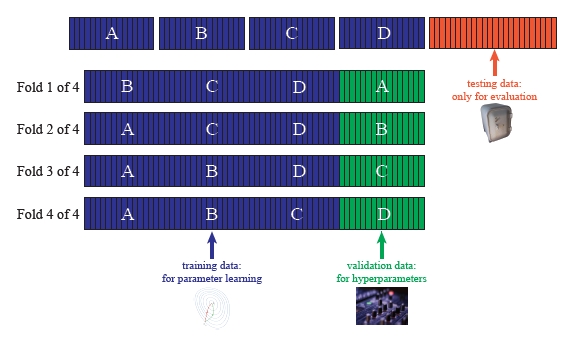

class: center, middle, inverse, title-slide # Lecture 10 ## Model Fit, Validation and Counterfactual Simulations ### Tyler Ransom ### ECON 6343, University of Oklahoma --- # Plan for the Day 1. Discuss how to assess model fit 2. Model validation 3. Counterfactual simulations 4. Go through examples from a couple of recent papers - Fu, Grau, and Rivera (2020) - Lang and Palacios (2018) --- # Steps to producing a "structural" estimation - We discussed the structural workflow in our 3rd class meeting - Since that class meeting, we've focused mainly on estimation - We also briefly talked about identification - But there are still some steps we haven't covered - Counterfactuals are where you actually answer your research question - And before counterfactuals you need to show your model fits the data --- # Model Fit - Model fit basically consists of showing that your model can match the data - This is because the counterfactuals rely solely on the model - Most model fit is _ad hoc_: you can choose what to show - Typically, you'll want to show that moments of the `\(Y\)` variables match - e.g. choice frequencies in the data match choice probabilities of the model - But there may be other moments of interest, like dynamic choice transitions --- # Example from Fu, Grau, and Rivera (2020) - In this paper, the authors show the following model fit statistics: <table> <thead> <tr> <th style="text-align:left;"> Variable </th> <th style="text-align:right;"> Data </th> <th style="text-align:right;"> Model </th> </tr> </thead> <tbody> <tr> <td style="text-align:left;"> Ever arrested % </td> <td style="text-align:right;"> 5.60 </td> <td style="text-align:right;"> 5.10 </td> </tr> <tr> <td style="text-align:left;"> Always enrolled, 0 arrest % </td> <td style="text-align:right;"> 72.20 </td> <td style="text-align:right;"> 71.10 </td> </tr> <tr> <td style="text-align:left;"> GPA (standardized) </td> <td style="text-align:right;"> -0.39 </td> <td style="text-align:right;"> -0.43 </td> </tr> <tr> <td style="text-align:left;"> Retention % </td> <td style="text-align:right;"> 7.30 </td> <td style="text-align:right;"> 8.00 </td> </tr> <tr> <td style="text-align:left;"> Grade Completed by T </td> <td style="text-align:right;"> 11.10 </td> <td style="text-align:right;"> 11.20 </td> </tr> </tbody> </table> - These results are for youth with parents who are not well educated - (This group is the most at risk to be arrested or drop out of school) - Model fit for other groups is similar --- # How to do model fit There are a couple of options for producing model fit statistics 1. Use the model assumptions and estimates to simulate a new dataset 2. Use the data and estimates to compute `\(\hat{Y}\)` and compare with `\(Y\)` --- # Simulating a new dataset - To simulate a new data set, you simply draw the unobservables from the model - Use any initial conditions from the data - Then (if the model is dynamic) simply draw `\(Y\)` in `\(t=1\)` - Then update the `\(X\)`'s in `\(t=2\)` and draw `\(Y\)` in `\(t=2\)`, ... - If you used SMM to estimate the model, you should already have code for this - Typically you want to repeat this process a few times - This is because you don't want model fit to be subject to simulation error --- # Assessing model fit from the data and estimates - A simpler option is to predict the `\(\hat{Y}\)` using the actual data - This is identical to using a `predict()` function (like in PS6) - However, this approach may not be possible in a model with key latent variables - For example, unobserved types or other unobservables are not in the data - In this case, you have no choice but to go the simulation route --- # Model Validation - Even if your model fits the data well, some may still be skeptical - This is because, in most cases, you used your entire dataset in estimation - If you do this, you open yourself up to the possibility of .hi[overfitting] - .hi[Model validation] is a way of showing that your model is not overfit - To do so, you show that the model reproduces key stats in a "holdout sample" - This sample was "held out" of the estimation for purposes