 390 (Other Manufacturing — 61.3%) sell half or more of their output to retailers and directly to consumers.

| SIC | Total no. of firms | % to retailers | % to public | % retailers and public combined | % government | % wholesalers |

|---|---|---|---|---|---|---|

| 312 | 25 | 24.16 | 15.72 | 39.88 | 1.20 | 58.92 |

| 313 | 3 | - | 29.33 | 29.33 | 0 | 70.67 |

| 321 | 8 | 15.06 | 0.11 | 15.17 | 1.17 | 83.67 |

| 322 | 2 | 52.92 | 14.58 | 67.50 | 0 | 32.50 |

| 324 | 5 | 45.00 | 4.00 | 49.00 | 0 | 51.00 |

| 332 | 8 | 10.85 | 20.15 | 31.00 | 5.92 | 63.08 |

| 341 | 6 | 5.00 | 0 | 5.00 | 0 | 95.00 |

| 342 | 9 | 19.44 | 34.44 | 53.89 | 7.22 | 38.89 |

| 351 | 5 | 15.20 | 6.00 | 21.20 | 2.80 | 76.00 |

| 352 | 8 | 37.81 | 5.50 | 43.31 | 4.47 | 52.22 |

| 353 | 3 | 5.67 | 5.00 | 10.67 | 0 | 89.33 |

| 355 | 5 | 21.00 | 0 | 21.00 | 0 | 79.00 |

| 362 | 1 | 10.00 | 0 | 10.00 | 0 | 90.00 |

| 369 | 8 | 21.25 | 28.75 | 50.00 | 12.88 | 37.13 |

| 372 | 3 | 10.00 | 0 | 10.00 | 1.67 | 88.33 |

| 381 | 22 | 12.41 | 14.73 | 27.14 | 2.50 | 70.36 |

| 382 | 20 | 11.20 | 30.00 | 41.20 | 9.00 | 49.80 |

| 383 | 15 | 13.87 | 7.13 | 21.00 | 9.07 | 69.93 |

| 384 | 7 | 0 | 34.57 | 34.57 | 0 | 65.43 |

| 390 | 3 | 58.00 | 3.33 | 61.33 | 3.33 | 35.33 |

| 356 | 11 | 15.55 | 6.00 | 21.55 | 3.18 | 75.27 |

11 Identification Strategy

Because the firms’ optimization decisions depend on the fiscal environment, the identification strategy should be motivated by the fiscal environment \(\Gamma\). In particular, the identification strategy will be as good as how well we can tell apart a subset of firms that have the highest incentive to not evade. For example, in the case of Spain, the firms above the revenue LTU threshold. In the case of Colombia, the corporations.

For those firms, then \(\mathbb{E}[e_{it}|\theta_i\in\Theta^{NE}]=0\)

In addition, I impose the following timing assumption.

Assumption 11.2 implies that input overreporting is independent of the current period output shock, \(e_{it} \perp \varepsilon_{it}\). In the literature is not rare to assume that the output shock is not part of the information set of the firms, \(\varepsilon_{it}\not\in \mathcal{I}_t\) (Gandhi et al. 2020). Timing and information set assumptions are not uncommon for identification strategies in production functions and demand estimation (Ackerberg et al. 2021; Ackerberg 2019).

11.1 Identifying the production function parameters

Assume the production function is Cobb-Douglas, \(G(M_{it}, K_{it}, L_{it})\exp(\omega_{it}+\varepsilon_{it})=M^{\beta}_{it}K_{it}^{\alpha_K}L_{it}^{\alpha_L}\exp(\omega_{it}+\varepsilon_{it})\).

The econometrician observes output, capital, labor, and prices of intermedite inputs and output \(\{Y_{it},K_{it},L_{it},\rho_t, P_t\}\), but she only observes overreported intermediate inputs, \(M^*_{it}=M_{it}\exp(e_{it})\)4.

