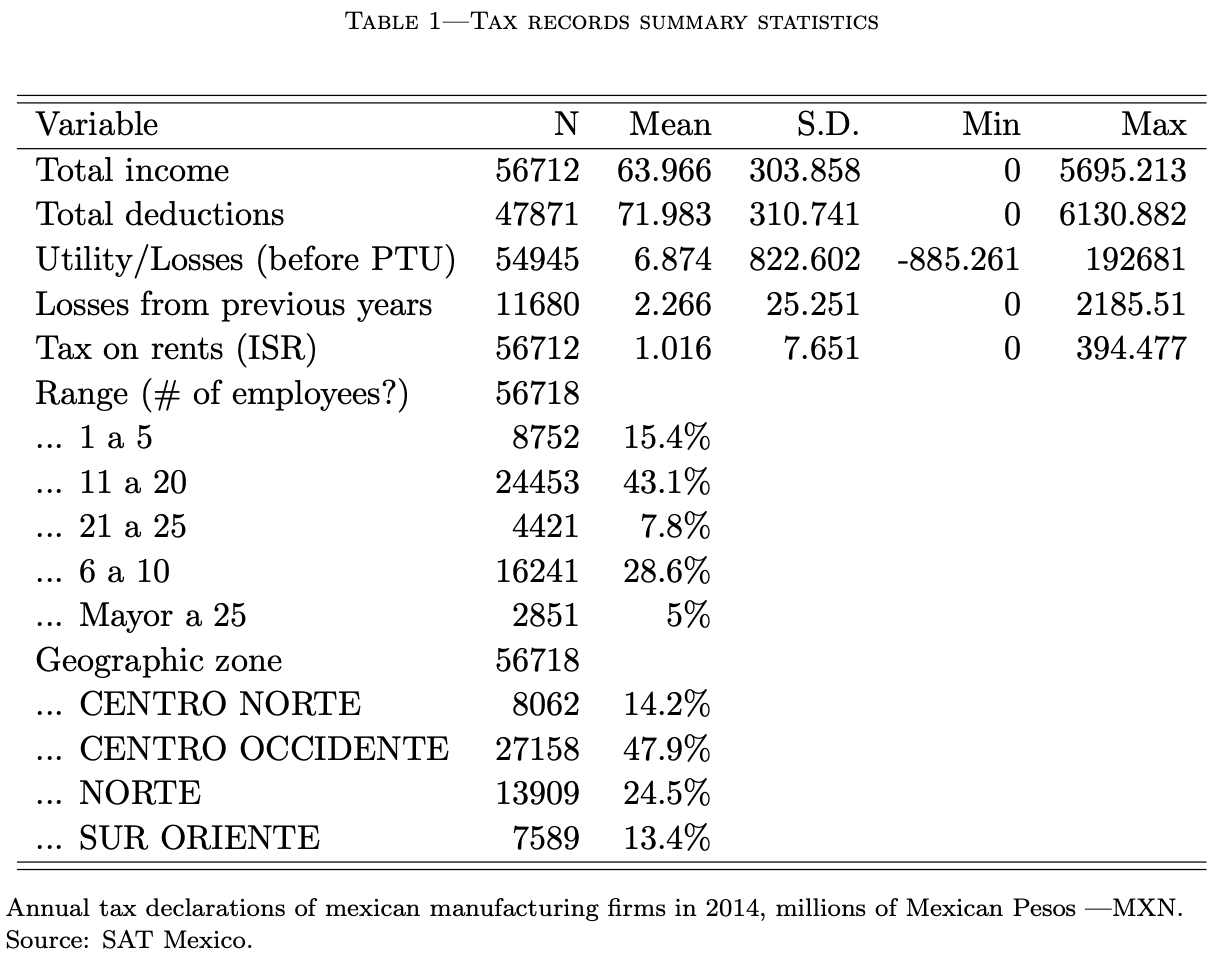

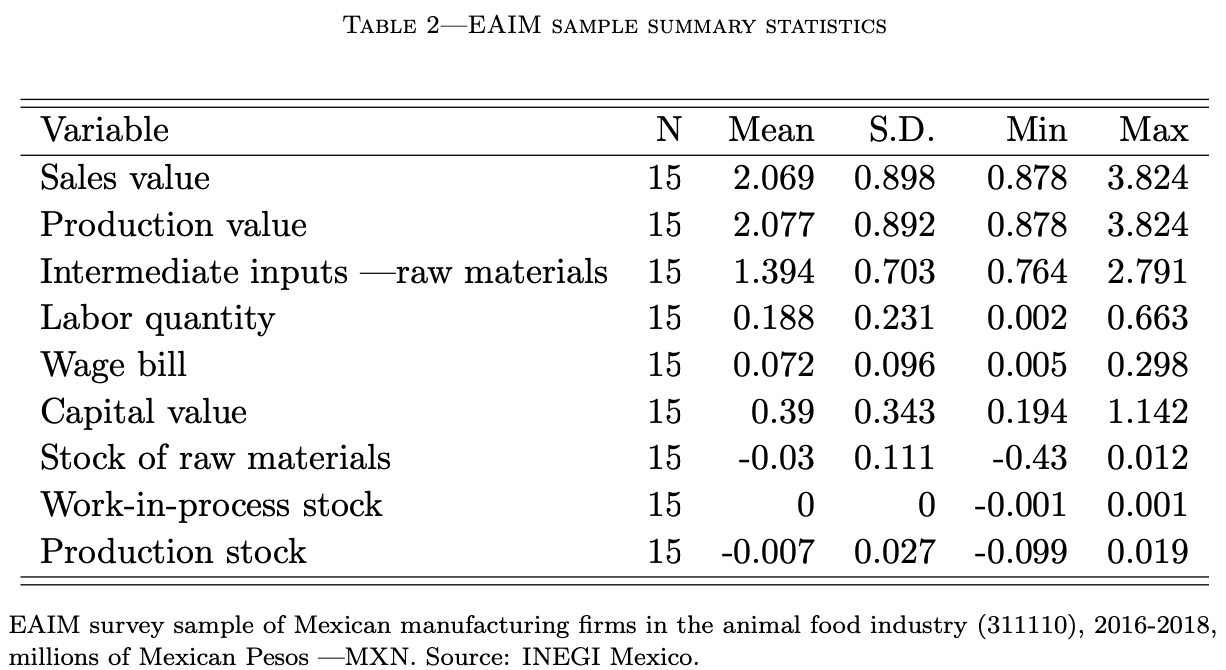

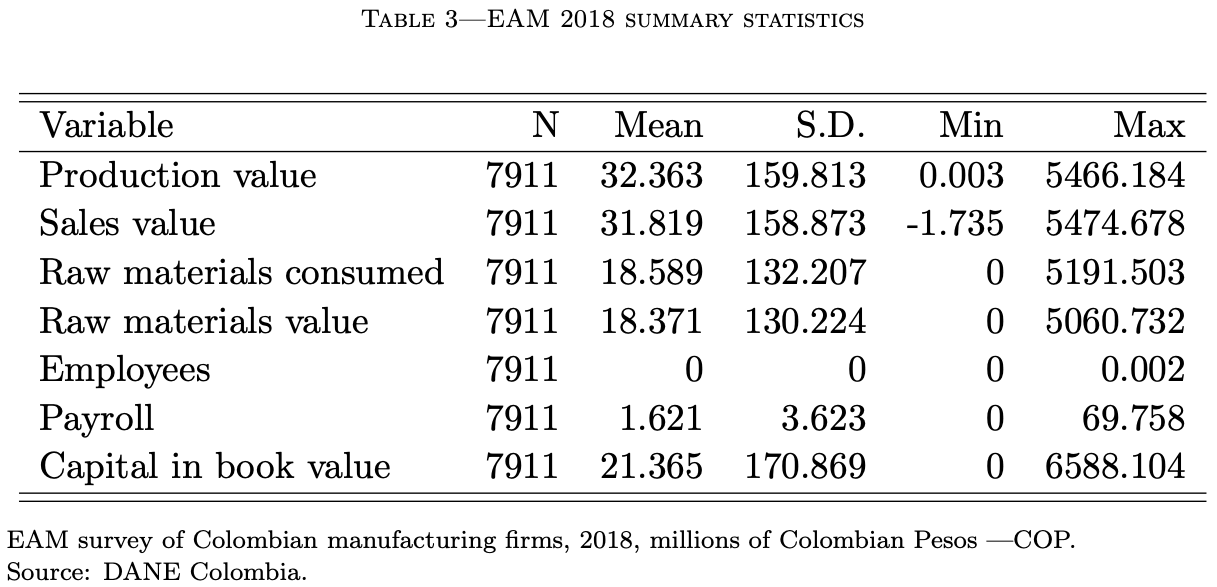

class: center, middle, inverse, title-slide # Tax evasion and productivity ### Hans Martinez ### Jun 27, 2022 --- ## Agenda - Where we left: - On board to proceed with Tax evasion and Productivity idea - Salvador's main concern: too small; why would ______ care? - Step back: rethink and start writing (document due July 31) - Today - Question (enlarge) - Interesting and relevant (provide) - Feasible (improve) - Expected challenges - Next steps --- ## Interest and importance - Tax evasion, a widespread phenomenon: developed and developing countries .small[(Slemrod, 2019)] - Not (specifically) addressed before. - Unsatisfactory coping with it in the literature .small[(e.g., Blalock et al., 2004, p.204)]: measurement error - Tax-evasion misreporting: unidirectional and follows IC. - Non-trivial: unobserved and hard to measure. - "Even most credible studies do not have a reliable measure of evasion" .small[(Slemrod, 2019)]. --- ## Interest and importance Bias in productivity measurement due to tax evasion: - Help explain part of the productivity gap .small[(Syverson, 2011)]. - Needed for the design of public policies aiming at efficient reallocation .small[(Eslava et al., 2004; Levy, 2018)]. - Low-productivity firms might not always be the ones with the larger incentives to evade taxes .small[(e.g., profit threshold for tax regimes with different tax liabilities)]. - Needed to compare productivity across countries. - Different tax systems generate different evasion incentives. More relevant for developing countries. --- ## Clear and original question - Can we recover **unbiased productivity** estimates in the presence of systematic misreporting due to **tax evasion**? - at the firm level using a gross-output production function - intermediates, the flexible input - what is the **magnitude** of this bias, in particular for developing countries? - how much of the **productivity gap** can tax evasion explain *within* a country and *across* countries? - accounting for their different tax systems —rates, rules, and enforcement procedures. --- ### Feasibility - Empirical approach Tax evasion: Overreporting inputs `$$\begin{aligned} X_{it}&=X_{it}^*+\varepsilon^X_{it}(S_{i}) \\ \varepsilon^X_{it}(S_{i}) &= \left \{ \begin{array}{ll} 0 &, (1-\tau)\Pi(x_{it}^*) \ge \Pi(x_{it}^*)-\tau\Pi(x_{it})-C(x_{it}-x_{it}^*, s_{i}) \\ (0,\tilde x] &, \text{otherwise} \end{array} \right. \end{aligned}$$` where `\(\Pi(X_{it})=P_{t}Y_{it}-\rho_{t} X_{it}\)` and `\(\Pi(\tilde x)=0\)` `\(C(\cdot)=\kappa Pr(a)+c(X_{it}-X_{it}^*, S_{i})\)` --- layout: true ### Empirical approach --- Gross-output production function `$$\begin{equation*}\label{eq:prod} Y_{it}=G(X^*_{it})e^{\omega_{it}+\varepsilon^Y_{it}} \end{equation*}$$` Productivity measurement bias. Assume CD: `$$\begin{aligned} \mathbb{E}[\log Y_{it}|x]&=\mathbb{E}[\beta \log X_{it}|x]+\mathbb{E}[\omega_{it}|x] \\ \mathbb{E}[\log Y_{it}|x]&=\mathbb{E}[\beta \log(X^*_{it}+\varepsilon^X_{it})|x]+\mathbb{E}[\omega_{it}|x] \\ \mathbb{E}[\omega_{it}|x]&=\mathbb{E}[\log Y_{it}|x]-\beta \mathbb{E}[\log(X^*_{it}+\varepsilon^X_{it})|x] \end{aligned}$$` --- `$$\begin{aligned} \Delta_{\omega}& =\beta \left(\mathbb{E}[\log(X^*_{it}+\varepsilon^X_{it})-\log(X^*_{it})|x]\right) \\ & = \beta \left(\mathbb{E}[\log\left(\frac{X^*_{it}+\varepsilon^X_{it}}{X^*_{it}}\right)|x]\right) \\ & \ge \beta \left(\log(\mathbb{E}\left[\frac{X^*_{it}+\varepsilon^X_{it}}{X^*_{it}}|x\right])\right) \\ & \ge 0 \end{aligned}$$` by Jensen's inequality and because `\(\varepsilon_{it}^X\ge0\)` --- > **Identification assumption** : larger firms do not overreport inputs. - Costlier to keep the double accounting, higher probability to be denounced to the authority, and access to other legal tools to reduce their tax liabilities. - Evidence from tax evasion literature: Small and medium size firms .small[Slemrod, 2019] Let `\(L(X^*_{it},S_i)=\tau [\Pi(X^*_{it})-\Pi(X_{it})]-C(X_{it}-X^*_{it},S_{i})\)`. Therefore, for large firms `\(S_i=s\)`. `$$\begin{equation}\label{eq:l_ic} \mathbb{E}[L(X^*_{it},S_i)|X^*_{it},S_{i}=s]=0 \end{equation}$$` --- layout: true ### Estimation strategy --- Recovering the joint distribution `\(f(y_{it},x_{it},p_{t},s_i)=f(y_{it},x_{it},x^*_{it},p_{t},\omega_{it},\omega_{it-1},s_i)\)` from the data `\(\mathcal{O}=\{Y_{it},X_{it},P_{t},S_{i}\}_{i\in I, t \in T}\)`. Assumptions: 1. `\(f_1(y_{it}|x_{it}, x_{it}^*,\omega_{it},\omega_{it-1}, s_{i}, p_{t})=f_1(y_{it}|x_{it}^*,\omega_{it})\)` 1. `\(f_2(p_{t}|x_{it}, x_{it}^*,\omega_{it},\omega_{it-1}, s_{i})=f_2(p_{t}|x_{it}^*)\)` 1. `\(f_3(\omega_{it}|x_{it}, x_{it}^*,\omega_{it-1}, s_{i}, p_{t})=f_3(\omega_{it},|\omega_{it-1})\)` 1. `\(f_4(x_{it}|x_{it}^*,\omega_{it},\omega_{it-1}, s_{i}, p_{t})=f_4(x_{it}|x_{it}^*,s_{i})\)` --- Recast joint distribution as `$$\begin{aligned} f&(y_{it},x_{it},p_{t},s_i)\\ &= f(y_{it},x_{it},p_{t},\omega_{it},\omega_{it-1},x^*_{it},s_i) \\ \notag &= f_1(y_{it}| x^*_{it},\omega_{it}) f_2(p_{it}|x^*_{it},\omega_{it}) f_3(\omega_{it}|\omega_{it-1}) f_4(x_{it}|x^*_{it},s_i) f(\omega_{it-1})f(x_{it}^*,s_i) \notag \end{aligned}$$` --- Assuming `\(f(y_{it},x_{it},p_{t},s_i)\)` is time invariant, we can form the quasi likelihood function as follows: `$$\begin{equation*} \label{eq:mle_def} \sum_{i\in I}\left( \sum_{t\in T} \log f(y_{it},x_{it},p_{t},s_i) \right) \equiv \sum_{i\in I} l(D_i;\alpha) \end{equation*}$$` in which `\(D_i=(Y_{it},X_{it},P_{t},S_{i})\)` and --- `$$\begin{aligned} \label{eq:mle} l(D_i:\alpha) &\equiv l(D_i;\theta, f_1,f_2,f_3,f_4)\notag\\ &= \sum_{t\in T}\log \bigg\{ \int f_1(y_{it} - g(x^*_{it})+\omega_{it}) \\ & f_2\left(-\ln\left(\frac{\rho_t X^*_{it}}{P_{t}Y_{it}}\right)+\ln\left(\frac{G_x(x^*_{it})X^*_{it}}{G(x^*_{it})}\right)\right)\\ & f_3(\omega_{it}-h(\omega_{it-1})) \\ & f_4(0|s_{i})^{\mathbb 1 [L(x^*_{it},s_i)\ge 0]} f_4(x_{it}-x^*_{it}|s_{i})^{\mathbb 1 [L(x^*_{it},s_i) < 0]}dx^* \bigg\} \\ & + \sum_{t\in T}\log f(\omega_{it-1})f(x_{it}^*,s_i) \end{aligned}$$` --- layout: false ## Data - I use anonymized annual tax declarations from a sample of Mexican firms and - Survey data at the establishment level for manufacturing firms in Mexico (EAIM-INEGI) and Colombia (EAM) collected annually. - Mexico: No input prices in Mexican data. The tax records cannot be linked to the survey records. - Colombia: data on firms does include input prices. --- <!-- {width="50%"} --> <img src="tax_t.png" width="75%" style="display: block; margin: auto;" /> ---  ---  --- .pull-left[ .large[Exploratory analysis]] <img src="tax_dens_notrim.png" width="50%" style="display: block; margin: auto;" /> --- <img src="tax_dens_over.png" width="50%" style="display: block; margin: auto;" /> --- layout: true ### Expected challenges --- - Firms might cheat on sales. - Focus on business-to-business (B2B) sales firms instead of business-to-consumer (B2C) ones .small[(Chile; Pomeranz, 2015)] - Firms might cheat on input prices. - Possible solution: base case, lower bound for tax evasion bias. For robustness, model cheating on prices. - Firms might also report losses and use past losses to reduce the tax burden of the current period. - Counter-argument: it increases the cheating cost by increasing audit probability. Data shows a high concentration around zero. --- - No input prices on Mexican data. - If firms are price-taking, then a time-dummy can take care of it if firms do not cheat on prices (?) - In Mexico, if firms are classified as Small or Medium, they are subject to a lower tax rate. - Colombia: - what's the tax evasion evidence? .small[(Ortega and Scartascini, 2015; 2018). Also for Ecuador, Chile, Pakistan.] - what's the tax scheme? - is there data on firms' taxes? .small[Administrative data: Canada, UK, Brazil, Chile, China, Costa Rica, Ecuador, India, Pakistan, Rwanda, Tunisia, and Uganda.] --- layout: false ### Next steps - Related literature - Mexico and Colombia: Tax systems and productivity - Chile (?) - Exploratory analisys - Preliminay parametrized estimates - MC experiments --- name: final_slide count: false layout: false class: center middle [hansmartinez.com](hansmartinez.com) <img src="DR-062022_files/figure-html/unnamed-chunk-4-1.png" width="90%" /> .small[ Download slides: Scan QR with your phone's camera ] <!-- .center[Link to slides: Scan me!] --> <!-- .footer[ .full-width[Hello there]] -->