of validation --- # Mini aside on machine learning Machine learning is all about automating two hand-in-hand processes: 1. Model selection - What should the specification be? 2. Model validation - Does the model generalize to other (similar) contexts? - The goal of machine learning is to automate these processes to maximize prediction - This is different than the goal of econometrics (causal inference) --- # Model selection - In classical econometrics, we always select our models by hand - This what the famed and sometimes maligned "robustness checks" address - In machine learning, we let the computer tell us which specification is "best" - "Best" is defined by minimizing both in- and out-of-sample prediction error - This involves estimating many different specifications - For complex models, automated model selection is computationally intensive - Rust (1987) did this by hand when exploring the shape of the cost function --- # Model validation - Broadly speaking, model validation is about whether the model "makes sense" - It can be qualitative ("do the parameter results make sense? conform to theory?") - It can also be quantitative ("is the prediction error sufficiently low?") - In machine learning, .hi[cross-validation] is typically used - Cross-validation informs about the optimal complexity of the model - Then we (can) automate our specification search subject to that optimal complexity - Automated specification search is still not commonly done in structural estimation --- # How cross-validation works (Adams, 2018) .center[] - Blue is the data that we use to estimate the model's parameters - We randomly hold out `\(K\)` portions of this data one-at-a-time (Green boxes) - We assess the performance of the model in the Green data - This tells us the optimal complexity (by "hyperparameters" if CV is automated) --- # Validation in Lang and Palacios (2018) - A common question is how much unobserved heterogeneity to allow for - This is not _ex ante_ knowable - Typical approach is to put "enough" in there such that the in-sample fit is good - Lang and Palacios (2018) search for optimal number of types - Use a 20% holdout sample to assess the out-of-sample fit - Note that they do not do cross-validation - They simply compare how the model fits in the estimation and holdout data --- # Validation in Delavande and Zafar (2019) - Another form of validation could be to predict treatment effects in control group - If the model is good, it should be able to do this - Delavande and Zafar (2019) do something similar to this - Rather than comparing model predictions in/out of sample, - They compare them for a different state of the world - In their case, the new state of the world is one without schooling costs - They can do this because they elicited preferences for schooling under both regimes - But they only used one regime when estimating their model --- # Counterfactuals - Counterfactuals involve changing the model, simulating new data and then comparing w/status quo - "Changing a policy" typically can be captured by changing the value of a set of parameters - "Policy experiments" typically mimic some real-world policy in this way - .hi[Note:] policy experiments always assume invariance of the other model parameters! - So if I change the value of one parameter, that won't "leak" into any others - This may be a heroic assumption, depending on the model --- # Examples of counterfactuals .smaller[ - Fu, Grau, and Rivera (2020) - Would low-SES youth commit fewer crimes if we sent them to better schools? - Arcidiacono, Aucejo, Maurel, and Ransom (2016) - How would human capital investment change if there were perfect information? - Arcidiacono, Kinsler, and Ransom (2019) - Would Harvard become less white if it were to eliminate legacy admissions? - Ransom (2019) - Would American workers move to a new city if they were paid $10,000 to do so? - Caucutt, Lochner, Mullins, and Park (2020) - What can reduce disparities in child investment across rich/poor families? ] --- # How to do counterfactuals - To perform the counterfactual simulations, follow these steps: - Impose parameter restrictions - Simulate