Then, for the case of Colombia, equation 6 applies since the type of firms is the juridical organization and the non-evaders are Corporations. By multiplying both sides by the intermediate inputs and dividing by the output, we get

\[ \begin{aligned} \ln\left(\frac{\rho_t M_{it}}{P_{t}Y_{it}}\right) &=\ln\beta + \ln \mathcal{E}- \varepsilon_{it} \\ &\equiv \ln D^{\mathcal{E}}- \varepsilon_{it} \\ &\\ \ln(M^*_{it})&=\ln(M_{it})+e_{it} \\ &\\ \ln\left(\frac{\rho_t M^*_{it}}{P_{t}Y_{it}}\right) &=\ln\beta + \ln \mathcal{E}- \varepsilon_{it}+e_{it} \\ \end{aligned} \tag{13}\]

where, \(\mathcal{E}\equiv \mathbb{E}[\exp(\varepsilon_{it})|\mathcal{I}_{it}]=\mathbb{E}[\exp(\varepsilon_{it})]\).

We can use Equation 13 and assumption 11.1 to recover the production function parameter \(\beta\)

\[ \mathbb{E}\left[\ln\left(\frac{\rho_t M^*_{it}}{P_{t}Y_{it}}\right)\Bigg| \Theta^{NE}\right]=\ln D^{\mathcal{E}} \tag{14}\]

The constant \(\mathcal{E}\) is also identified (Gandhi et al. 2020),

\[ \mathcal{E}=\mathbb{E}\left[\exp\left(\ln D^{\mathcal{E}}- \ln\left(\frac{\rho_t M^*_{it}}{P_{t}Y_{it}}\right)\right)|\theta^{NE}\right]=\mathbb{E}\left[\exp(\varepsilon_{it})|\theta^{NE}\right]=\mathbb{E}[\exp(\varepsilon_{it})] \tag{15}\]

and, thus, the output elasticity of input, \(\beta\), is also identified,

\[ \beta=\exp\left(\ln D^{\mathcal{E}}-\ln\mathcal{E}\right). \tag{16}\]

11.2 Identifying Tax Evasion

Having recovered both the flexible input elasticity, \(\beta\), and the constant \(\mathcal{E}\), for all firms, I can form the following variable using observed data.