fake data under those restrictions - Compare the resulting model summary to a "baseline" prediction - (The baseline prediction is your model fit) - As you can see, if you use SMM, you've already got the code to simulate the model --- # Coding example: multinomial logit estimation This code comes from the first question of Problem Set 4: .scroll-box-16[ ```julia using Random, LinearAlgebra, Statistics, Optim, DataFrames, CSV, HTTP, GLM, ForwardDiff, FreqTables # read in data url = "https://raw.githubusercontent.com/OU-PhD-Econometrics/fall-2020/master/ProblemSets/PS4-mixture/nlsw88t.csv" df = CSV.read(HTTP.get(url).body) X = [df.age df.white df.collgrad] Z = hcat(df.elnwage1, df.elnwage2, df.elnwage3, df.elnwage4, df.elnwage5, df.elnwage6, df.elnwage7, df.elnwage8) y = df.occ_code # estimate multionomial logit model include("mlogit_with_Z.jl") θ_start = [ .0403744; .2439942; -1.57132; .0433254; .1468556; -2.959103; .1020574; .7473086; -4.12005; .0375628; .6884899; -3.65577; .0204543; -.3584007; -4.376929; .1074636; -.5263738; -6.199197; .1168824; -.2870554; -5.322248; 1.307477] td = TwiceDifferentiable(b -> mlogit_with_Z(b, X, Z, y), θ_start; autodiff = :forward); θ̂_optim_ad = optimize(td, θ_start, LBFGS(), Optim.Options(g_tol = 1e-5, iterations=100_000, show_trace=true, show_every=50)); θ̂_mle_ad = θ̂_optim_ad.minimizer H = Optim.hessian!(td, θ̂_mle_ad) θ̂_mle_ad_se = sqrt.(diag(inv(H))) ``` ] --- # Coding example: model fit and counterfactuals Now let's evaluate model fit and effect of counterfactual policy .scroll-box-16[ ```julia # get baseline predicted probabilities function plogit(θ, X, Z, J) α = θ[1:end-1] γ = θ[end] K = size(X,2) bigα = [reshape(α,K,J-1) zeros(K)] P = exp.(X*bigα .+ Z*γ) ./ sum.(eachrow(exp.(X*bigα .+ Z*γ))) return P end println(θ̂_mle_ad) P = plogit(θ̂_mle_ad, X, Z, length(unique(y))) # compare with data modelfitdf = DataFrame(data_freq = 100*convert(Array, prop(freqtable(df,:occ_code))), P = 100*vec(mean(P'; dims=2))) display(modelfitdf) # now run a counterfactual: # suppose people don't care about wages when choosing occupation # this means setting θ̂_mle_ad[end] = 0 θ̂_cfl = deepcopy(θ̂_mle_ad) θ̂_cfl[end] = 0 P_cfl = plogit(θ̂_cfl, X, Z, length(unique(y))) modelfitdf.P_cfl = 100*vec(mean(P_cfl'; dims=2)) modelfitdf.ew = vec(mean(Z'; dims=2)) modelfitdf.diff = modelfitdf.P_cfl .- modelfitdf.P display(modelfitdf) │ Row │ data_freq │ P │ P_cfl │ diff │ ew │ │ │ Float64 │ Float64 │ Float64 │ Float64 │ Float64 │ ├─────┼───────────┼─────────┼─────────┼───────────┼─────────┤ │ 1 │ 10.5976 │ 11.2549 │ 8.34334 │ -2.91158 │ 1.96627 │ │ 2 │ 5.24943 │ 6.21553 │ 4.98708 │ -1.22845 │ 1.85026 │ │ 3 │ 38.6462 │ 37.5457 │ 34.4537 │ -3.092 │ 1.71771 │ │ 4 │ 4.66067 │ 4.88623 │ 5.70078 │ 0.814551 │ 1.54756 │ │ 5 │ 1.54063 │ 1.80065 │ 1.62727 │ -0.173382 │ 1.75298 │ │ 6 │ 15.1525 │ 14.676 │ 15.123 │ 0.447092 │ 1.58918 │ │ 7 │ 18.3571 │ 17.3364 │ 23.3689 │ 6.03245 │ 1.42956 │ │ 8 │ 5.79588 │ 6.28457 │ 6.39589 │ 0.111316 │ 1.59501 │ ``` ] --- # Discussion of model fit counterfactuals - Model fit is good, and I would have expected even better - MLE is designed to match the data choice frequencies - The counterfactuals make sense - Removing preference for earnings leads to re-sorting of occupations - Sorting into low-wage occupations and out of high-wage ones --- # Confidence intervals around counterfactuals - The counterfactuals above give us a new predicted occupational distribution - But we don't know what the confidence intervals are around the prediction - Our estimates inherently come with sampling variation - We should incorporate that variation into our counterfactual - How do we do this? Bootstrapping --- # Bootstrapping to get CIs around counterfactuals - Recall: `\(-H^{-1}\)` is the variance matrix of our estimates, where `\(H\)` is the Hessian - Assume that `\(\hat{\theta} \sim MVN(\theta,-H^{-1})\)` - but remember that we want to minimize `\(-\ell\)` so we just use `\(H^{-1}\)` - We sample from this distribution `\(B\)` times and compute our new counterfactuals - Then we can look at the 2.5th and 97.5th percentiles - This will represent a 95% confidence interval - This algorithm is known as the .hi[parametric bootstrap] - Cf. .hi[nonparametric bootstrap] which is when we randomly re-sample from our data --- # Coding example: parametric bootstrap - Here's how we can get the confidence interval around the policy effect - Note: it's uncommon to see this, due to computational demands of just one cfl .scroll-box-12[ ```julia # now do parametric bootstrap Random.seed!(1234) invHfix = UpperTriangular(inv(H)) .- Diagonal(inv(H)) .+ UpperTriangular(inv(H))' # this code makes inv(H) truly symmetric (not just numerically symmetric) d = MvNormal(θ̂_mle_ad,invHfix) B = 1000 cfl_bs = zeros(8,B) for b = 1:B θ_draw = rand(d) Pb = plogit(θ_draw, X, Z, length(unique(y))) Pbs = 100*vec(mean(Pb'; dims=2)) θ_draw[end] = 0 P_cflb = plogit(θ_draw, X, Z, length(unique(y))) Pcfl_bs = 100*vec(mean(P_cflb'; dims=2)) cfl_bs[:,b] = Pcfl_bs .- Pbs end bsdiffL = deepcopy(cfl_bs[:,1]) bsdiffU = deepcopy(cfl_bs[:,1]) for i=1:size(cfl_bs,1) bsdiffL[i] = quantile(cfl_bs[i,:],.025) bsdiffU[i] = quantile(cfl_bs[i,:],.975) end modelfitdf.bs_diffL = bsdiffL modelfitdf.bs_diffU = bsdiffU display(modelfitdf) │ Row │ data_freq │ P │ P_cfl │ diff │ ew │ bs_diffL │ bs_diffU │ │ │ Float64 │ Float64 │ Float64 │ Float64 │ Float64 │ Float64 │ Float64 │ ├─────┼───────────┼─────────┼─────────┼───────────┼─────────┼───────────┼───────────┤ │ 1 │ 10.5976 │ 11.2549 │ 8.34334 │ -2.91158 │ 1.96627 │ -3.37791 │ -2.40627 │ │ 2 │ 5.24943 │ 6.21553 │ 4.98708 │ -1.22845 │ 1.85026 │ -1.46601 │ -1.0004 │ │ 3 │ 38.6462 │ 37.5457 │ 34.4537 │ -3.092 │ 1.71771 │ -3.72105 │ -2.4462 │ │ 4 │ 4.66067 │ 4.88623 │ 5.70078 │ 0.814551 │ 1.54756 │ 0.666758 │ 0.967763 │ │ 5 │ 1.54063 │ 1.80065 │ 1.62727 │ -0.173382 │ 1.75298 │ -0.214975 │ -0.135771 │ │ 6 │ 15.1525 │ 14.676 │ 15.123 │ 0.447092 │ 1.58918 │ 0.387452 │ 0.506462 │ │ 7 │ 18.3571 │ 17.3364 │ 23.3689 │ 6.03245 │ 1.42956 │ 4.82327 │ 7.20728 │ │ 8 │ 5.79588 │ 6.28457 │ 6.39589 │ 0.111316 │ 1.59501 │ 0.0795148 │ 0.143139 │ ``` ] --- # References .tiny[ Adams, R. P. (2018). _Model Selection and Cross Validation_. Lecture Notes. Princeton University. URL: [https://www.cs.princeton.edu/courses/archive/fall18/cos324/files/model-selection.pdf](https://www.cs.princeton.edu/courses/archive/fall18/cos324/files/model-selection.pdf). Arcidiacono, P., E. Aucejo, A. Maurel, et al. (2016). _College Attrition and the Dynamics of Information Revelation_. Working Paper. Duke University. URL: [https://tyleransom.github.io/research/CollegeDropout2016May31.pdf](https://tyleransom.github.io/research/CollegeDropout2016May31.pdf). Arcidiacono, P., J. Kinsler, and T. Ransom (2019). _Legacy and Athlete Preferences at Harvard_. Working Paper 26316. National Bureau of Economic Research. DOI: [10.3386/w26316](https://doi.org/10.3386%2Fw26316). Caucutt, E. M., L. Lochner, J. Mullins, et al. (2020). _Child Skill Production: Accounting for Parental and Market-Based Time and Goods Investments_. Working Paper 27838. National Bureau of Economic Research. DOI: [10.3386/w27838](https://doi.org/10.3386%2Fw27838). Delavande, A. and B. Zafar (2019). "University Choice: The Role of Expected Earnings, Nonpecuniary Outcomes, and Financial Constraints". In: _Journal of Political Economy_ 127.5, pp. 2343-2393. DOI: [10.1086/701808](https://doi.org/10.1086%2F701808). Fu, C., N. Grau, and J. Rivera (2020). _Wandering Astray: Teenagers’ Choices of Schooling and Crime_. Working Paper. University of Wisconsin-Madison. URL: [https://www.ssc.wisc.edu/~cfu/wander.pdf](https://www.ssc.wisc.edu/~cfu/wander.pdf). Lang, K. and M. D. Palacios (2018). _The Determinants of Teachers' Occupational Choice_. Working Paper 24883. National Bureau of Economic Research. DOI: [10.3386/w24883](https://doi.org/10.3386%2Fw24883). Ransom, T. (2019). _Labor Market Frictions and Moving Costs of the Employed and Unemployed_. Discussion Paper 12139. IZA. URL: [http://ftp.iza.org/dp12139.pdf](http://ftp.iza.org/dp12139.pdf). Rust, J. (1987). "Optimal Replacement of GMC Bus Engines: An Empirical Model of Harold Zurcher". In: _Econometrica_ 55.5, pp. 999-1033. URL: [http://www.jstor.org/stable/1911259](http://www.jstor.org/stable/1911259). ]