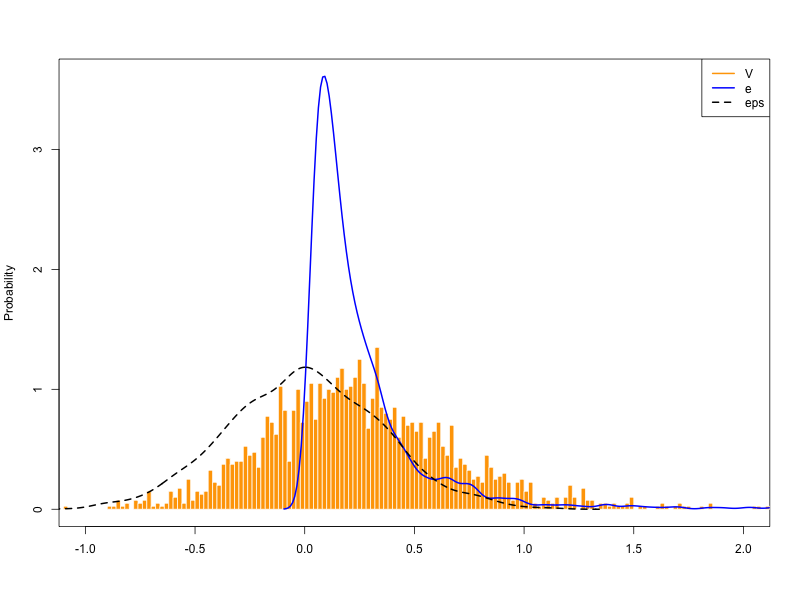

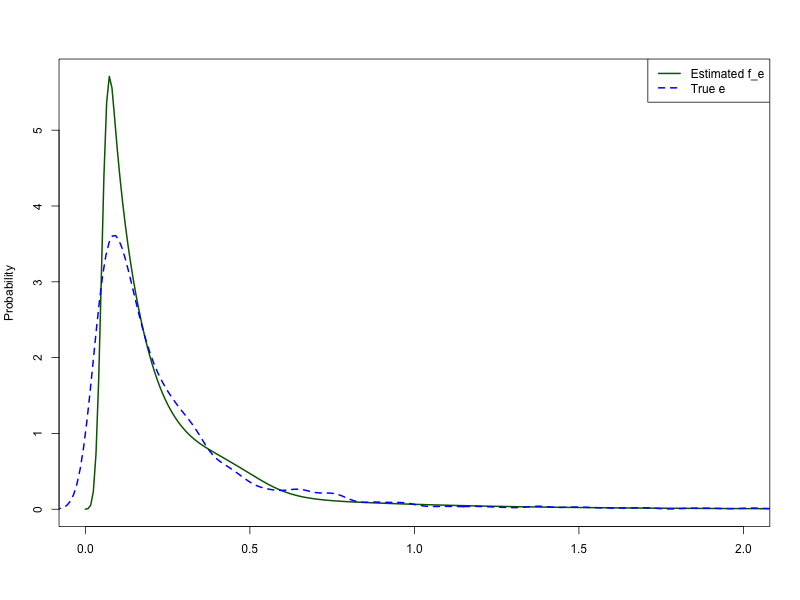

\[ \begin{aligned} \mathcal V_{it}\equiv&\ln\left(\frac{\rho_t M^*_{it}}{P_{t}Y_{it}}\right)-\ln\beta -\ln\mathcal{E}\notag \\ &=-\varepsilon_{it} +e_{it} \end{aligned} \tag{17}\]

Tax evasion therefore can be recovered up to an independent random variable. We can do better however. By assumption 11.2, the tax evasion, \(\varepsilon_{it}\) ,is independent of \(e_{it}\). Note that, from Equation 13, we also recovered \(f_{\varepsilon}(\varepsilon)\) the distribution of \(\varepsilon\). By using deconvolution methods, I can recover the tax evasion apart from the output shock.

In particular, from probability theory,

Definition 1

11.3 Identifying Productivity

Here, I show how to recover the rest of the parameters of the production function, including productivity and its Markov process. We can do it in several ways, depending on our object of interest.

In the literature, it is not uncommon to assume that productivity follows a Markov process. That is,

\[ \omega_{it}=h(\omega_{it-1})+\eta_{it} \tag{18}\]

Let \(\ln X_{it}=x_{it}\). With Equation 17, we can form the following observed variable,

\[ \begin{aligned} \mathcal W_{it} & \equiv y_{it} - \beta (m^*_{it}-\mathcal{V}_{it})\\ & = y_{it} - \beta (m_{it}+e_{it}-e_{it}+\varepsilon_{it})\\ % & = y_{it} - \beta (m^*_{it}+\varepsilon_{it})\\ & = y_{it} - \beta m_{it}-\beta\varepsilon_{it}\\ & = \alpha_K k_{it}+\alpha_L l_{it}+\omega_{it}+(1-\beta)\varepsilon_{it} \end{aligned} \tag{19}\]

Here, intuitively, we are trading unobservables, the unobserved tax evasion for the output shock, just to make our lives easier. We could have use use directly \(m^*\) since we know the distribution of tax evasion \(e\), which is equivalent to the distribution of \(f_{m^*|m}(m^*|m)\). Also note that is it not necessary to learn tax evasion to recover productivity. This is useful if a practicioner is only interested in productivity and not on tax evasion.

By replacing \(\omega_{it}\) from Equation 19 in Equation 18, we get

\[ \begin{aligned} \mathcal W_{it}=(1-\beta)\varepsilon_{it}+\alpha_K k_{it}+\alpha_L l_{it}+h(\mathcal W_{it-1}-(1-\beta)\varepsilon_{it-1}-\alpha_K k_{it-1}-\alpha_L l_{it-1})+\eta_{it} \end{aligned} \tag{20}\]

If \(h(\xi)=\delta_0 +\delta_1\xi\), to learn \(\alpha\) and \(h\), we need to find instruments \(Z\) such that,

\[ \mathbb{E}[\eta_{it}+(1-\beta)\varepsilon_{it}+\delta_1(1-\beta)\varepsilon_{it-1}|Z]=0. \tag{21}\]

Table 19 displays candidates for \(Z\)

| Orthogonality | |

|---|---|

| \(\eta_{it}\) | \(k_{it},l_{it},\varepsilon_{it}\), \(k_{it-1},l_{it-1},\varepsilon_{it-1},\omega_{it-1},\mathcal{W}_{it-1},m_{it-1},m^*_{it-1}\) |

| \(\varepsilon_{it}\) | \(k_{it},l_{it},\omega_{it},m_{it},m^*_{it},\eta_{it}\), \(k_{it-1},l_{it-1},\varepsilon_{it-1},\omega_{it-1},\mathcal{W}_{it-1},m_{it-1},m^*_{it-1}\) |

| \(\varepsilon_{it-1}\) | \(k_{it},l_{it},\omega_{it},\varepsilon_{it},m_{it},m^*_{it},\eta_{it}\), \(k_{it-1},l_{it-1},\omega_{it-1},\mathcal{W}_{it},m_{it-1},m^*_{it-1}\) |

The possible instruments are \(Z_{it}=\{k_{it},l_{it},k_{it-1},l_{it-1}, m^*_{it-1}, \mathcal{W}_{it-2}\}\).

During estimation, I use labor and capital as instruments for themselves \(Z_{it}=\{k_{it},l_{it}\}\), and the constant and the lag of observed overreported intermediates as instrument for the AR(1) productivity Markov process \(h(\cdot)\).

Once the paramaters of the production function are identified, we can use the following observed variable to recover \(\omega_{it}\)

\[ \begin{aligned} \widetilde{\mathcal W_{it}} & \equiv \mathcal W_{it} - \alpha_K k_{it}-\alpha_L l_{it}\\ & = \omega_{it}+(1-\beta)\varepsilon_{it} \end{aligned} \tag{22}\]

11.4 Identification with two Flexible Inputs

Suppose now that \(M_{it}\) and \(L_{it}\) are flexible inputs, but \(K_{it}\) is not. Furthermore, \(M_{it}\) is deductible and \(L_{it}\) is not. Under a Cobb-Douglas production function, Equation 10 and Equation 11 become,

\[ \begin{aligned} \ln\left(\frac{\rho_t M_{it}}{P_t Y_{it}}\right)=&\ln \beta +\ln \mathcal{E} -\varepsilon_{it} \\ =& \ln D^{\mathcal{E}}_M - \varepsilon_{it} \\ \end{aligned} \tag{23}\]

\[ \begin{aligned} \ln\left(\frac{w_t L_{it}}{(1-\tau)P_t Y_{it}}\right)=&\ln \alpha_L +\ln \mathcal{E} -\varepsilon_{it} \\ =& \ln D^{\mathcal{E}}_L - \varepsilon_{it} \end{aligned} \tag{24}\]

Note that firms do not have incentives to overreport non-deductible flexible inputs. So the observed non-deductible flexible inputs are the true inputs consumed in production. For the deductible flexible inputes, we still observe the overreported inputs, \(M^*_{it}=M_{it}\exp(e_{it})\).

So, Equation 23 becomes,

\[ \ln\left(\frac{\rho_t M^*_{it}}{P_t Y_{it}}\right)=\ln D^{\mathcal{E}}_M -\varepsilon_{it}+e_{it} \tag{25}\]

The constant \(\ln D^{\mathcal{E}}_L\) is identified by a linear regression from Equation 24. Likewise, using assumption 11.1, we can identify the constant \(\ln D^{\mathcal{E}}_M\) by running a linear regression of Equation 25 for the non-evaders.

To identify the elasticities from the constant \(\mathcal{E}\), let \(\hat\varepsilon^M_{it}\) and \(\hat\varepsilon^L_{it}\) be the residuals of the regressions of Equation 25 and Equation 24, respectively. Then, we can form the following observed variable,

\[ \varepsilon_{it}= \begin{cases} \lambda_{it} \hat \varepsilon^M_{it} + (1-\lambda_{it}) \hat \varepsilon^L_{it} & \text{if $i$ is a Non-evader}\\ \hat \varepsilon^L_{it} & \text{otherwise} \end{cases} \tag{26}\]

where \(\lambda_{it}\) is a weight that can be chosen by the practicioner. For example, it can be set to the share of the cost of both flexible inputs in the total cost of production, \(\lambda_{it}=\frac{\rho_t M^*_{it}}{\rho_t M^*_{it}+w_t L_{it}}\). In this way, we would have a time-firm specific weight that captures the relative importance of each flexible input in the production process. alternatively, we can can have time or firm fixed weights, \(\lambda_t=N^{-1}\sum_i\lambda_{it}\) or \(\lambda_i=T^{-1}\sum_t\lambda_{it}\), respectively.

Another option is to use the optimal weight to minimize the variance of \(\varepsilon_{it}\),

\[ \lambda = \arg\min_{\lambda} \mathbb{E}\left[\varepsilon^2|\Theta^{NE}\right] \]

\[ \begin{aligned} \mathbb{E}\left[\varepsilon^2|\Theta^{NE}\right] =&\lambda^2 \mathbb{E}\left[\left(\hat \varepsilon^M_{it}\right)^2|\Theta^{NE}\right] + (1-\lambda)^2 \mathbb{E}\left[\left(\hat \varepsilon^L_{it}\right)^2|\Theta^{NE}\right]\\ &+ 2\lambda(1-\lambda)\mathbb{E}\left[\hat \varepsilon^M_{it}\hat \varepsilon^L_{it}|\Theta^{NE}\right] \end{aligned} \]

Deriving the first order condition, we get

\[ 2\lambda \mathbb{E}\left[\left(\hat \varepsilon^M_{it}\right)^2|\Theta^{NE}\right] + 2(1-2\lambda) \mathbb{E}\left[\hat \varepsilon^M_{it}\hat \varepsilon^L_{it}|\Theta^{NE}\right] - 2(1-\lambda)\mathbb{E}\left[\left(\hat \varepsilon^L_{it}\right)^2|\Theta^{NE}\right] = 0 \]

Finally, solving for \(\lambda\) gives us the optimal weight,

\[ \lambda^* = \frac{\mathbb{E}\left[\left(\hat \varepsilon^L_{it}\right)^2|\Theta^{NE}\right]-\mathbb{E}\left[\hat \varepsilon^M_{it}\hat \varepsilon^L_{it}|\Theta^{NE}\right]}{\mathbb{E}\left[\left(\hat \varepsilon^M_{it}\right)^2|\Theta^{NE}\right] + \mathbb{E}\left[\left(\hat \varepsilon^L_{it}\right)^2|\Theta^{NE}\right]-2\mathbb{E}\left[\hat \varepsilon^M_{it}\hat \varepsilon^L_{it}|\Theta^{NE}\right]}. \tag{27}\]

This might work only if the covariance of the residuals is less than the variance of any residual. In theory, the covariance cannot be larger than the variance of either residua. In that case, it means the both residuals are good estimates of the output shock \(\varepsilon_{it}\) and we can use either of them to recover the output shock \(\varepsilon_{it}\).

Then, we can recover \(\mathcal{E}=\mathbb{E}[\exp(\varepsilon_{it})]\) and the elasticities \(\beta=\exp(\ln D^{\mathcal{E}}_M-\ln \mathcal{E})\) and \(\alpha_L=\exp(\ln D^{\mathcal{E}}_L-\ln \mathcal{E})\).

11.5 Identifying Tax Evasion with Two Flexible Inputs

\[ \begin{aligned} \mathcal{V}_{it} \equiv&\ln \left(\frac{\rho_t M^*_{it}}{P_t Y_{it}}\right)-\ln D^{\mathcal{E}}_M +\varepsilon_{it}\\ =& \ln \left(\frac{\rho_t M_{it}}{P_t Y_{it}}\right)-\ln D^{\mathcal{E}}_M +\varepsilon_{it}+e_{it}\\ =& -\varepsilon_{it}+\varepsilon_{it}+e_{it}\\ =& e_{it} \end{aligned} \]

In the case of the two flexible inputs, we can form a firm-time specific variable that captures the tax evasion by overreporting the deductible flexible input, \(\mathcal{V}_{it}=e_{it}\).

11.6 Identifying Productivity with Two Flexible Inputs

To recover \(\alpha_K\), we can now form the following observed variable,

\[ \begin{aligned} \mathcal{Y}_{it} \equiv& y_{it} - \beta (m^*_{it}-e_{it}) - \alpha_L l_{it} - \varepsilon_{it}\\ =& y_{it} - \beta m_{it} - \alpha_L l_{it} - \varepsilon_{it}\\ =& \alpha_K k_{it} + \omega_{it} \end{aligned} \]

Then, using ortogonality of \(\eta_{it}\),

\[ \mathbb{E}[\mathcal{Y}_{it}|Z_{it}]=\alpha_K k_{it} + \mathbb{E}[h(\mathcal{Y}_{it-1}-\alpha_K k_{it-1})|Z_{it}] \]

where \(Z_{it}=\{k_{it},k_{it-1},\mathcal{Y}_{it-1}\}\).

11.7 Translog Production Function

To identify tax evasion and relaxing the assumption of a CD production function, we would need a flexible input for which firms have no incentives to overreport. Firms might face flexible inputs that they cannot deduct from their VAT or CIT, for example. If this is the case, then firms would have no incentives to overreport non-deductible flexible inputs.

Assume now that \(L_{it}\) is a non-deductible flexible input and, without loss of generality, there are only two inputs (\(L_{it}, M_{it}\)). Let’s assume the production function is now translog. We have,

\[ \ln G(l,m)=\beta_0m_{it}+\beta_1m_{it}l_{it}+\beta_2m_{it}m_{it}+\beta_3l_{it}+\beta_4l_{it}l_{it} \]

Then, equation Equation 11 becomes

where \(s_{it}^{L} \equiv\ln\left(\frac{w_t L_{it}}{(1-\tau)P_{t}Y_{it}}\right)\).

Note that by assumption 11.1, \(D^{\mathcal{E}}\) and the density of \(\varepsilon\) are still identified.

11.7.1 Testing for Tax Evasion

We can design a test for tax evasion by forming the analog of Equation 17,

\[ \begin{aligned} \mathcal{V}_{it}^{L} =&\ln D^{\mathcal{E}}(l_{it},m_{it}^*)-s_{it}^L\\ =&\ln D^{\mathcal{E}}(l_{it},m_{it}+e_{it})-s_{it}^L\\ =&\ln D^{\mathcal{E}}(l_{it},m_{it}+e_{it})-\ln D^{\mathcal{E}}(l_{it},m_{it})+\varepsilon_{it}\\ =&\ln\left(\frac{D^{\mathcal{E}}(l_{it},m_{it}+e_{it})}{D^{\mathcal{E}}(l_{it},m_{it})}\right)+\varepsilon_{it}\\ \end{aligned} \]

Note that \(\ln\left(\frac{D^{\mathcal{E}}(l,m+e)}{D^{\mathcal{E}}(l,m)}\right)\ge0\) is always positive because \(e_{it}\ge0\) and \(D^{\mathcal{E}}\) is strictly increasing in \(m\). Thus, \(\frac{D^{\mathcal{E}}(l,m+e)}{D^{\mathcal{E}}(l,m)}\ge1\).

11.7.2 Identifying Tax Evasion

Once we recovered the parameters of Equation 28, we can invert it to solve for the true inputs \(m^*\) as a function of observed data and the output. Then, the difference between the observed and true inputs is by definition the tax evasion by overreporting.

\[ \begin{aligned} m^*_{it}&=m_{it}+e_{it}\\ &=D^{-1}(\exp(s^L_{it}-\ln\mathcal{E}+\varepsilon_{it}),l_{it})+e_{it}\\ % &= m_{it}^*+e_{it} -D^{-1}(\exp(s^L_{it}-\ln\mathcal{E}-\varepsilon_{it}),l_{it})\\ % &= m_{it}^*+e_{it} -D^{-1}(D(l_{it},m_{it}^*),l_{it})\\ % &=e_{it} \end{aligned} \]

Again, having recovered the distribution of the output shock \(f_{\varepsilon}(\varepsilon)\), we can use deconvolution techniques to learn the distribution of \(e\). In particular, to learn the p.d.f of tax evasion \(f_e(e)\), we can deconvolute it by

\[ \int f_e(m^*_{it}-D^{-1}(\exp(s^L_{it}-\ln\mathcal{E}-\varepsilon_{it}),l_{it})) f_{\varepsilon}(\varepsilon)d\varepsilon \]

11.8 Non-Parametric Identification of Tax Evasion

The previous result also suggests a non-parametric identification strategy, as long as \(D^{\mathcal{E}}\) is monotonic in \(m\). This identification strategy is analogous to Hu et al. (2022), where the authors also require monotonicity and independence to recover a nonparametric function of \(m^*\) with nonclassical measurement error.

In our case, intuitively, if we know the density of \(\varepsilon\) and the function \(D^{\mathcal{E}}\), the variation left is due to \(e\), which can be recovered as long as we can vary \(D^{\mathcal{E}}\) by moving \(e\).

To see why the non-deductible flexible input is needed to identify tax evasion consider the following. Suppose that only the input \(M\) is flexible and deductible.

\[ \ln\left(\frac{\rho M}{PY}\right)=\ln D^{\mathcal{E}}(K,L,M)-\varepsilon \]

\(D^{\mathcal{E}}(K,L,M)\) is still identified by assumption 11.1, however, when we form the analogous of Equation 17, we now have

\[ \begin{aligned} \ln\left(\frac{\rho M^*}{PY}\right)-&\ln D^{\mathcal{E}}(K,L,M^*)=\\ &\ln\left(\frac{\rho(M+e)}{PY}\right)-\ln D^{\mathcal{E}}(K,L,M+e)\\ =&\ln\left(\frac{\rho(M+e)}{PY}\right)-\ln D^{\mathcal{E}}(K,L,M+e)\\ &+\left[\ln\left(\frac{\rho M}{PY}\right)-\ln D^{\mathcal{E}}(K,L,M)\right]\\ &-\left[\ln\left(\frac{\rho M}{PY}\right)-\ln D^{\mathcal{E}}(K,L,M)\right] \\ =&\ln\left(\frac{\rho M}{PY}\right)-\ln D^{\mathcal{E}}(K,L,M) \\ &+\left[\ln\left(\frac{\rho(M+e)}{PY}\right)-\ln\left(\frac{\rho(M)}{PY}\right)\right]\\ &-\left[\ln D^{\mathcal{E}}(K,L,M+e)-\ln D^{\mathcal{E}}(K,L,M)\right]\\ =& -\varepsilon \\ &+\left[\ln D^{\mathcal{E}}(K,L,M+e)-\varepsilon-\ln D^{\mathcal{E}}(K,L,M)+\varepsilon\right]\\ &-\left[\ln D^{\mathcal{E}}(K,L,M+e)-\ln D^{\mathcal{E}}(K,L,M)\right]\\ =& -\varepsilon(K,L,M) \end{aligned} \]

Now, we are not able to separate the variation of \(\varepsilon\) from \(e\).

12 Implementation

We are interested in the distribution of tax evasion \(e\) but it cannot be observed. What is observed is the contaminated version \(\mathcal{V}\) Equation 17. Evasion \(e\) and the output shock \(\varepsilon\) are independent [11.2] with probability density distributions \(f_e\) and \(f_{\varepsilon}\). Then, from Definition 1

\[ f_{\mathcal{V}}(\mathcal{V})=\int f_e(\mathcal{V}+\varepsilon)f_{\varepsilon}(\varepsilon)\text{d}\varepsilon \]

where \(f_{\mathcal{V}}\) denotes the density of \(\mathcal{V}\).

12.1 Parametric Deconvolution

Assume a functional form for \(f_{\varepsilon}(\cdot;\gamma)\) that depends on known parameters \(\gamma\). Assume a known functional form for the density \(f_e(\cdot;\lambda)\) that depends on unknown parameters \(\lambda\). We can estimate parameters \(\lambda\) by

\[ \hat \lambda = \arg \max_{\lambda}\sum_{i=1}^n \log \left(\int f_e(\mathcal{V}_i+\varepsilon;\lambda)f_{\varepsilon}(\varepsilon;\gamma)\text{d}\varepsilon\right) \tag{29}\]

Properties of MLE with unobserved scalar heterogeneity have been derived elsewhere before (Chen 2007; Yi 2021).

12.2 Non-Parametric Deconvolution by Splines

Following Kang and Qiu (2021), consider the following logspline model:

\[ f_{e|\Theta}(e)=\exp(s(e;\theta)-C(\theta)), \quad L < e < R \]

where, \([L,R]\) define the support of \(f_e\),

\[ s(e;\theta)=\sum_{j=1}^{K-1}\theta_j B_j(e), \]

\(\{B_j(E), j=1,2,\dots, K\}\) is a sequence of cubic B-spline basis functions, and

\[ C(\theta) = \log\left(\int^R_L \exp(s(e;\theta)) \text{d}e \right) < \infty . \]